After years of ready, the central financial institution of Brazil has lastly licensed Meta‘s WhatsApp service provider cost system, the newest illustration of how the Brazilian cost market is quick evolving.

Final week, the regulator cleared the best way for the tech large. Customers can now pay for items and providers at shops by way of its messaging utility.

WhatsApp is massively common in Brazil and Latin America. Within the newest earnings calls, Meta executives mentioned the Brazilian market, with a inhabitants of 215 million, was one of many firm’s most necessary.

The cost function builds on Brazil’s present peer-to-peer cost system, which has been working since 2021. Nevertheless, the central financial institution had frozen Meta’s intention to roll out the identical function for retailer funds.

Now, the financial institution clears the best way for retailers to gather these. Brazilians will pay straight with their bank cards by way of WhatsApp. The tech large is partnering with heavyweights within the monetary trade, similar to Mastercard and Visa.

A ‘large progress’ within the monetary system

Though Meta’s peer-to-peer transfers haven’t gained as a lot scale, some consider releasing store funds might make a distinction.

“Right this moment is a contented day for us. We accomplished each regulatory step,” Guilherme Horn, Head of WhatsApp, Latin America, wrote in a LinkedIn submit. ” Paying to companies through WhatsApp could have a huge effect for everybody, bringing simplicity to customers whereas serving to small and medium-sized companies improve their gross sales.”

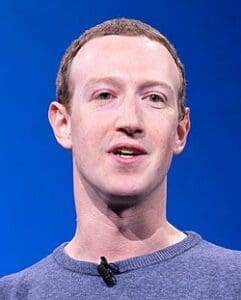

“Individuals will have the ability to pay small companies proper on WhatsApp,” Meta’s Mark Zuckerberg celebrated whereas broadcasting on Instagram. “Excited to roll out this quickly.”

To authorize WhatsApp, the central financial institution suspended a measure on Meta that prevented such funds from taking a better take a look at it, José Luiz Rodrigues, a director at ABFintechs, mentioned.

“The central financial institution’s strategy was good,” he wrote. “It took an especially necessary resolution that reveals the regulator’s concern to advertise innovation safely. That is positively large progress for the Brazilian monetary system.”

A problem to Pix?

Actually, clearance from the central financial institution comes years after Pix was launched in Brazil. When WhatsApp first disclosed its intentions years in the past, some argued it might threaten the central financial institution’s brand-new prompt cost system.

The inexperienced mild comes at a time when Pix is firmly established amongst Brazilians. In response to official knowledge from the central financial institution, greater than half the Brazilian inhabitants used it at the least as soon as.

“We’re seeing the transformation of the well-known messaging app, so current in our every day lives, right into a cost channel within the palm of Brazilians’ fingers,” mentioned Marcelo Tangioni, Mastercard Brasil’s president. “That is innovation!”

The corporate has partnered with most native buying corporations. This consists of Cielo, Rede, Fiserv , Getnet Brasil and, Mercado Pago.

There isn’t any date for the launch to happen.