Fast Take

On Could 23, Bitcoin skilled a slight decline, dropping to a low of roughly $66,300. This dip was triggered by the S&P US Composite PMI Flash exceeding consensus expectations, pushing anticipated price cuts additional away. Consequently, short-term holders—those that have held the digital asset for lower than 155 days and are notably delicate to market volatility—reacted strongly.

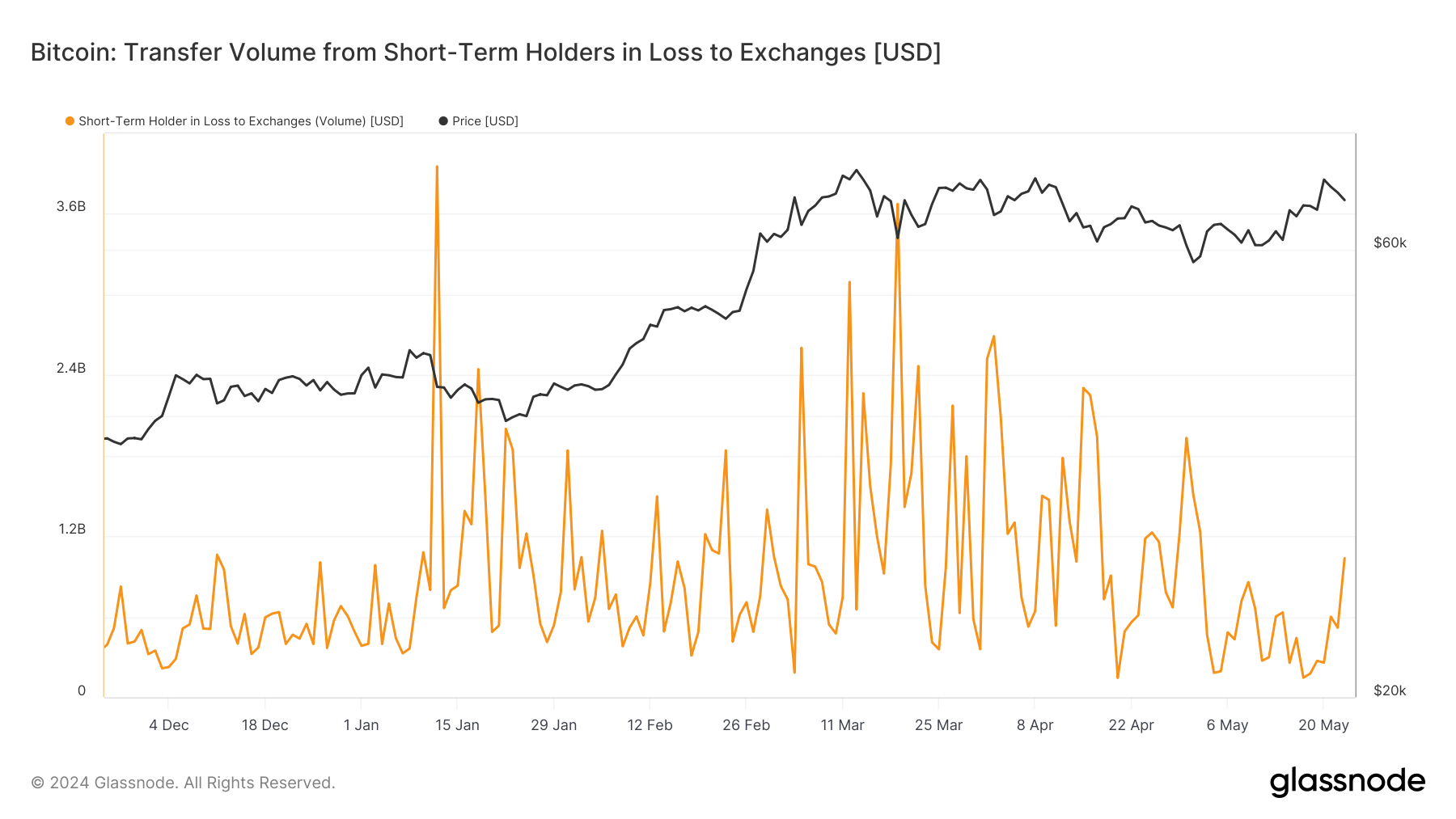

Knowledge from Glassnode reveals that this cohort despatched over $1 billion price of Bitcoin, or round 15,000 BTC, to exchanges at a loss, the very best since Could 2. Regardless of this important occasion, it’s encouraging to notice a sample of reducing promote stress with every subsequent sell-off, indicating that these holders have gotten extra accustomed to Bitcoin’s inherent volatility.

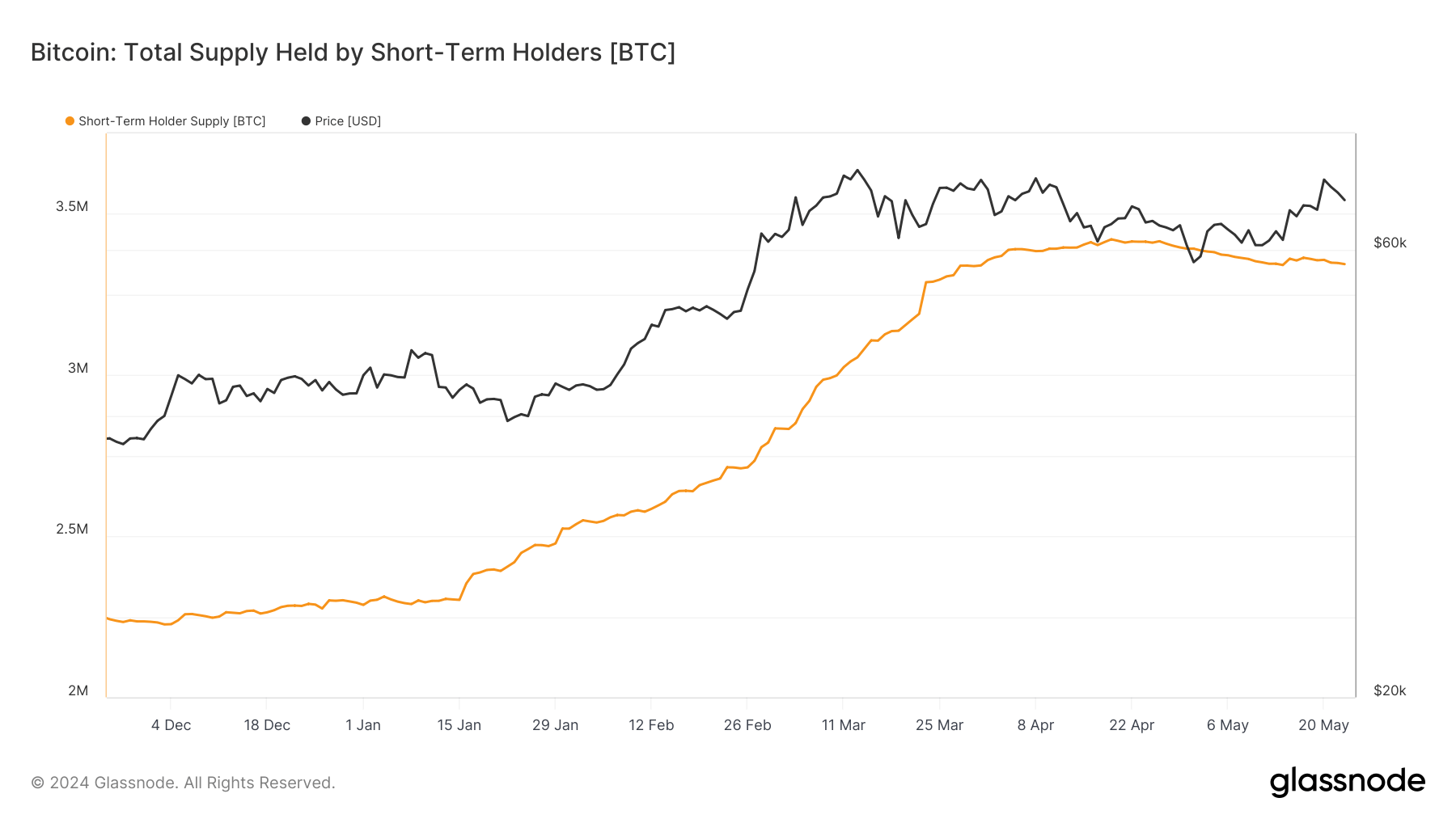

Knowledge from Glassnode reveals that the provision of Bitcoin held by short-term holders has seen a slight decline since its peak in April, dropping from 3.4 million BTC to three.3 million BTC. This shift suggests a rising maturity amongst short-term traders, as they’ve held by a correction exceeding 20%. In earlier phases of the cycle, this cohort would doubtless have exhibited a extra substantial decline.