Abstract

Cash markets proceed to cost in greater peaks for central banks charges, which embrace the U.S. and EU, as financial development is holding up higher than anticipated as CPI inflation continues to run sizzling, and yields proceed to rise.

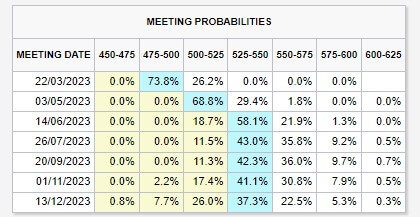

The mantra throughout central banks is ‘Greater for longer’ because the US cash market swaps value at a peak price of 5.5%. The long run feds funds price is per three further 25 foundation level hikes, with no price cuts till 2024.

The EU

Inflation

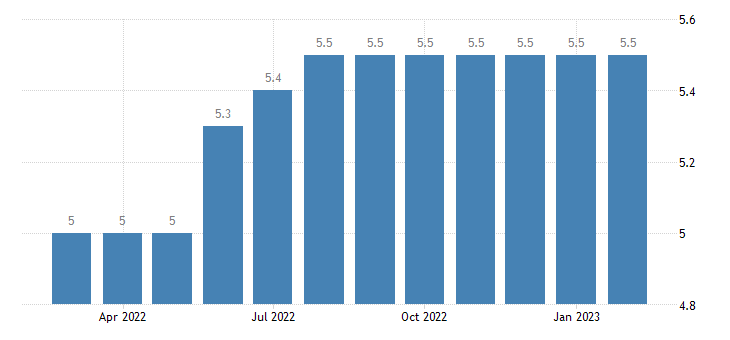

Inflation continues to riot in Europe, as Eurozone headline inflation was forecasted to fall to eight.3%. Nonetheless, it slowed all the way down to solely simply 8.5%. Power inflation dropped significantly to 13.7% from 19%. Nonetheless, the problem that raised concern was core inflation rising to a file excessive of 5.6% towards 5.3%.

Robust information continues to place strain on ECB

February S&P manufacturing PMIs for the southern area (Italy and Spain) rose way over anticipated in expansionary territory. On the similar time, Germany’s unemployment remained at 5.5% for seven months, indicating a extra resilient workforce than anticipated.

The U.S.

U.S. home value declines speed up

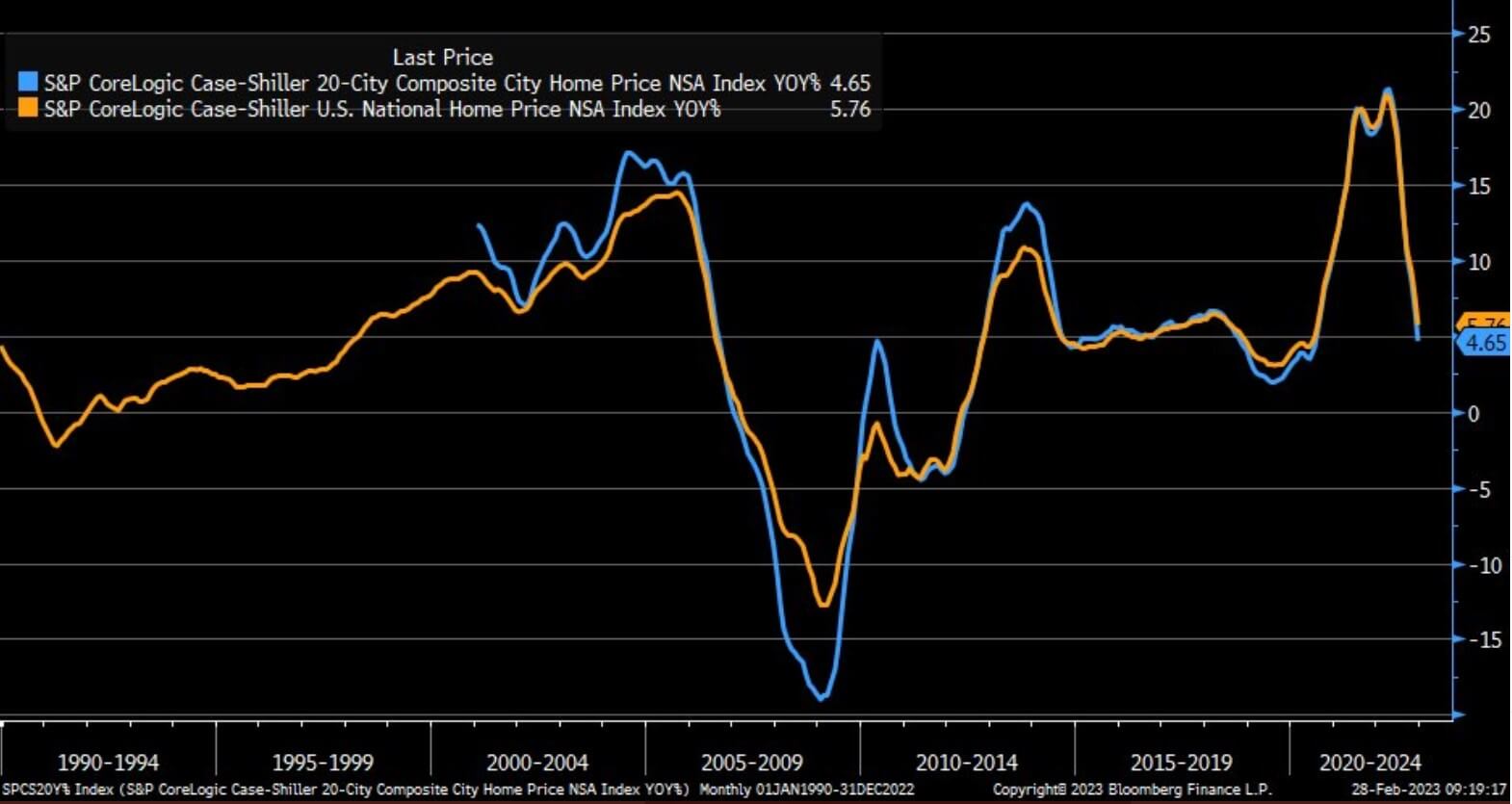

The S&P CoreLogic 20-city, home value index fell quicker than anticipated, which noticed the year-over-year value development price down from 6.8% to 4.7%. This index is a lagging indicator of costs on a three-month common going way back to Q3 2022.

Whereas 30-year mortgage charges have topped 7% once more, mortgage functions for residence purchases fell as a lot as 6% final week, following an 18% drawdown the week prior.

The U.S. economic system remains to be sizzling

ISM providers acquired launched in March 3, which confirmed that the U.S. economic system remains to be extraordinarily robust. Providers had been higher than anticipated, decrease costs paid, stronger employment, and stronger new orders.

All eyes on FOMC

The following FOMC assembly, which takes place on March 22, will embrace an replace of the Fed Dot Plot and an replace on the abstract of financial projections, which could have larger significance than only a 25 or 50bps elevate by the fed.

The U.Ok.

Report meals inflation

Troubling occasions are forward for the U.Ok. as store value inflation accelerated by virtually double digits in February, whereas meals value inflation reached a file 17.1%, based on the British Retail Consortium.

BOE caught between a rock and a tough place

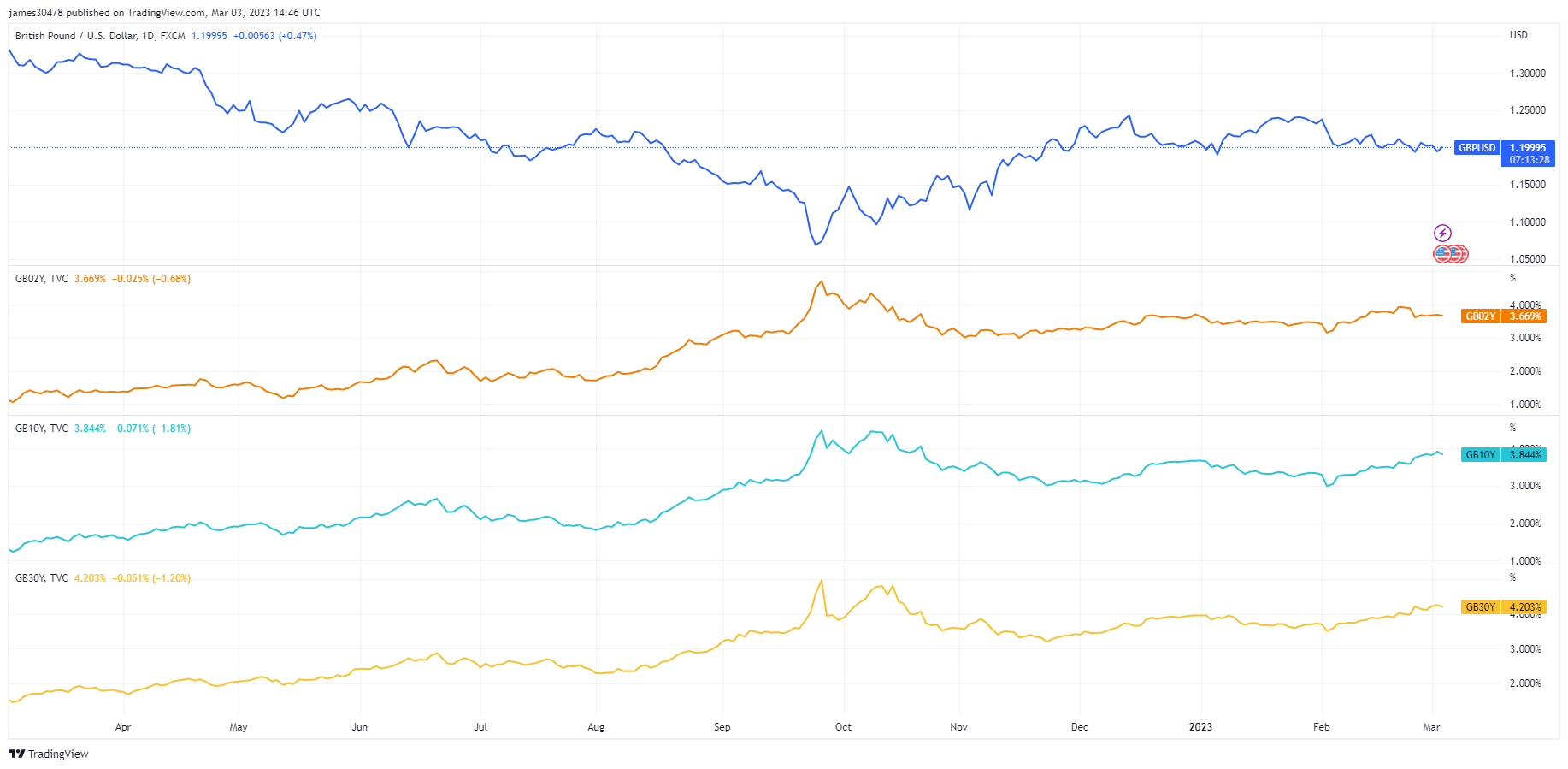

Yields up, GBP down because the BOE struggles in many alternative methods. In contrast to the Fed and ECB, who’ve devised a hawkish plan for 2023, the BOE continues to flip-flop with no clear path. The pound at $1.199 approaches a year-to-date low whereas the yield curve continues to steepen.