There are dozens of technical indicators for Foreign currency trading that will assist determine market developments, level to approaching reversals and decide oversold or overbought ranges. Having this data could also be vital for making buying and selling choices. So it’s essential to decide the best Foreign currency trading indicators for optimum outcomes.

On this article, we’ll check out 4 common technical indicators for Foreign currency trading and potential mixtures. By studying about these instruments and testing them, you possibly can choose probably the most appropriate devices to your buying and selling strategy.

The Transferring Common

The Transferring Common is a straightforward software that many merchants use of their technical evaluation for Foreign exchange market. It’s a trend-following indicator. The principle purpose of the Transferring Common is to decide the pattern path (upward or downward).

✍️

When the worth chart crosses the Transferring Common line from under, it might level to an upward pattern. Quite the opposite, if the worth chart crosses the Transferring Common line from above, it’d point out a downward pattern.

The Transferring Common could also be used by itself and together with most forms of technical indicators for Foreign currency trading.

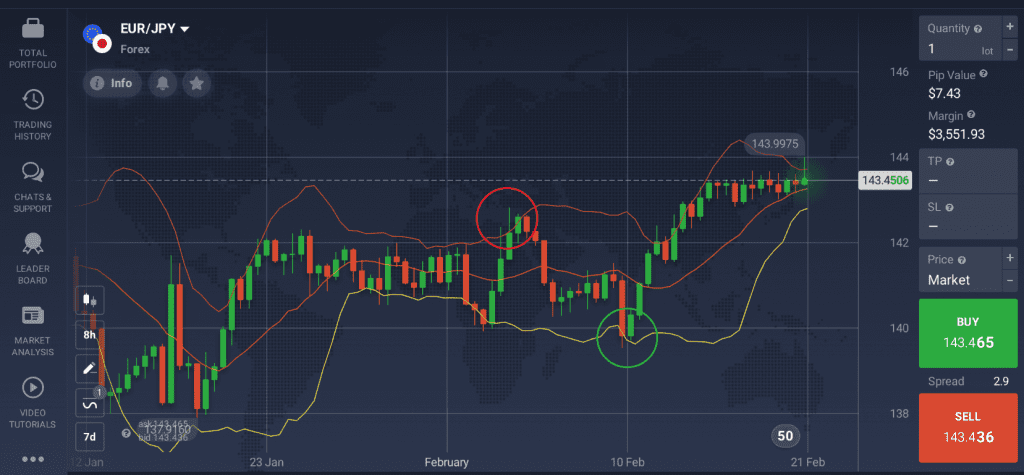

Bollinger Bands

The Bollinger Bands indicator consists of three strains: a easy Transferring Common (orange) and a pair of bands (pink and yellow) that seem above and under the Transferring Common line. Its objective is to decide the overbought and oversold ranges, which can point out an upcoming pattern reversal.

✍️

If the worth chart reaches the highest band, it might point out that the asset is overbought. This can be adopted by downward motion.

Conversely, if the worth chart will get nearer to the decrease band and touches it, this would possibly recommend that the asset is oversold. On this case, the worth could flip upward.

A pattern reversal could happen when the candlesticks of the worth chart cross the Transferring Common line.

The Bollinger Bands will not be the best Foreign currency trading indicator if utilized by itself, but it surely is likely to be fairly helpful mixed with different instruments, such because the RSI.

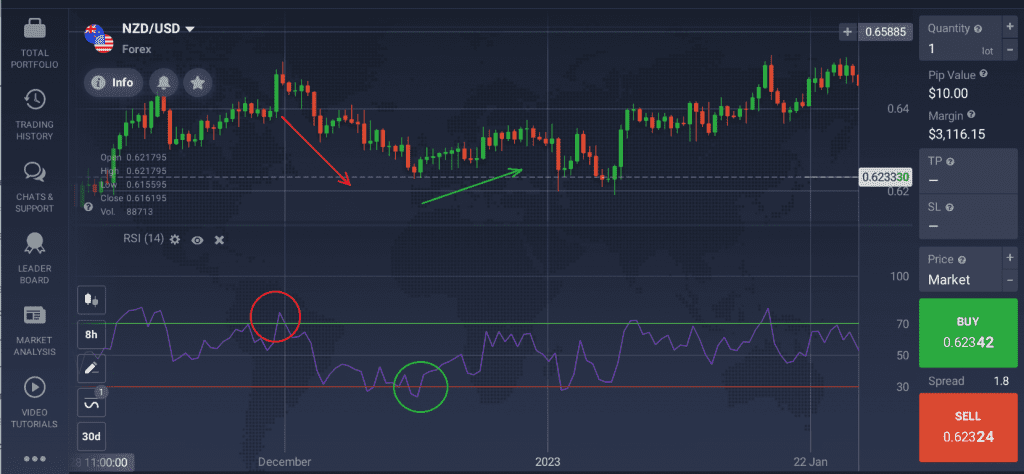

The Relative Power Indicator (RSI)

The RSI is an oscillator which may assist merchants asses the pattern energy and spot potential reversals. It strikes on a scale from 0 to 100, offering details about the overbought and oversold ranges.

✍️

The asset could also be thought-about overbought, if the RSI bottom line strikes above 70. At this level, merchants would possibly anticipate a bearish pattern to observe, with the worth taking place.

Quite the opposite, every time the RSI line crosses 30, the asset is likely to be considered as oversold. That’s when merchants could anticipate a reversal to a bullish pattern.

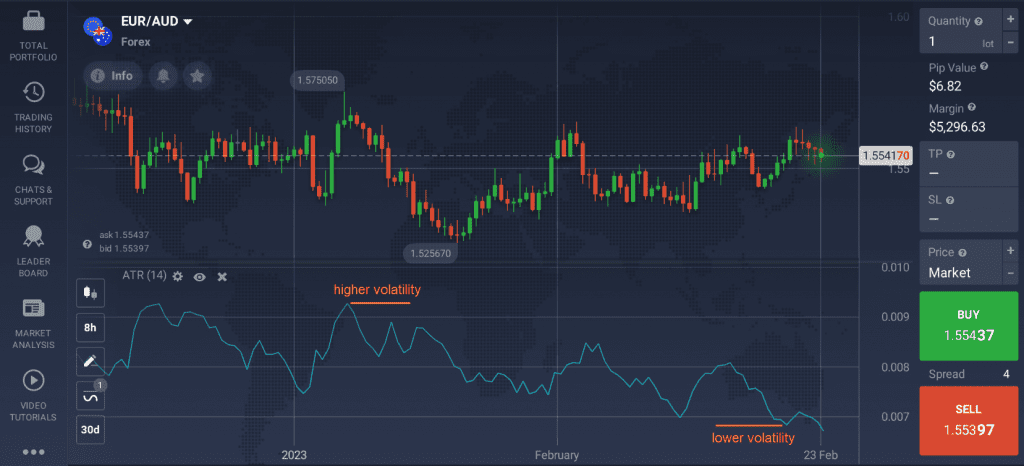

The Common True Vary (ATR)

The ATR indicator is an efficient software generally utilized in technical evaluation for Foreign exchange market. It might help merchants in measuring market volatility – an essential think about figuring out whether or not the present pattern will proceed.

✍️

When market volatility is rising, the ATR line goes up. As value adjustments following greater volatility could supply new buying and selling alternatives, some merchants would possibly see this second as such a possibility.

If market exercise is lowering, the ATR line will go down accordingly. As soon as merchants study to evaluate the market volatility, they are able to select the optimum entry and exit factors.

Parabolic SAR

This indicator’s fundamental objective is to assist decide the pattern path and level to potential reversals. It’s displayed on the worth chart as a collection of dots under or above it.

✍️

If the Parabolic SAR dots are above the worth chart, it might point out a following bearish pattern. As soon as the dots transfer under the chart, an upcoming bullish pattern is likely to be anticipated. Having this data could supply some insights into belongings’ value actions and level to buying and selling alternatives.

The Parabolic SAR may additionally supply further insights into Foreign exchange market exercise when utilized in mixture with different indicators, such because the Transferring Common.

Tips on how to Mix Greatest Technical Indicators for Foreign exchange Buying and selling?

There are fairly just a few Foreign exchange indicators that work properly collectively. Making use of a number of instruments on the identical time could supply extra accuracy and supply further details about asset costs. Right here is an instance of a well-liked Foreign exchange indicator combo.

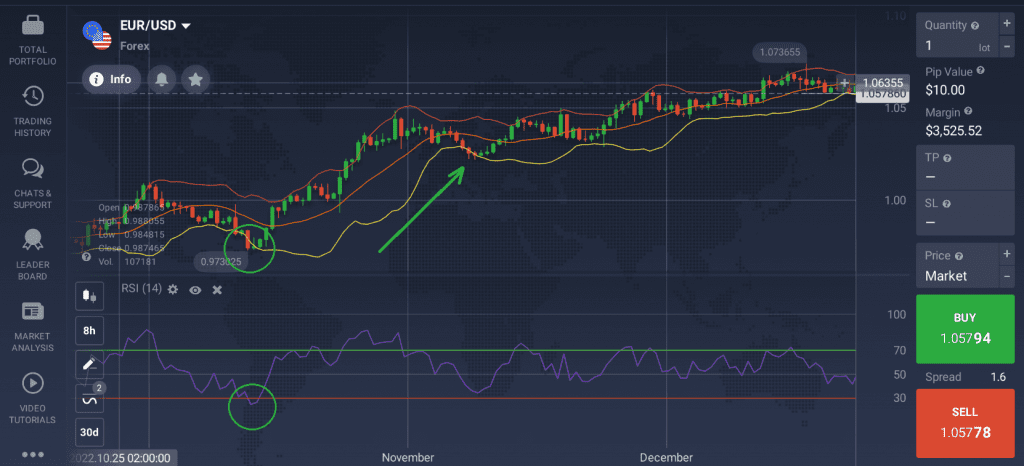

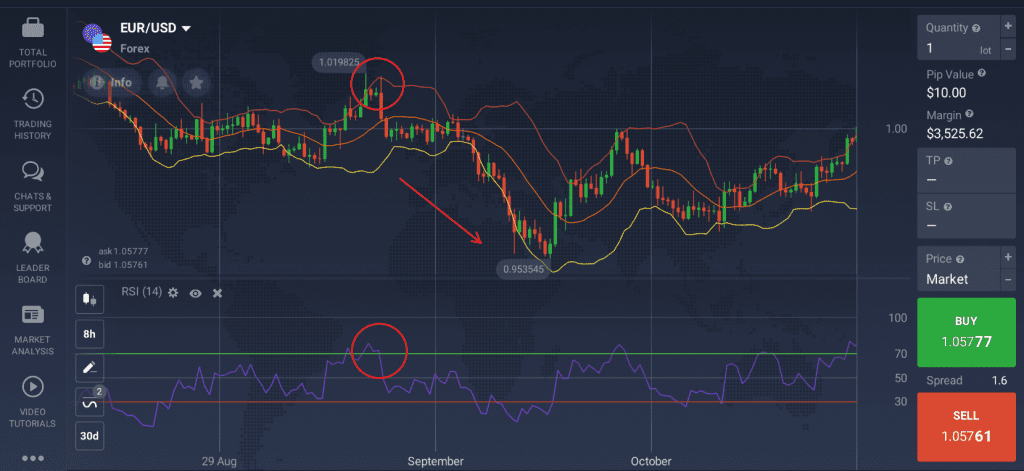

RSI + Bollinger Bands

Combining these 2 technical indicators would possibly assist merchants discover the suitable second to open an extended (BUY) or a brief (SELL) place relying on their desire.

If the worth chart crosses the decrease line of the Bollinger bands, whereas the RSI crosses the oversold degree and strikes upward, it might point out a bullish pattern.

As soon as the candlesticks attain the highest line of the Bollinger bands with the RSI on the overbought degree, it’d sign a bearish pattern.

Take into account that no technical indicator for Foreign currency trading or their mixtures can supply 100% correct outcomes, so make certain to use the suitable Cease-Loss and Take-Revenue ranges to handle your trades.

Put up Views: 1