With the creation of Bitcoin in 2009, a radical new method of creating funds emerged earlier than our eyes: with decentralized digital currencies not managed by any authorities, known as cryptocurrencies.

Since then, the event of this new type of fee continues to be exponential, being accepted by massive firms similar to Microsoft, Etsy, Twitch, PayPal, Entire Meals, and even between international locations.

The entry of Bitcoin as authorized tender in El Salvador, together with different necessary initiatives within the crypto ecosystem, made 2021 the yr when cryptocurrencies turned mainstream. In consequence, curiosity in crypto funds has elevated exponentially, each from huge firms and small retailers all over the world.

Nevertheless, what is going on in 2022? How is the crypto funds market evolving in comparison with 2021? What cryptocurrencies do prospects use to pay in shops? What digital currencies do retailers need to obtain for his or her items and providers?

On this article, we are going to reply all these questions, sharing charts and stories based mostly on CoinPayments knowledge.

We can even present the 5 most used cryptocurrencies in transactions made via our crypto fee gateway, evaluating the outcomes of 2021 and 2022 to see their evolution.

On the finish of the article, you’ll study first-hand the place cryptocurrency tendencies are transferring, and you’ll perceive why you must settle for these digital currencies in what you are promoting.

The expansion of crypto funds from 2021

All through 2021, the crypto funds sector has seen a serious evolution. As you will notice under, CoinPayments’ knowledge reveals that increasingly more individuals need to spend their cryptocurrencies in the identical method they use their fiat currencies.

On the identical time, each massive manufacturers and small retailers are capturing this new group of shoppers who need to pay with crypto.

In consequence, extra retailers are integrating crypto funds into their companies, that are processing extra quantity and transactions with cryptocurrencies.

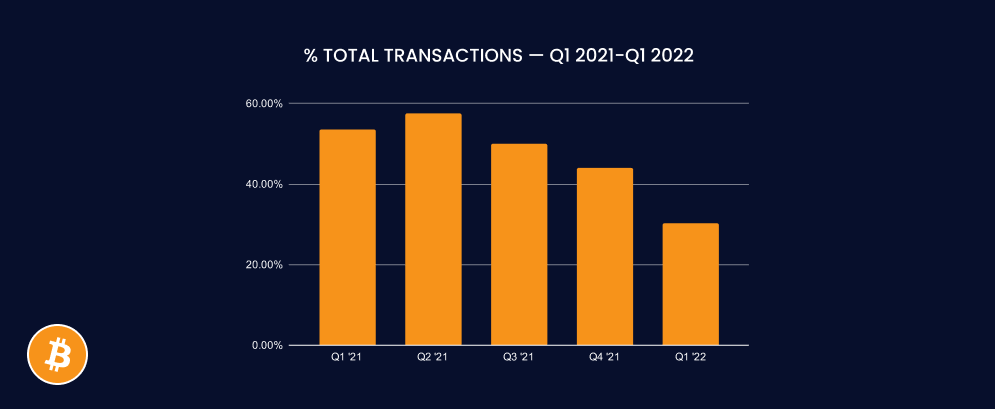

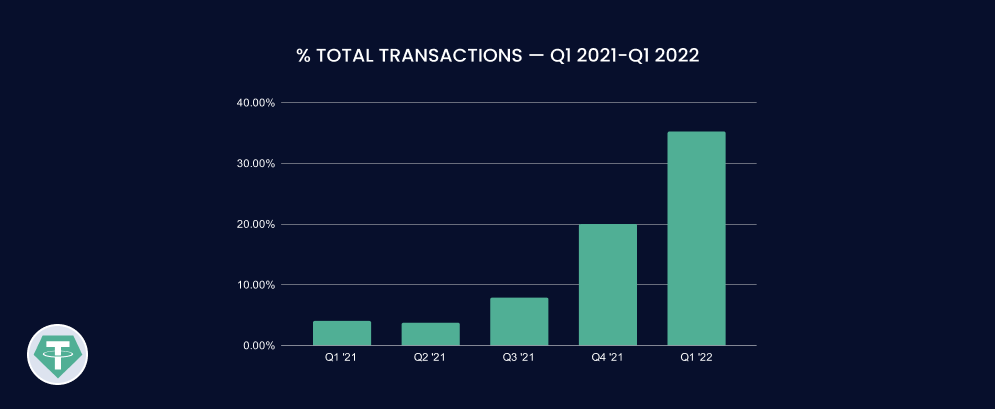

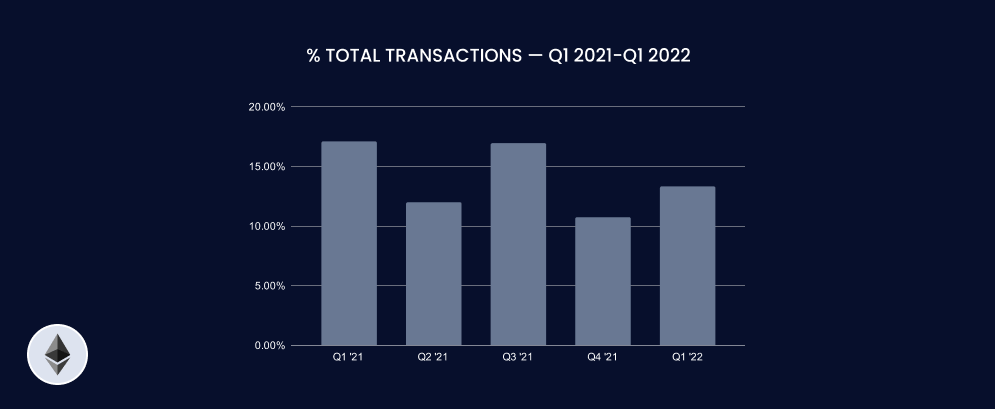

If we think about the whole variety of transactions processed by CoinPayments in 2021, we have now had a slight lower of 17.92% because the starting of the yr.

Nevertheless, if we embrace the info for the primary months of 2022 as much as March, we will see how the variety of transactions has elevated by 32.52% since January 2021.

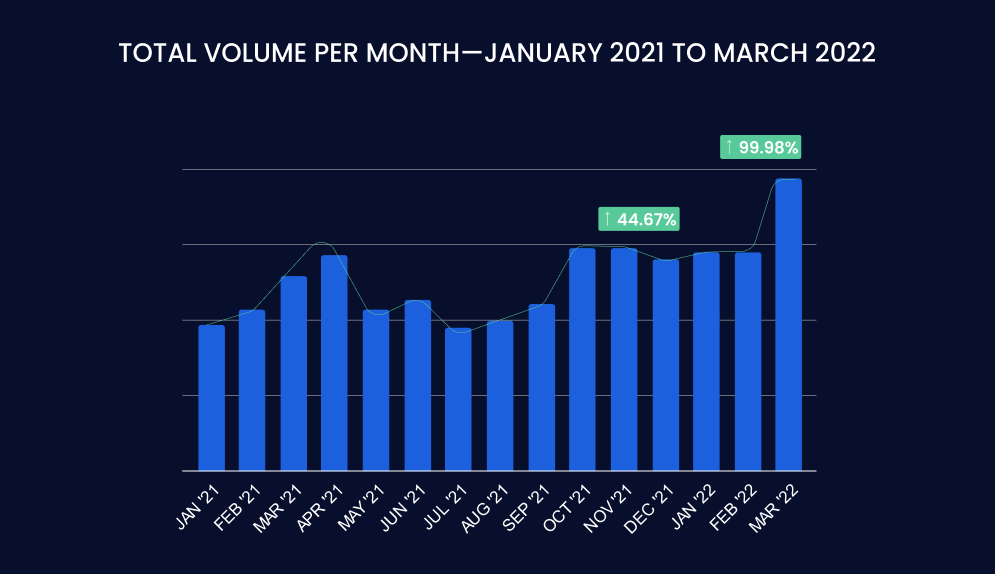

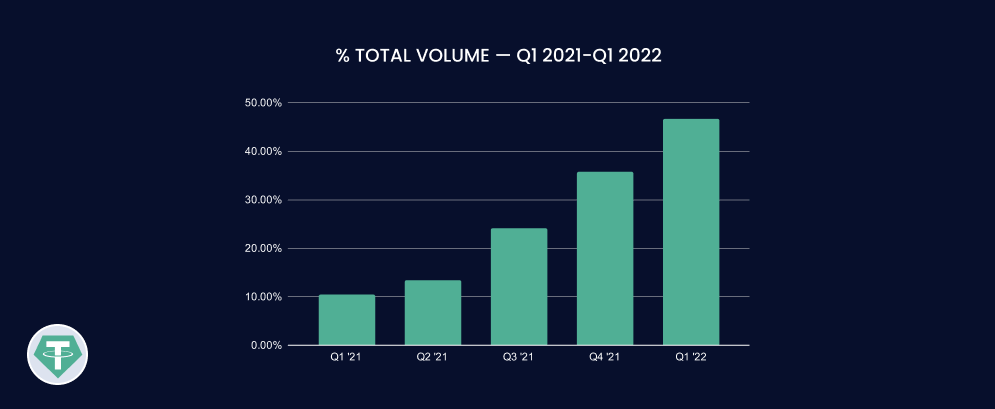

Whole quantity figures are on the identical development, each in 2021 and within the first quarter of 2022.

Regardless of month-on-month variations from the start to the tip of 2021, the whole quantity processed by our platform has elevated by 44.67%.

And if we take note of the primary quarter of 2022, this progress rises to nearly 100% (99.98% to be precise).

That’s, from January 2021 to March 2022, the amount processed in crypto funds by CoinPayments doubled, confirming that crypto funds are on the rise.

The overall notion of cryptocurrencies, amongst each customers and companies, appears to be shifting from being an asset class—just like gold or bonds—to being a foreign money to spend.

Firms are transferring shortly towards this new actuality, utilizing options similar to CoinPayments gateway to facilitate funds with crypto.

Now, which cryptocurrencies are retailers accepting? Which cash do customers want to pay with?

Let our knowledge converse for itself.

Prime 5 cryptocurrencies used for funds in 2021 and 2022

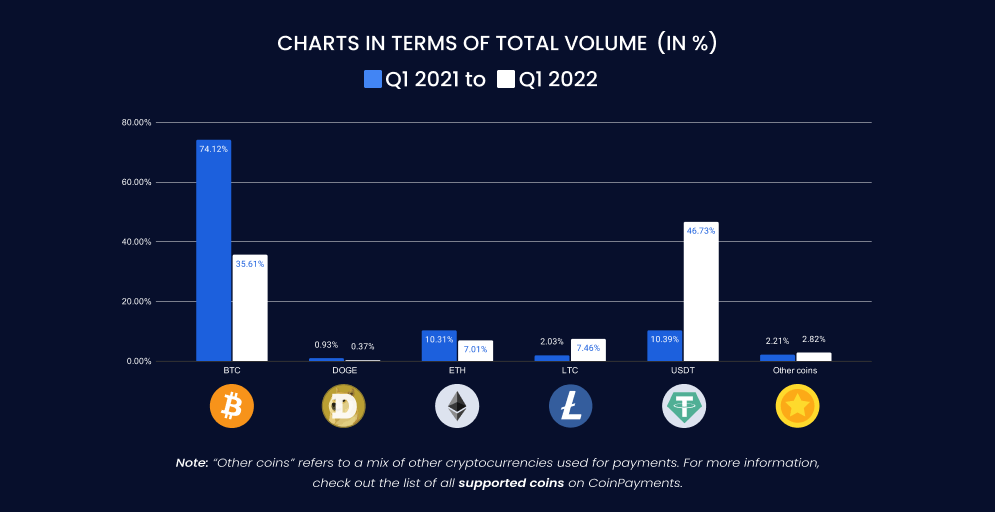

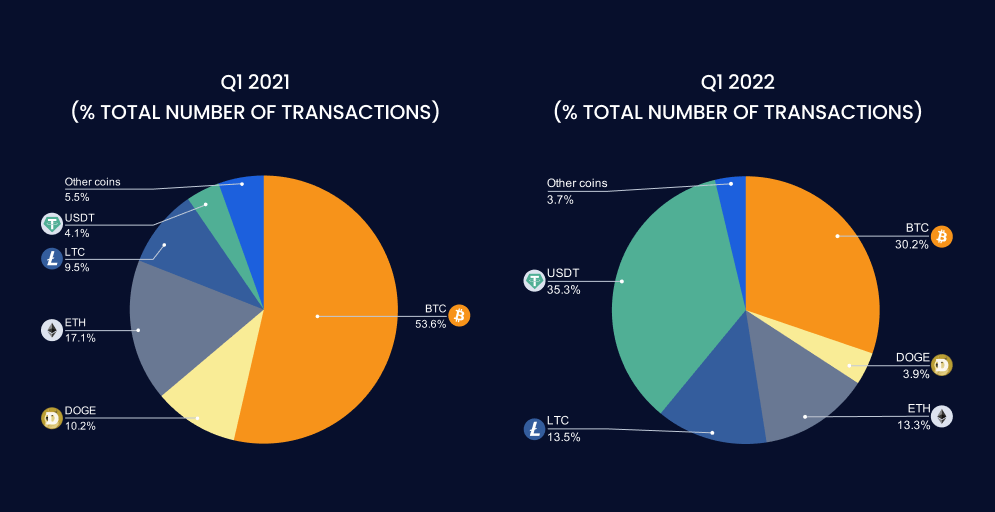

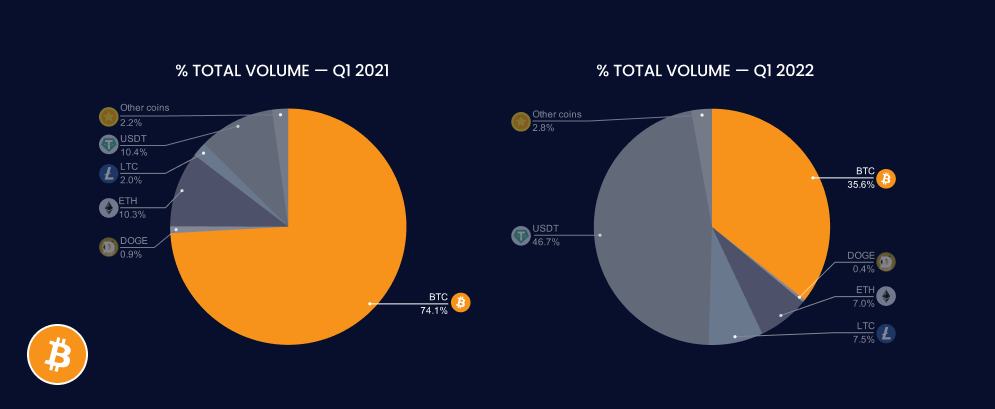

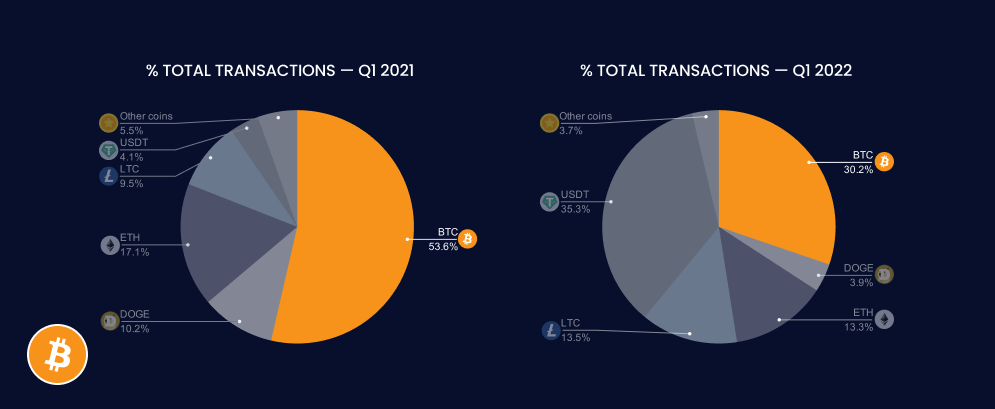

We have now in contrast our whole quantity and the variety of transactions carried out in two durations: Q1 2021 and Q1 2022.

In each durations, and all through 2021, essentially the most generally used cryptocurrencies for funds by customers are the next:

Nevertheless, let’s check out the comparative charts for each durations. This may give us an outline of how every foreign money has carried out, each when it comes to quantity and variety of transactions.

Information concerning the Prime 5 Cash You Ought to Be Accepting in Your Enterprise

About Bitcoin (BTC)

Designed by the pseudonymous Satoshi Nakamoto in early 2009, Bitcoin is a peer-to-peer digital money system whose foreign money is bitcoin (BTC), the primary cryptocurrency in historical past.

It’s a kind of foreign money based mostly on blockchain expertise, 100% digital, divisible, fungible and scarce (as there’ll solely be 21 million bitcoin in existence).

A censorship-resistant asset that may be despatched, obtained and saved with out relying on third events, similar to governments or central banks.

Its revolutionary properties, in addition to its management when it comes to market capitalization, have made it essentially the most extensively used cryptocurrency for funds for greater than a decade. Not less than, it has been so till 2021.

Quantity of Bitcoin funds

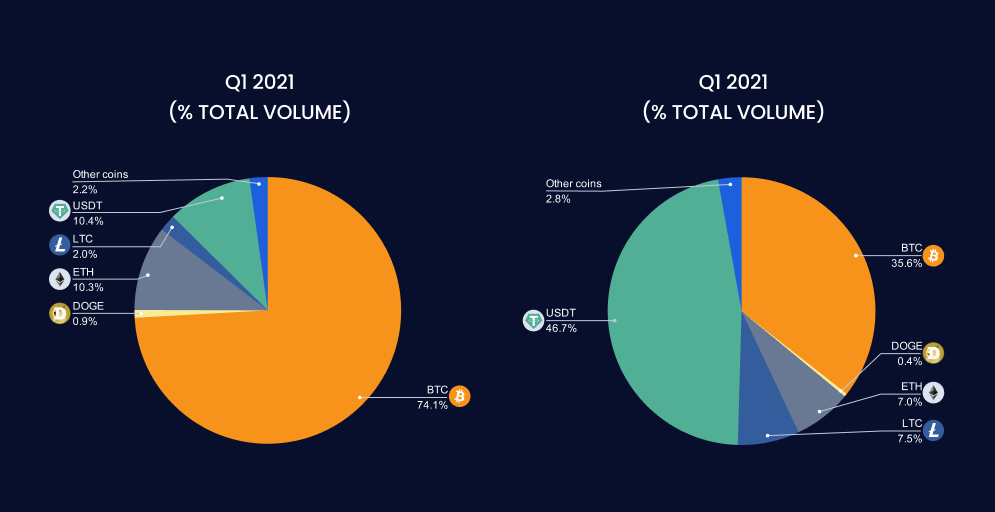

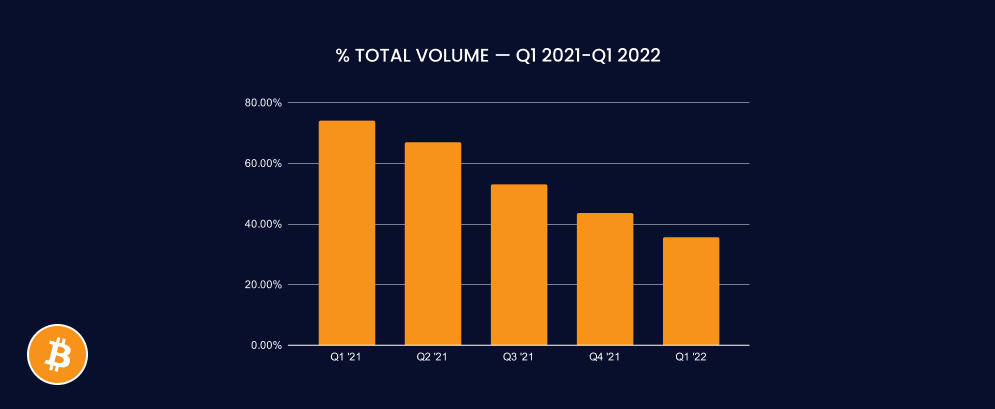

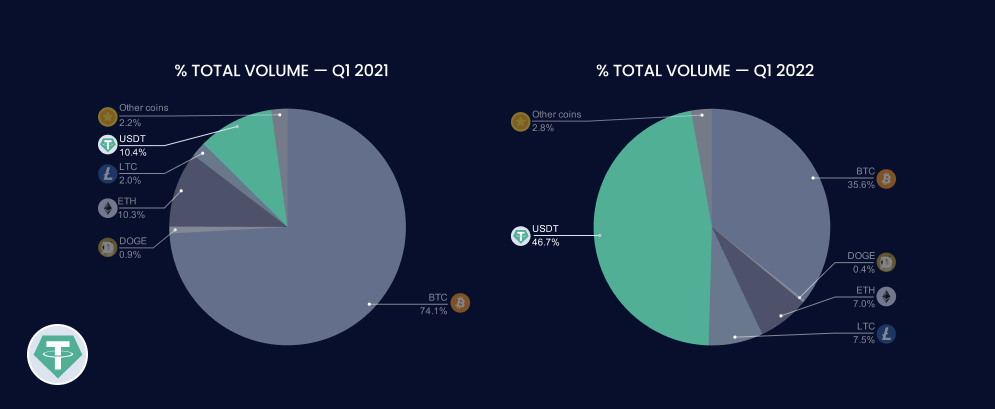

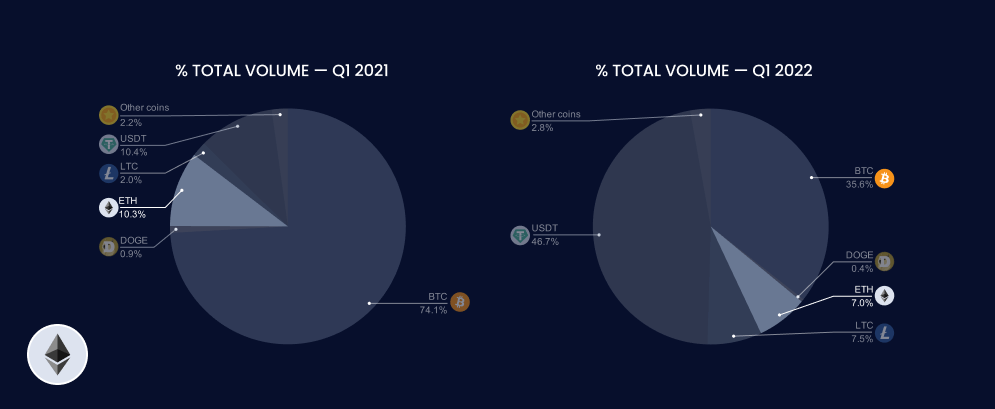

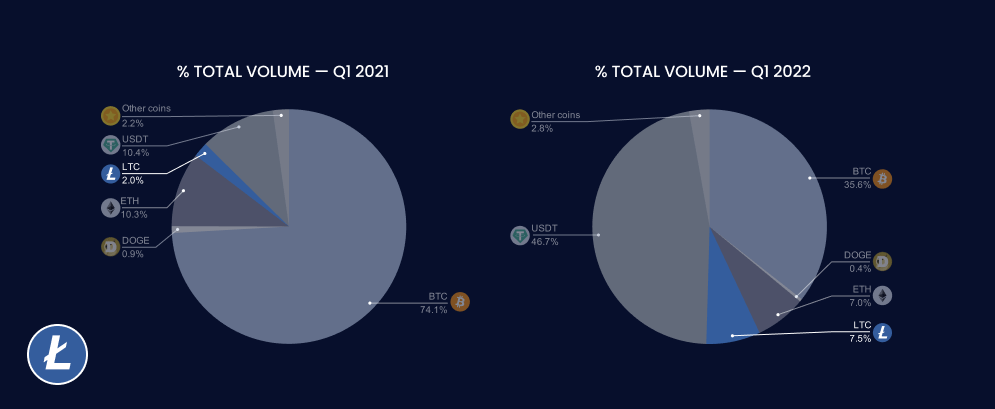

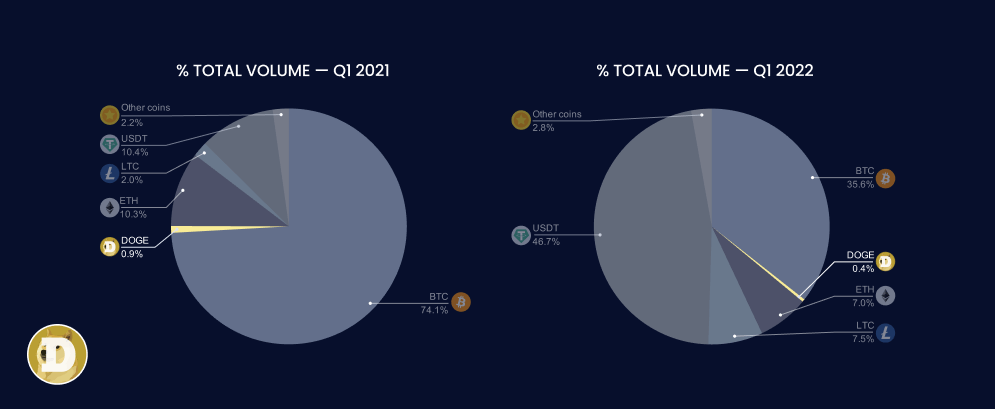

Within the first quarter of final yr, Bitcoin accounted for nearly three-quarters of the whole quantity processed by our platform (precisely 74.1%). Nevertheless, firstly of 2022, it has lowered its place to 35.6%, which is sort of a 3rd of the whole quantity.

In a single yr, its share of our whole transacted quantity has dropped 38.5 share factors. This reveals how Bitcoin is sustaining a downward development and shedding its largely dominant place lately.

Variety of transactions in BTC

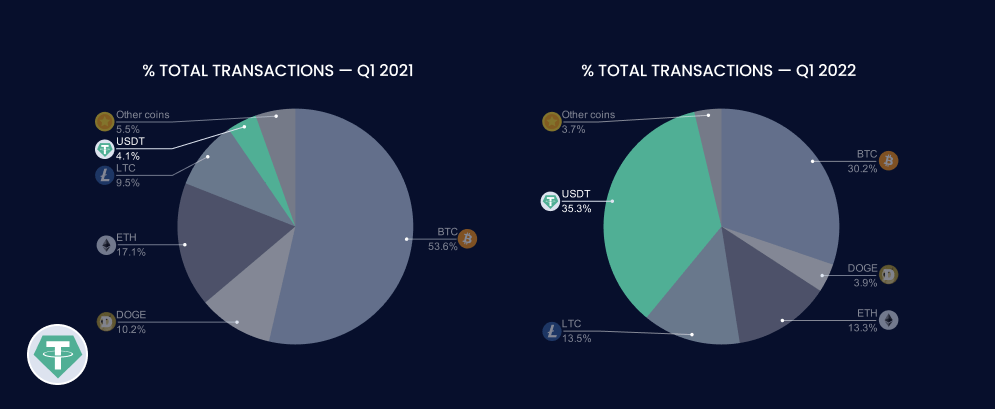

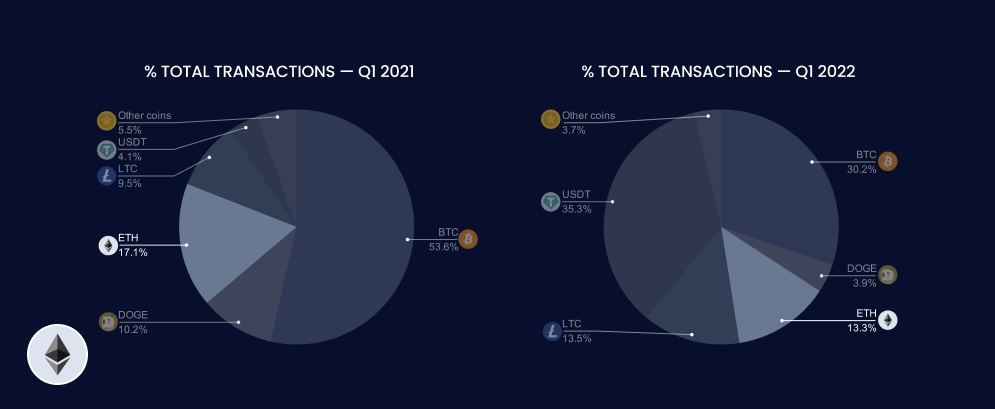

The identical applies if we analyse the variety of transactions made with Bitcoin within the final yr.

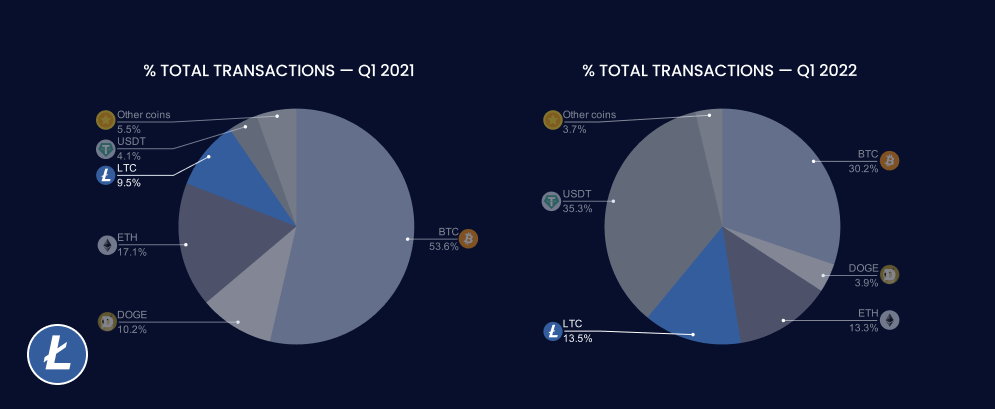

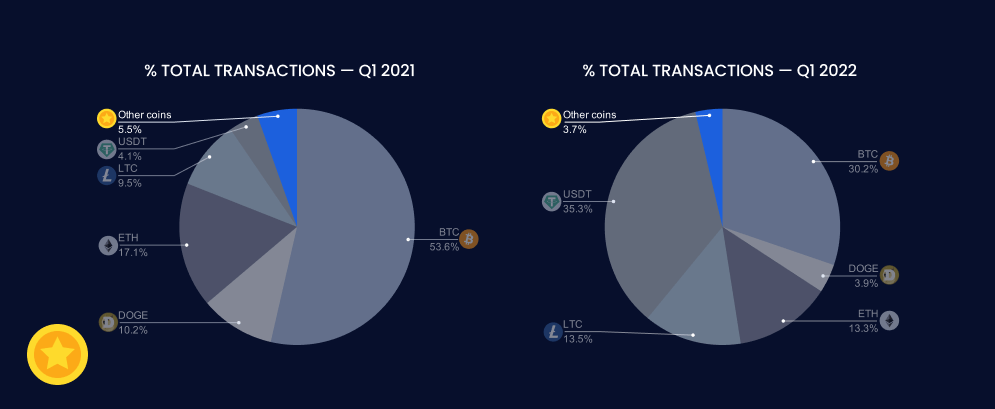

Originally of 2021, BTC represented 53.6% of all cryptocurrency transactions on CoinPayments. This share has been lowered to 30.2% throughout the first quarter of 2022.

Nevertheless, regardless of this 23.4% drop within the variety of transactions, Bitcoin stays among the many prime 5 most used cash for crypto funds in 2022.

Bitcoin (BTC) briefly

All the pieces means that prospects have determined to cease spending their treasured and scarce Bitcoin in favour of different cryptocurrencies extra akin to their well-known fiat currencies, similar to Tether.

About Tether (USDT)

Launched as RealCoin in July 2014 and renamed 4 months after, Tether (USDT) is the most well-liked of the so-called stablecoins: cryptocurrencies whose purpose is to maintain their market valuation secure.

Tether belongs to the group of stablecoins collateralized with fiat foreign money. Particularly, a Tether token is pegged to the US greenback and maintains a 1:1 ratio with the greenback when it comes to worth (1 USDT = 1 USD). That is doable because of its reserves, that are a mixture of money, secured loans, US Treasury payments, and different investments.

Tether was particularly designed to supply the mandatory bridge between fiat currencies and cryptocurrencies, providing stability, transparency, and minimal transaction prices to customers.

Because of this and for being one of many pioneers of its form, Tether has turn into not solely the #1 stablecoin available on the market, but additionally the popular cryptocurrency for funds.

Quantity of Tether funds

USDT went from representing greater than a tenth of the whole quantity firstly of 2021 (10.4%) to account for nearly half of CoinPayments’ transaction quantity within the first quarter of 2022 (46.7%).

This represents a rise of 36.3% of the whole quantity managed on the platform. Common progress of 9% per 30 days has led to it displacing Bitcoin because the cryptocurrency with the best quantity transacted on the platform in 2022.

Variety of transactions in USDT

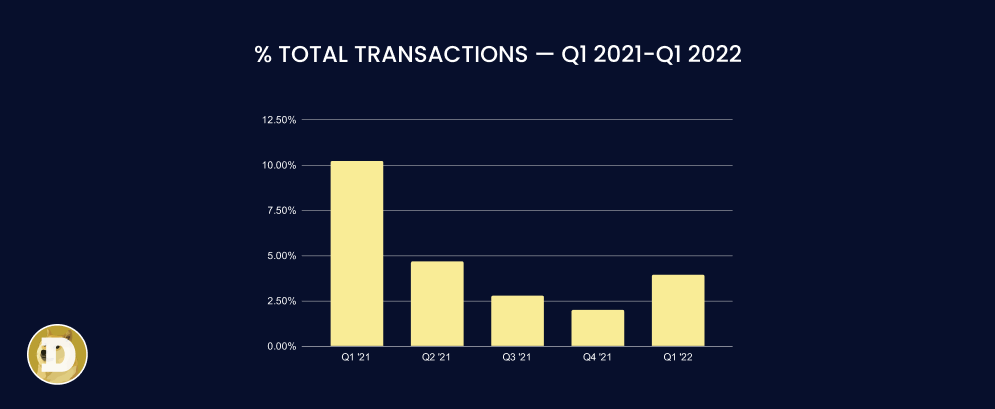

These figures are linked to the variety of transactions made with this stablecoin, which has elevated from simply 4.1% of transactions in Q1 2021 to 35.3% in Q1 2022 (8.6 instances extra).

Other than a big rise within the variety of transactions, what we will additionally observe is that this improve occurred primarily over the last quarter of 2021 and the primary quarter of 2022.

Because the bar chart reveals, Tether went from accounting for 20% of all transactions in This fall 2021 to 35.32% in Q1 2022.

Tether (USDT) briefly

The figures present a development change in each service provider acceptance of this particular cryptocurrency and client fee choice.

The place Bitcoin used to take up the overwhelming majority of transactions and quantity, it now appears that extra prospects want to pay with the stablecoin Tether.

Regardless of this, there are additionally many others preferring to pay with different cryptocurrencies, similar to Ethereum.

About Ethereum (ETH)

Conceived by Vitalik Buterin in 2013 and launched by him in collaboration with Gavin Wooden in July 2015, Ethereum is a decentralized blockchain-based software program platform that permits sensible contracts.

Ethereum permits any kind of decentralized software (dApp) to be constructed and programmed on it: from decentralized organizations (DAOs) to monetary providers (DeFi), non-fungible tokens (NFTs), video games, and lots of extra.

For this goal, it additionally has its native token, the Ether (ETH), which serves each to work together with Ethereum functions and to be saved, despatched, or obtained as fee for items and providers.

For a number of years this cryptocurrency has been the second largest cryptocurrency in market capitalization after Bitcoin (and simply forward of Tether, the third). Because of this and its a number of prospects, it stays one of many 5 most used currencies in crypto funds.

Quantity of Ethereum funds

Originally of 2021, ETH accounted for 10.3% of the whole quantity registered on CoinPayments, just about equal to Tether (USDT) at 10.4%.

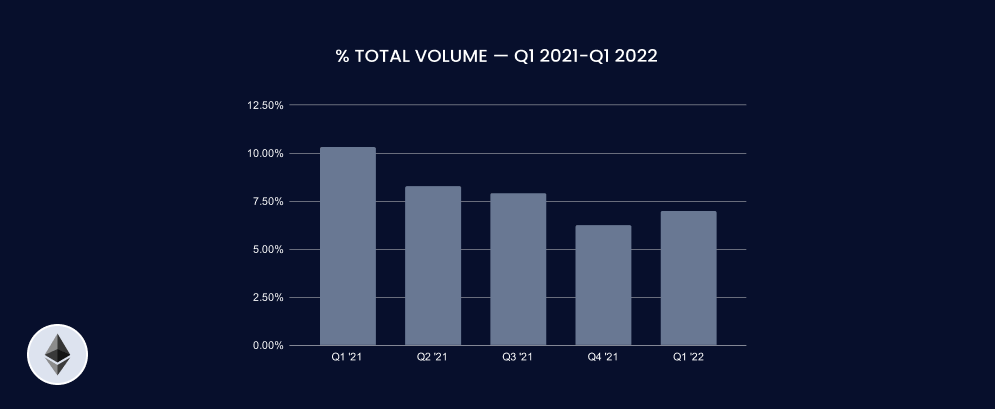

Nevertheless, not like what has occurred with the stablecoin, which has grown exponentially, ETH has barely lowered its place in whole quantity, registering at 7% (a 3.4% lower).

Variety of transactions in ETH

When it comes to the variety of transactions made with ETH throughout the first quarter of 2021, the token was the second most used, solely behind Bitcoin, with 17.1% of whole transactions.

In the identical interval of 2022, ETH accounted for 13.3% of all transactions made on CoinPayments (3.8% lower than in 2021), falling to 4th place in our prime 5 cash.

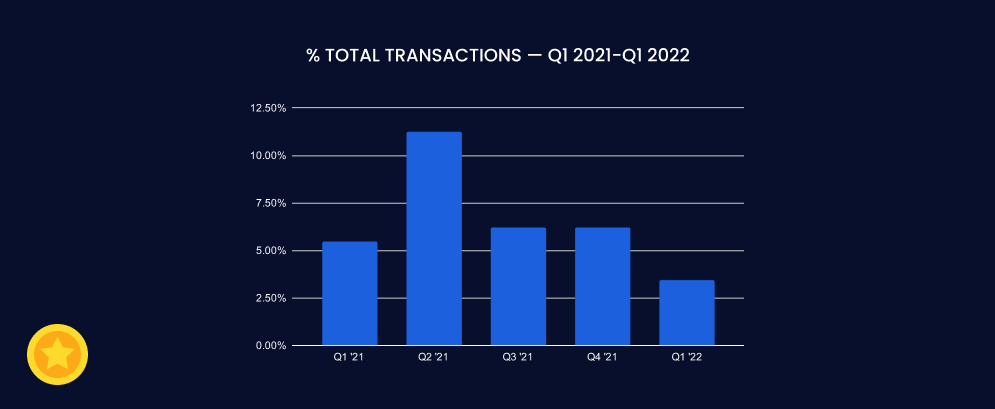

Alternatively, if we have a look at the bar chart, we will understand a curious sample: the variety of transactions goes up and down from quarter to quarter. This can be as a result of variable worth of fuel: the charge to be paid for making transactions on the Ethereum community.

When the community shouldn’t be saturated, the worth of creating transactions stays reasonably priced. Nevertheless, when the variety of transactions on the community will increase significantly, the worth of fuel skyrockets, making it significantly costlier to make a fee with ETH.

Ethereum (ETH) briefly

Regardless of this, ETH stays among the many prime 5 most used cryptocurrencies for crypto funds in 2022. Nevertheless, because of this instability within the charges for paying with ETH, many customers want to pay with different cash similar to Tether, Bitcoin, and even Litecoin.

About Litecoin (LTC)

Based in 2011 by a former Google engineer named Charlie Lee, Litecoin (LTC) is a peer-to-peer digital money system that was born from a fork of the Bitcoin blockchain.

Each initiatives are very comparable. Actually, in essence, and defined by its personal creator, Litecoin is a “lite model of Bitcoin” and its native foreign money, the LTC, “a foreign money that’s the silver to Bitcoin’s gold”.

Nonetheless, Litecoin differs from Bitcoin in some particulars similar to the utmost provide of cash (84 million, versus Bitcoin’s 21 million) or a better transaction processing velocity (2.5 minutes versus bitcoin’s 10 minutes).

This final property permits making funds in LTC 4 instances quicker than with BTC, being one of many compelling the explanation why Litecoin is among the many 5 most used cryptocurrencies in crypto funds in 2022.

Quantity of Litecoin funds

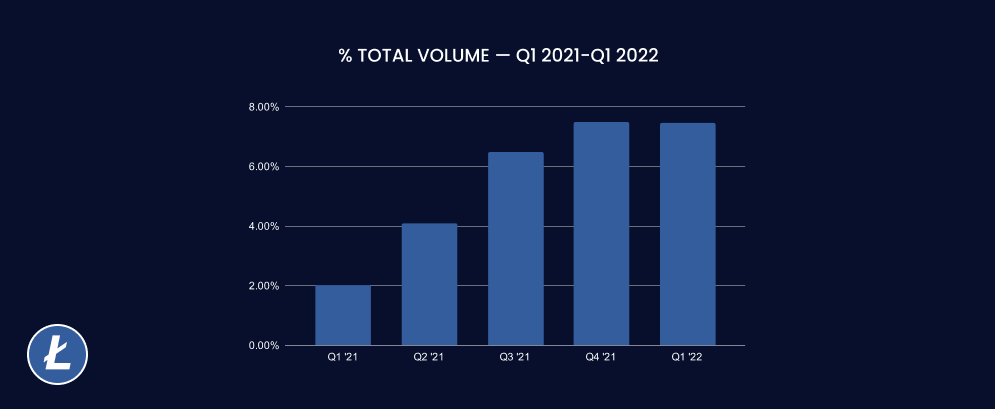

When it comes to whole quantity, it’s far behind the opposite currencies talked about above. Even so, its quantity has grown within the final yr.

Within the first quarter of 2021, LTC accounted for under 2% of the whole quantity. One yr later, it has nearly tripled its share, accounting for 7.5% of the whole.

Its highest quantity progress occurred in 2021. From January to December of final yr, Litecoin elevated its quantity 2.69 instances, because the bar chart reveals. Nevertheless, throughout the first quarter of 2022, it has barely lowered its place.

Variety of transactions in LTC

Alongside the identical upward development are LTC transactions, which have risen from 9.5% of the whole in early 2021 to 13.5% in Q1 2022 (a 4% improve).

Now, though the development in 2021 is upward, the variety of transactions made with LTC has declined to date in 2022: from 17% in This fall 2021 to 13.45% in Q1 2022 (a lower of three.5%).

Litecoin (LTC) briefly

Total, the usage of Litecoin for crypto funds has not solely been maintained however has grown in comparison with the earlier yr.

We should look forward to future months to see the way it performs, however all indications are optimistic that it’ll stay among the many prime 5 most used currencies in CoinPayments.

About Dogecoin (DOGE)

If Litecoin was a fork that emerged from the Bitcoin blockchain, Dogecoin (DOGE) is a fork that emerged from the Litecoin blockchain.

Launched in December 2013 and created by software program engineers Billy Markus and Jackson Palmer, Dogecoin is the primary so-called meme coin.

Its creators determined to create a fee system as a joke, making enjoyable of Bitcoin and the wild hypothesis on cryptocurrencies in 2013. Actually, its identify and brand come from a preferred meme on the time that used the intentionally misspelt phrase “doge” to explain a Shiba Inu canine.

Nevertheless, towards all odds, Dogecoin has been gaining recognition within the crypto neighborhood and as a way of fee.

Amongst its largest supporters are personalities similar to Elon Musk, Snoop Dogg, Mark Cuban, or Jake Paul, and firms just like the Dallas Mavericks, SpaceX, AMC Theaters, or Newegg settle for it as a fee methodology.

Dogecoin has confirmed that it’s not a joke however a severe venture, remaining yet another yr in our prime 5 cryptocurrencies.

Quantity of Dogecoin funds

When it comes to transaction quantity, DOGE represents the smallest of the 5 most used cryptocurrencies in funds.

Within the first quarter of 2021, DOGE was dealing with solely 0.9% of whole quantity, a determine that dropped by greater than half one yr later to 0.4% in early 2022.

Its highest file was in Q2 2021 when it accounted for nearly 1.5% of whole quantity. Nevertheless, since that quarter a substantial decline might be famous.

Variety of transactions in DOGE

When it comes to transactions, it’s fascinating to say that firstly of 2021, extra funds had been being made with DOGE than with LTC, particularly in comparison with USDT, the cryptocurrency with the best variety of transactions at this second.

10.2% of all transactions made on CoinPayments throughout the first quarter of 2021 had been made with DOGE, versus 9.5% of LTC or 4.1% of USDT.

A lot has modified within the first quarter of 2022, the place it has been relegated to fifth place with solely 3.9% of the whole transactions.

Regardless of the decline, to date in 2022 extra transactions are going down in DOGE than within the earlier two quarters, confirming its slight rise since mid-2021.

Dogecoin (DOGE) briefly

Whatever the discount in each quantity and variety of transactions in comparison with the earlier yr, Dogecoin stays one of many prime 5 most used cryptocurrencies in crypto funds.

And considering the variety of firms that settle for it as a way of fee, the whole lot signifies that it’ll turn into extra necessary over time.

About different cash

The “different currencies” group consists of all these cryptocurrencies that are used to make funds, however whose whole quantity doesn’t symbolize individually greater than 1%.

Amongst lots of them, essentially the most consultant cash on this group are Bitcoin Money (BCH), Binance Coin (BNB), Velas (VLX), Ripple (XRP), and different stablecoins similar to BUSD, USD Coin (USDC) or TrueUSD (TUSD).

You may verify all CoinPayments’ supported cash on this hyperlink: https://www.coinpayments.web/supported-coins

Fee quantity in different cash

Collectively, these cryptocurrencies accounted for two.2% of the whole quantity registered on CoinPayments firstly of 2021, barely forward of Litecoin (2%) and Dogecoin (0.9%).

Within the first quarter of 2022, this group’s quantity rose barely to 2.8% of whole quantity, surpassing solely DOGE (0.4%).

Nevertheless, this slight improve of solely 0.6% in a single yr doesn’t symbolize what occurred quarter by quarter, as might be seen within the bar chart.

If we solely take note of the final 3 quarters of 2021, we see that this group accounted for between 5% and eight% of the whole quantity. One of many causes for this rise could possibly be the rise in recognition of different stablecoins, associated to the massive progress of Tether (USDT) as a way of fee.

These figures are very totally different from these discovered within the first quarters of each years (2.21% in Q1 2021, and a couple of.82% in Q1 2022, respectively).

Variety of transactions in different cash

Throughout the first quarter of 2021, this group of blended cash accounted for five.5% of all transactions carried out on CoinPayments, collectively surpassing the stablecoin Tether at 4.1%.

However simply as what occurred with the amount transacted, the variety of transactions made by this set of currencies decreased barely firstly of 2022, representing solely 3.7% of the whole.

Excluding the second quarter of 2022, the development for transactions in different currencies outdoors our prime 5 is downward.

Different cash’ efficiency briefly

Information reveals that each prospects and retailers want to make use of extra established cryptocurrencies available in the market, similar to those in our prime 5.

Even so, and regardless of the downward development, it appears seemingly that there’ll proceed to be a distinct segment for many who need to pay with different digital currencies sooner or later.

Information in a nutshell

Under, we’re going to summarize in 7 factors a very powerful details concerning the 5 most used cryptocurrencies for crypto funds.

Bitcoin loses its crown

BTC has misplaced energy in comparison with the remainder of the highest cash used for funds, particularly in favour of USDT.

Nonetheless, regardless of the numerous decline, it stays the second most used foreign money on CoinPayments, each when it comes to quantity and variety of transactions.

Tether takes energy

Tether (USDT) has turn into the large winner to date in 2022, rising its place to achieve the highest 1 most transacted foreign money on the platform.

That reveals the choice of retailers and prospects for stablecoins, particularly USDT.

BTC & USDT, the union that makes strengths

Between BTC and USDT collectively, they account for 82.3% of the whole quantity and 65.5% of the variety of transactions made in early 2022.

This illustrates the prevailing willingness of retailers to just accept funds primarily in these two cryptocurrencies.

Ethereum offers up its seat

ETH has misplaced floor as a foreign money for crypto funds in comparison with the earlier yr, presumably because of excessive and risky charges by itself community.

Nevertheless, it nonetheless stays one of the crucial extensively used cryptocurrencies in commerce.

Litecoin, exponential improve

Together with USDT, LTC has been one of many winners of 2022, nearly quadrupling its quantity in a single yr.

This reveals that Litecoin can be chosen by 1000’s of retailers as a superb foreign money for crypto funds.

DOGE retains barking

Dogecoin remains to be the coin with the bottom quantity and the bottom variety of transactions amongst our prime 5.

Nevertheless, because of its rising recognition throughout the neighborhood and its current acceptance in massive companies, it’s doable that 2022 could possibly be a superb yr for this cryptocurrency.

Different cash usually are not forgotten

Among the many remainder of the cryptocurrencies outdoors the highest 5, the development reveals that prospects want to pay with extra stable and established digital currencies similar to Bitcoin, Tether, Ethereum, Litecoin, or Dogecoin, all of them with over 8 years within the crypto market.

Nonetheless, yr after yr, prospects proceed utilizing different cash to purchase items and providers, one thing that appears more likely to proceed via 2022.

Be a part of the development of accepting crypto funds in what you are promoting

It’s now not a secret to anybody: cryptocurrencies have gotten extra and extra established as a way of fee globally, each amongst firms and in international locations.

Whereas in 2021 El Salvador was the primary nation to just accept Bitcoin as authorized tender, to date in 2022, a second nation has already joined the development: the Central African Republic.

Small and enormous firms alike are headed in the identical course. In keeping with a examine* carried out by Visa, 25% of small companies in 9 international locations plan to just accept crypto funds by 2022.

Manufacturers similar to Gucci have already taken the step to just accept crypto this yr, and different main gamers similar to Airbnb, eBay, Amazon, and Uber have already hinted that they may achieve this within the close to future.

All this knowledge reveals the rise of cryptocurrencies as a way of fee, largely because of the advantages they carry to customers, firms, and international locations.

Benefits of accepting cryptocurrencies that you shouldn’t miss out on

- Enhance your model consciousness. The mere reality of accepting cryptocurrencies raises your model’s visibility at no cost.

- Attain extra prospects. Increasingly individuals are taking their paychecks in crypto and selecting to spend their cash.

- Increase your backside line. Including a brand new fee methodology similar to cryptocurrencies opens up a brand new income stream for what you are promoting.

- Get worldwide publicity. Digital currencies are international, so new prospects from all all over the world will be capable of buy your services and products.

- Get monetary savings on charges. Credit score and debit card funds add a 2%-4% surcharge, whereas crypto funds with CoinPayments solely add 0.5%.

- Keep away from chargebacks and “pleasant fraud”. Cryptocurrencies are based mostly on immutable Blockchain expertise. Each fee made is safe and non-reversible.

- Forestall fee delays. In contrast to conventional fee techniques, cryptocurrency funds work 24/7, day-after-day of the yr.

Begin accepting crypto the simple method with CoinPayments

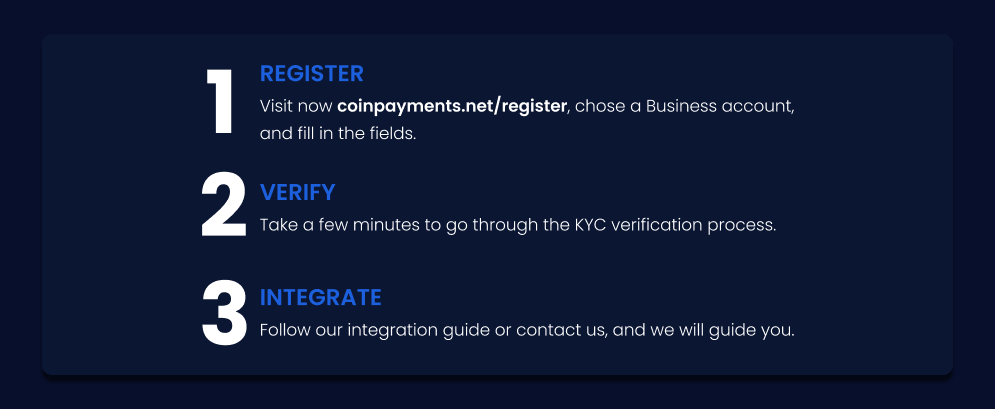

Opposite to what it might appear, it’s very simple to just accept crypto funds, particularly with full options like CoinPayments. Right here we present you methods to do it in 3 easy steps:

Our crypto fee gateway lets you settle for funds in Bitcoin, Tether, Ethereum, Litecoin, Dogecoin, and as much as 120 different cryptocurrencies. All this, sustaining one of many lowest transaction charges within the business—solely 0.5%.

Observe within the footsteps of greater than 117,000 retailers in over 190 international locations who’re already utilizing CoinPayments.

Register now to your free Enterprise account and begin having fun with the advantages of crypto funds right this moment.

Try this report in PDF format

Click on right here and go to our Issuu profile to benefit from the full report.