Candlesticks are arguably the preferred chart sort amongst merchants. They mix the info from numerous timeframes and current it in a handy method. Compared to the usual line chart, the candlestick chart offers merchants the chance to trace similarities in worth formation and spot repetitions. Chart sample buying and selling is predicated on recognizing comparable patterns of candlesticks, which can present the route by which the development would possibly transfer subsequent.

There are dozens of candlestick patterns that merchants often use. As we speak we are going to take a look at 4 well-liked ones: the Harami cross candlestick sample, Head and Shoulders, Doji and the Hanging Man. These patterns can doubtlessly assist merchants catch development reversals and enter new positions in a well timed method.

Hanging Man

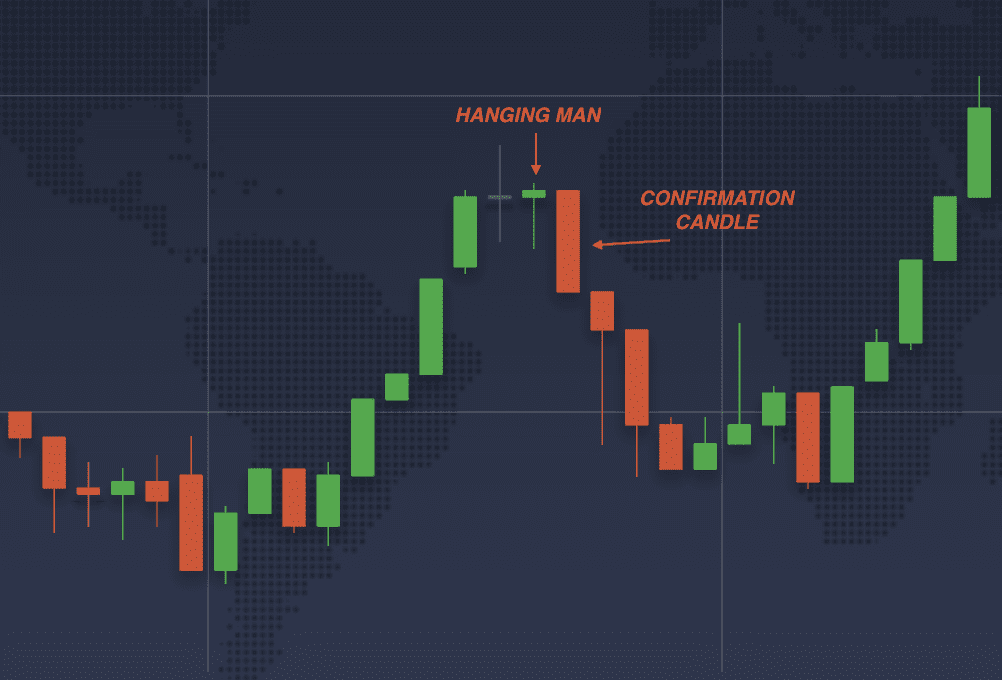

The Hanging Man is a well-liked buying and selling sample in technical evaluation, sometimes used to establish potential development reversals in monetary markets. The sample varieties when a candlestick reveals a protracted decrease shadow with a small physique on the prime, resembling a dangling man. It’s typically in comparison with the Hammer sample, however the distinction is within the context by which the patterns happen.

The Hanging Man sample can sometimes be noticed after an uptrend, indicating {that a} bearish development could begin quickly. The Hammer sample varieties after a downtrend and signifies a bullish reversal.

spot the Hanging Man sample:

- The sample normally happens after an uptrend.

- A candlestick with a quick physique and a protracted decrease shadow (and typically a brief higher shadow) is fashioned, indicating that the bullish development is dropping momentum.

- The next candle signifies that the worth is declining, confirming the reversal.

Head and Shoulders

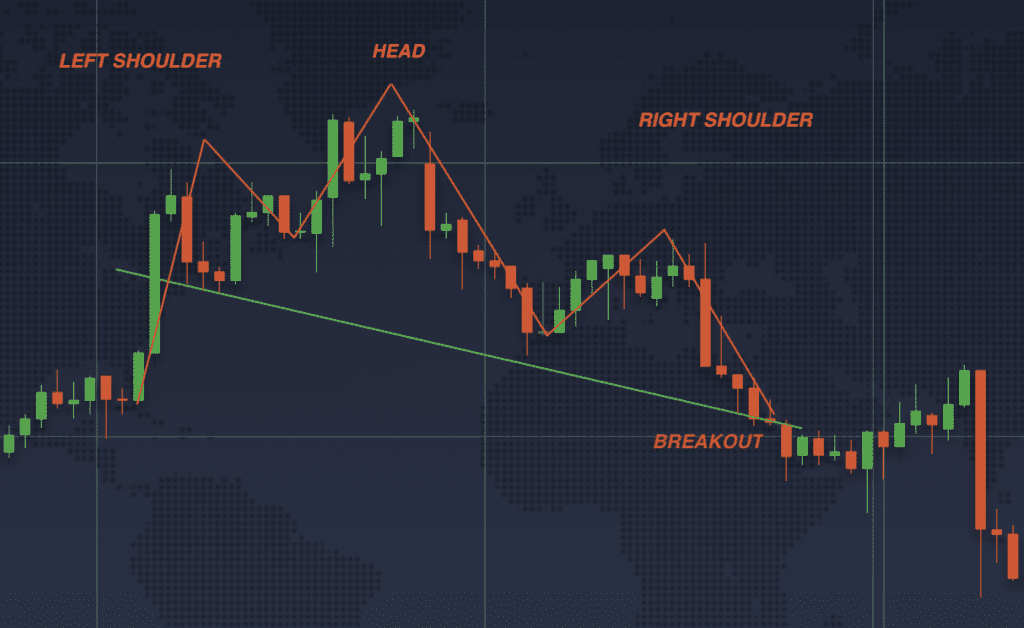

Like many different candlestick patterns, the Head and Shoulders is called after the form that it resembles. This sample is a formation that may be seen when viewing the chart on longer timeframes. With two smaller peaks forming on all sides of a bigger peak, this form appears like a head between two shoulders.

This sample normally signifies that the present upward development is dropping momentum and a decline is to be anticipated within the close to future. The neckline of the sample is drawn by connecting the lows of the 2 shoulders. A breakout beneath the neckline is taken into account a affirmation of the sample and a sign of a promote level.

spot the Head and Shoulders sample:

- You could search for an asset in a bullish development. After some time, the bullish development begins to lose momentum and the worth assessments a brand new low. It bounces again, forming the left shoulder of the sample.

- The worth begins to rise once more, forming the pinnacle.

- When the momentum proves to not be sufficient, the worth drops once more, after which makes one final try at bouncing upwards. This varieties the proper shoulder within the sample.

- A “neckline” will be drawn by connecting the low factors of the sample. As soon as the worth breaks by way of the neckline, the reversal of the development is confirmed.

The Head and Shoulders sample has its bullish model — the Head and Shoulders reversal. It appears the identical, however inverted. The breakout above the assist line could also be a sign that the bearish development is over and {that a} bullish indication is confirmed.

If you want to look at a recording of our stay webinar about chart sample buying and selling, try the video beneath.

Doji

Doji is commonly utilized in chart sample buying and selling to identify indecision out there. One of these a sample is fashioned when the open and the shut worth are very shut to one another, forming a really small and even nonexistent physique of the candle.

Whereas some merchants consider that the Doji signifies a development reversal out there, it’s not all the time the case. You will need to mix any single candlestick sample, together with the Doji, with different instruments of technical evaluation. Utilizing technical indicators will assist to verify the indications and make an knowledgeable choice.

spot the Doji candlestick sample:

There are a number of varieties of Doji to be careful for.

- Basic Doji: Open and shut costs are the identical or very shut to one another.

- Lengthy-legged Doji: The higher and decrease shadows are lengthy in comparison with the physique.

- Headstone Doji: The opening and shutting costs are at or close to the low of the buying and selling interval, creating a protracted higher shadow.

- Dragonfly Doji: The opening and shutting costs are at or close to the excessive of the buying and selling interval, creating a protracted decrease shadow.

Harami Cross

The Harami Cross candlestick sample is a two-candlestick sample, consisting of a big candlestick adopted by a Doji that’s utterly engulfed throughout the physique of the earlier candle.

Usually, the primary candlestick is lengthy, and it signifies a powerful bullish or bearish development. The second candlestick is a Doji, which signifies indecision or a possible reversal. Collectively they kind a sample that may present a change within the dealer’s sentiment. A bullish sample signifies that the worth could quickly reverse to the upside, whereas a bearish sample signifies that the worth would possibly begin falling quickly.

spot the Harami Cross candlestick sample:

- The primary candlestick that you could be be on the lookout for ought to be a lengthy candlestick that signifies a powerful development.

- The next candlestick is a basic Doji, which is absolutely positioned throughout the earlier candlestick’s physique.

- The following candlestick confirms the reversal. If it’s a bullish Harami Cross (crimson candlestick adopted by Doji), the reversal will probably be to a bullish development. If the sample is bearish (inexperienced candlestick, adopted by Doji), the reversal will probably be to the draw back.

To sum up

Chart sample buying and selling is an method that makes use of repetitions in candlestick patterns with the intention to try to predict the long run motion of the asset. Whereas patterns will be very helpful, there isn’t a single candlestick sample that would present utterly correct info each single time. Combining candlestick patterns with different evaluation instruments is a vital step to make sure that you’re higher knowledgeable and have a number of sources of indications.

Should you’d wish to be taught extra about different candlestick patterns, examine this text subsequent: Buying and selling with Candlestick Patterns.

Put up Views: 1