Fast Take

- Bitcoin long-term holders (LTHs) are outlined as buyers who’ve held Bitcoin for longer than six months and are thought of the sensible cash of the ecosystem. Sometimes they are going to purchase Bitcoin when the value is suppressed and distribute in bull markets.

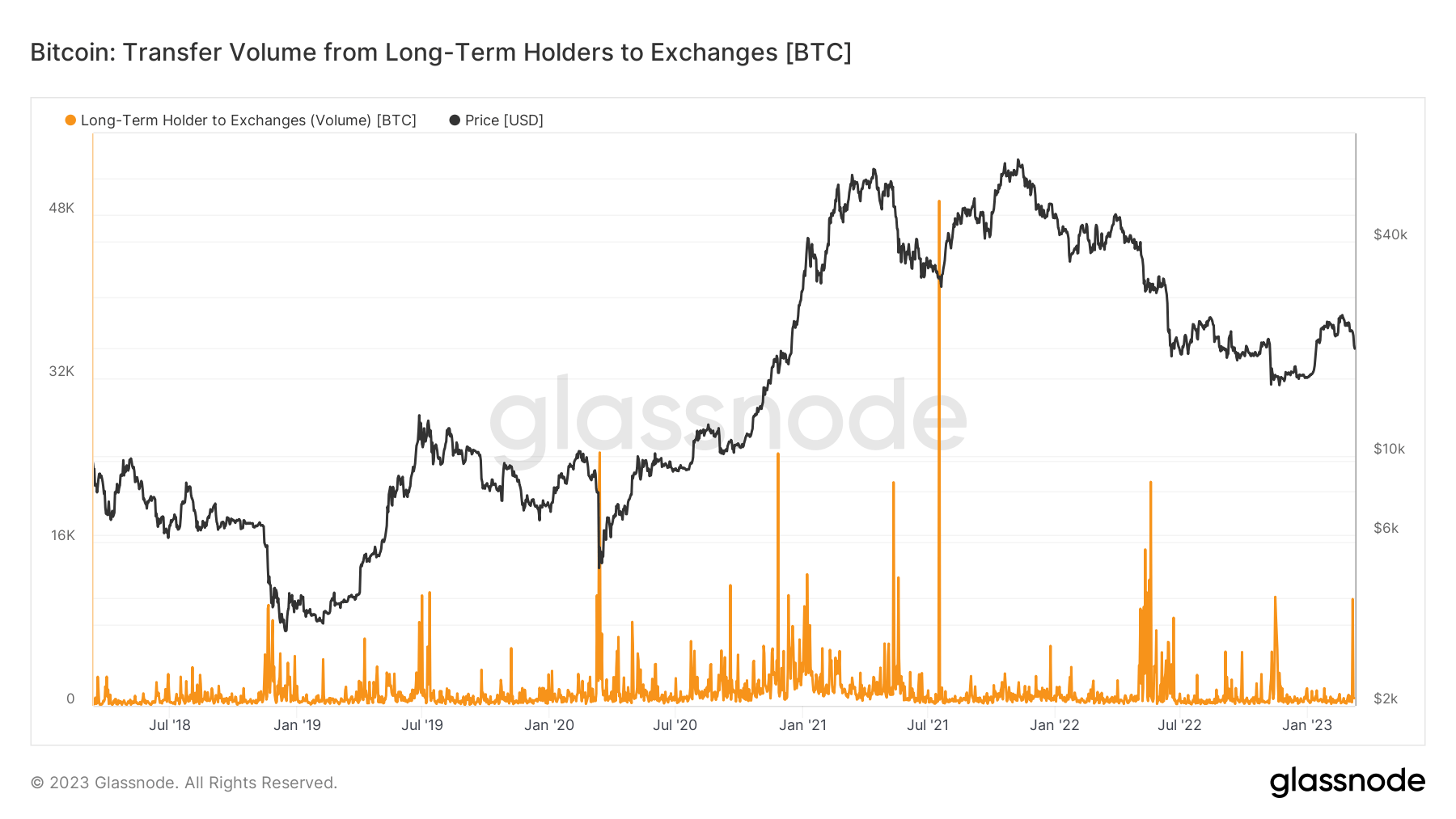

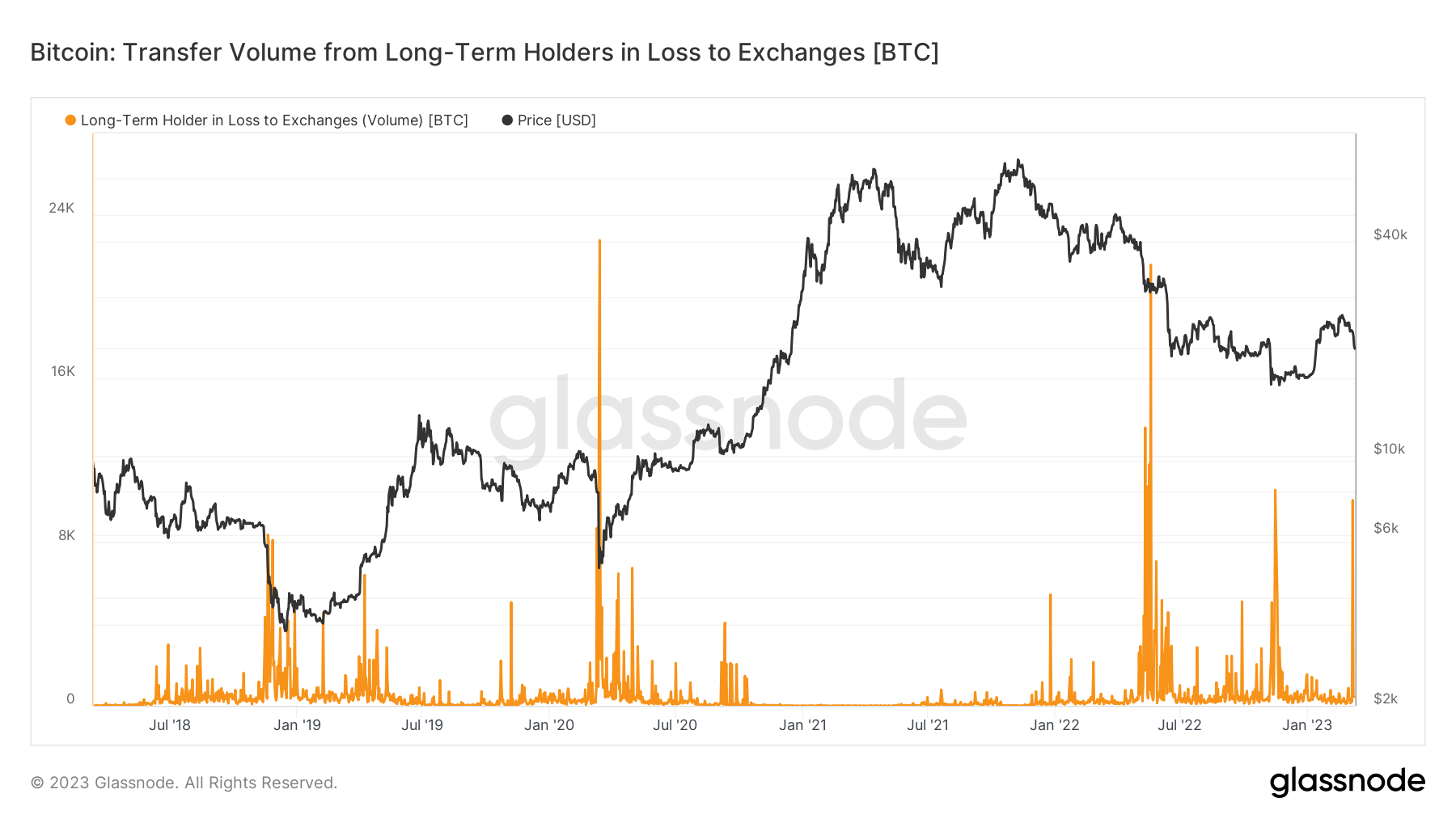

- Nevertheless, LTHs do capitulate and promote Bitcoin when panic and worry happen out there, this may be seen beneath with these on-chain metrics.

- These metrics present when LTHs promote Bitcoin to exchanges, appreciable spikes occur in moments of worry and capitulation. These occasions embody the LUNA and FTX collapse, the China ban in Could 2021, and now important capitulation because of the fallout of Silvergate after which Silicon Valley Financial institution.

- Lengthy-term holders have capitulated to ranges much like the FTX collapse. Roughly 10,000 Bitcoin have been despatched to exchanges, all offered at a loss.

- Capitulations, particularly with long-term holders, can mark bottoms in Bitcoin cycles. Nevertheless, the fallout and contagion from the banking and financials sector are nonetheless unknown, which will likely be short-term bearish for Bitcoin value motion.

The put up Bitcoin long-term holders capitulate at ranges seen throughout FTX collapse appeared first on CryptoSlate.