The ADX (Common Directional Index) is a pattern power indicator – a technical evaluation software used to measure the pattern power. Because of this it might point out whether or not the pattern is upward, downward or weakening earlier than the upcoming value motion.

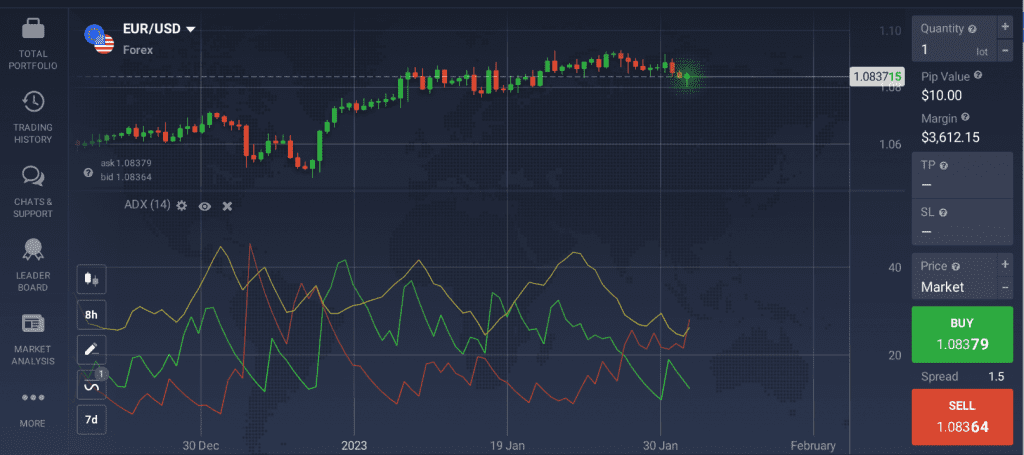

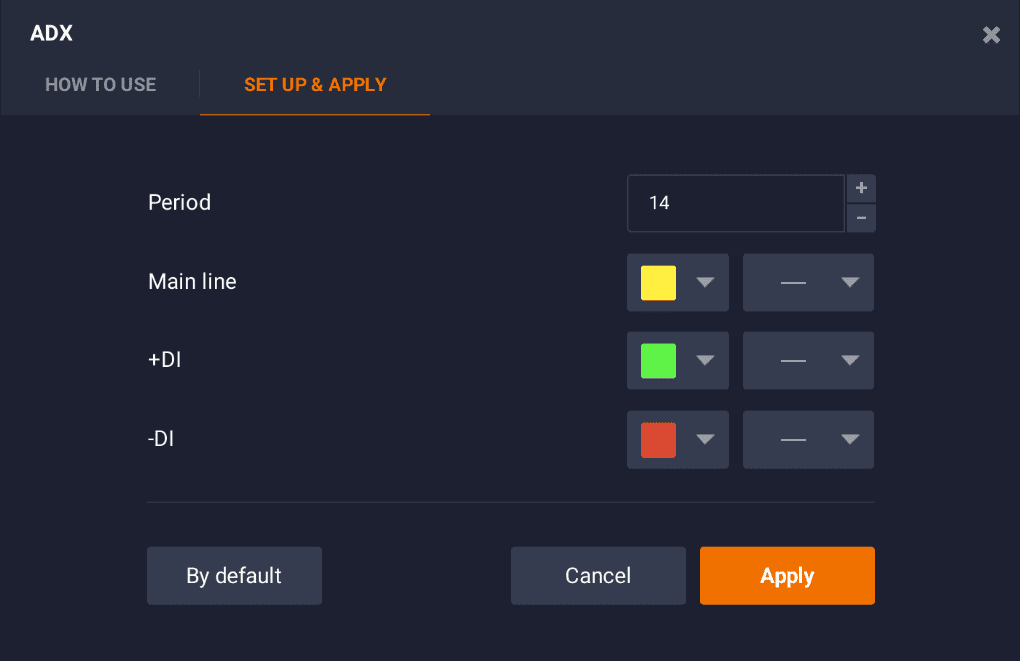

To grasp how you can use the ADX indicator, it’s necessary to first be taught the fundamentals. This indicator consists of three traces: the predominant line (yellow), the +DI (inexperienced line) and the -DI (pink line).

The ADX is taken into account a strong pattern power indicator, so the principle line exhibits the general pattern power.

In case the +DI line is above the -DI, the ADX measures the power of the uptrend. When the -DI strikes greater than +DI, the ADX line measures the power of the downtrend.

Collectively, they kind a buying and selling system that will assist decide each the pattern course and the pattern power.

The right way to Learn the ADX?

To determine how you can use the ADX indicator in buying and selling, it is best to first be taught to know its readings.

The ADX values vary from 0 to 100, with 0 being an equal of the completely flat market and 100 — a really highly effective pattern.

| ADX Worth | Pattern Energy |

| 0-25 | Absent or Weak Pattern |

| 25-50 | Robust Pattern |

| 50-75 | Very Robust Pattern |

| 75-100 | Extraordinarily Robust Pattern |

When the +DI line is above the -DI, the market could also be thought-about bullish.

Alternatively, when the -DI line is greater than the +DI, it might level to a bearish market sentiment.

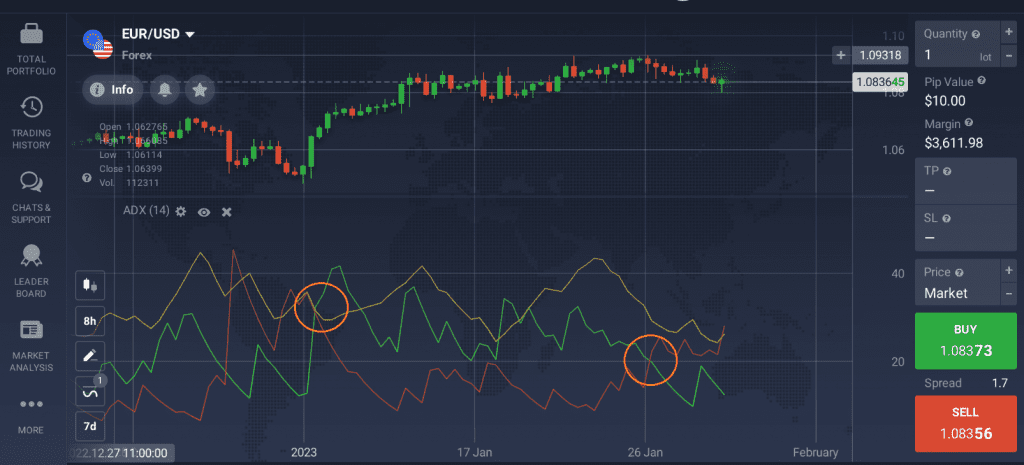

Generally the +DI and -DI traces cross, which can level to an upcoming pattern reversal. This data could also be used determine the optimum second to enter or exit a deal.

It is very important perceive that the ADX (the yellow line) demonstrates solely the pattern power and never the course of the pattern. Pattern course might be decided by wanting on the +DI and -DI (pink and inexperienced traces) as a substitute.

The right way to Set Up the ADX Indicator?

There are completely different ADX interval settings that you could be select relying in your buying and selling strategy. To learn the way to arrange the ADX indicator, let’s check out the principle steps.

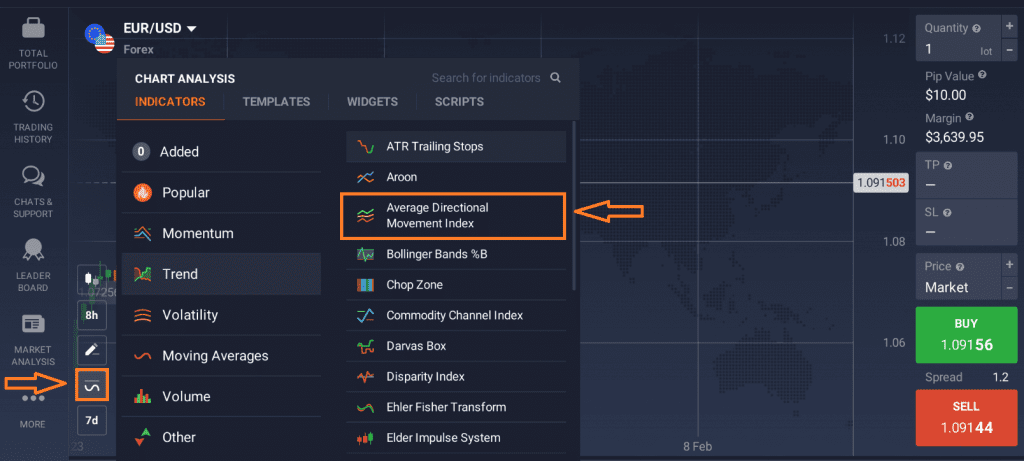

1. Go to the ‘Indicators’ tab within the bottom-left nook of the display.

2. Discover the ADX indicator within the ‘Pattern’ part amongst different related instruments.

3. Now it’s possible you’ll both apply the usual parameters or customise them to your liking. For example, it’s possible you’ll select the ADX interval settings and modify the colours of all 3 traces. Word that by rising the ADX interval settings it’s possible you’ll cut back the indicator’s sensitivity and on the identical time enhance its accuracy.

4. The ADX indicator set-up is completed and it’s possible you’ll begin buying and selling.

Is ADX a Good Indicator?

The Common Directional Index is a superb technical evaluation indicator that, mixed with different indicators, could grow to be a great tool within the fingers of a dealer. Accompanied by +DI and -DI traces, it isn’t solely able to predicting the pattern power, but in addition the pattern course.

As some other indicator, nonetheless, it ought to be used with warning and double-checked on completely different timeframes. No indicator is able to offering correct indicators 100% of the time. The ADX could generally be lagging behind the precise pattern and might, due to this fact, present outdated data.

What’s the Finest Mixture with the ADX Indicator?

The ADX might be mixed with different indicators that present the course of the long run value motion. One such mixture is ADX + Parabolic SAR.

SAR stands for “cease and reverse” and will assist determine upcoming pattern reversals. When utilizing SAR alongside the +DI and -DI traces, merchants could possibly verify the pattern and determine potential pattern reversals.

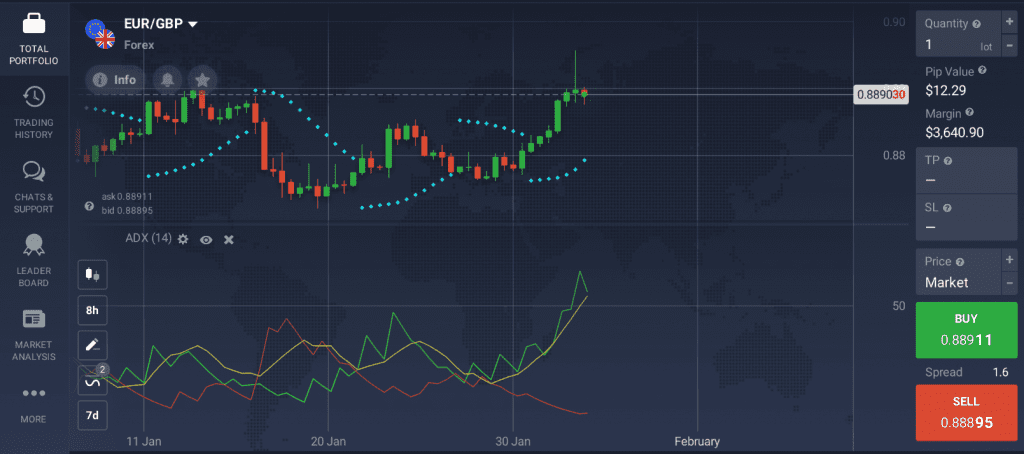

Let’s check out an instance of an ADX indicator combo. At present, the +DI line is above the -DI line on the EUR/GBP value chart, which can level to an uptrend. The ADX line that measures the power of this uptrend has climbed over the worth of fifty, indicating a really sturdy pattern. Lastly, because the parabolic SAR indicator’s dots are positioned beneath the worth, it additionally factors to an uptrend.

As soon as the SAR strikes above the worth, it might point out an upcoming pattern reversal. By monitoring this indicator and evaluating its indicators with the pattern power of the ADX values, merchants could catch upcoming pattern reversals and determine on the optimum time to enter the market.

Put up Views: 1,310