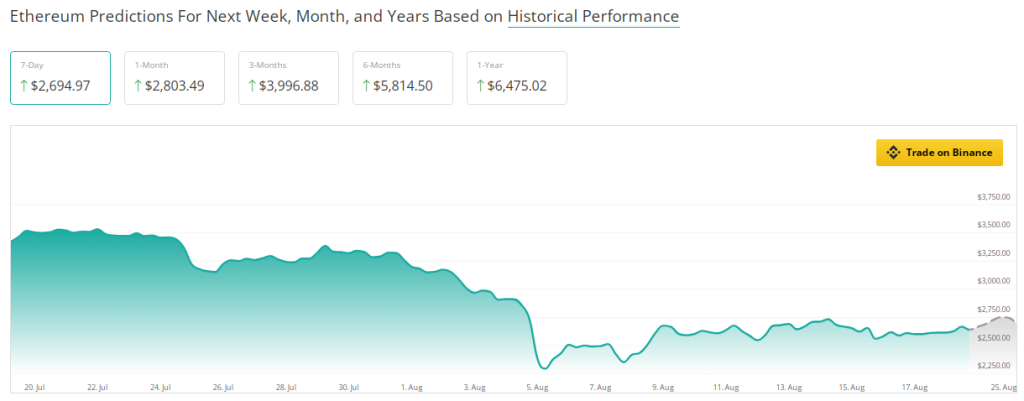

Ethereum may be on the verge of a serious breakout, with predictions suggesting it’d attain $3,000 subsequent month. In line with CoinCheckup, a preferred crypto market prediction platform, Ethereum ought to rise by 51% within the subsequent three months. With such a constructive forecast, the present decline within the value of Ethereum may very effectively be a short-term hiccup in opposition to the looming rally.

Associated Studying

Quick-Time period Evaluation And Market Indicators

A crypto analyst, Michael van de Poppe, has been following Ethereum’s latest efficiency and believes it might quickly reverse into an upward pattern. Poppe make clear the truth that ETH had been buying and selling 6.14% under the estimated value for the following month.

Regardless of this, he feels there may be an 80% probability ETH will surge above $3,000 in September. He likens the present market to previous cycles, recalling the final time the altcoin noticed a protracted loss was earlier than the bear market in 2018.

There’s just one event the place $ETH has been making greater than three month-to-month candles in purple.

It was the beginning of the bear market in 2018.

I feel that the possibility of $ETH being above $3,000 in September is bigger than 80%. pic.twitter.com/deUgSGfqkR

— Michaël van de Poppe (@CryptoMichNL) August 17, 2024

ETH discovered help near $2,500 on weekly charts, a stage normally seen earlier than massive recoveries. One other measure supporting the possibilities of value reversal lies with the stochastic RSI, now in oversold territory. If ETH may handle to clear itself of the $3,000 resistance and a minimum of present some first rate enhancements in its demand tendencies, the rally would then be imminent.

Demand Tendencies And Investor Sentiment

Although the symptoms are fairly promising technically, not the whole lot is rainbow-colored with respect to Ethereum. The most important altcoin has undergone a downtrend in demand, which the declining weekly RSI displays. For Poppe’s projection to materialize, this downtrend must be negated. Nevertheless, there can even be the uplifting indicators. US buyers are exhibiting elevated curiosity in ETH, highlighted by the constructive Coinbase Premium Index.

Even futures markets speculators are optimistic, with the Taker Purchaser Promote Ratio indicating that there’s extra shopping for than promoting. This sentiment of merchants does inform the truth that the market’s temper is such that it’s going to assist Ether go up.

Ethereum: Lengthy-Time period Development Projections

Trying past short-term strikes, nonetheless, CoinCheckup predictions are overwhelmingly constructive for Ethereum in the long run. It has forecasted the cryptocurrency will rise by 120% within the subsequent six months and by 145% within the subsequent 12 months. That basically means the present dip in value may simply be a blip earlier than Ethereum rallies considerably.

Associated Studying

These impartial forecasts now mix to indicate the large potential of Ethereum. It is going to be a very good alternative for buyers to extend their positions in ETH if the current market circumstances play out in accordance with the given predictions.

The present Ethereum value ranges, backed by these technical indicators and optimistic investor sentiment, do have the potential to push above $3,000. After all, bettering tendencies in demand and community exercise will probably be hurdles to climb. Nevertheless, the long-term outlook for this cryptocurrency could be very promising. Traders ought to preserve themselves up to date and look ahead to indicators which will verify the expected rally.

Featured picture from Pexels, chart from TradingView