One of many issues with making loans like BNPL such an ordinary a part of the checkout is that they’re SO simple. One might lose monitor of the funds and the quantity of loans one has on the go.

Fifty {dollars} each two weeks for these sneakers might not sound like lots, however then instances that by 5… or ten… issues can begin to get out of hand. This may very well be notably problematic for many who have already got low credit score scores, BNPL’s most prolific customers. Not solely may a late fee drive their rating down even additional, however for many who are already “financially fragile,” shedding monitor of the quantity of mortgage installments may create a worsening cycle of debt.

Already, greater than half of BNPL customers have fallen behind on funds. Because the sector is about for 157% progress by 2027, the scenario may get lots worse and shortly.

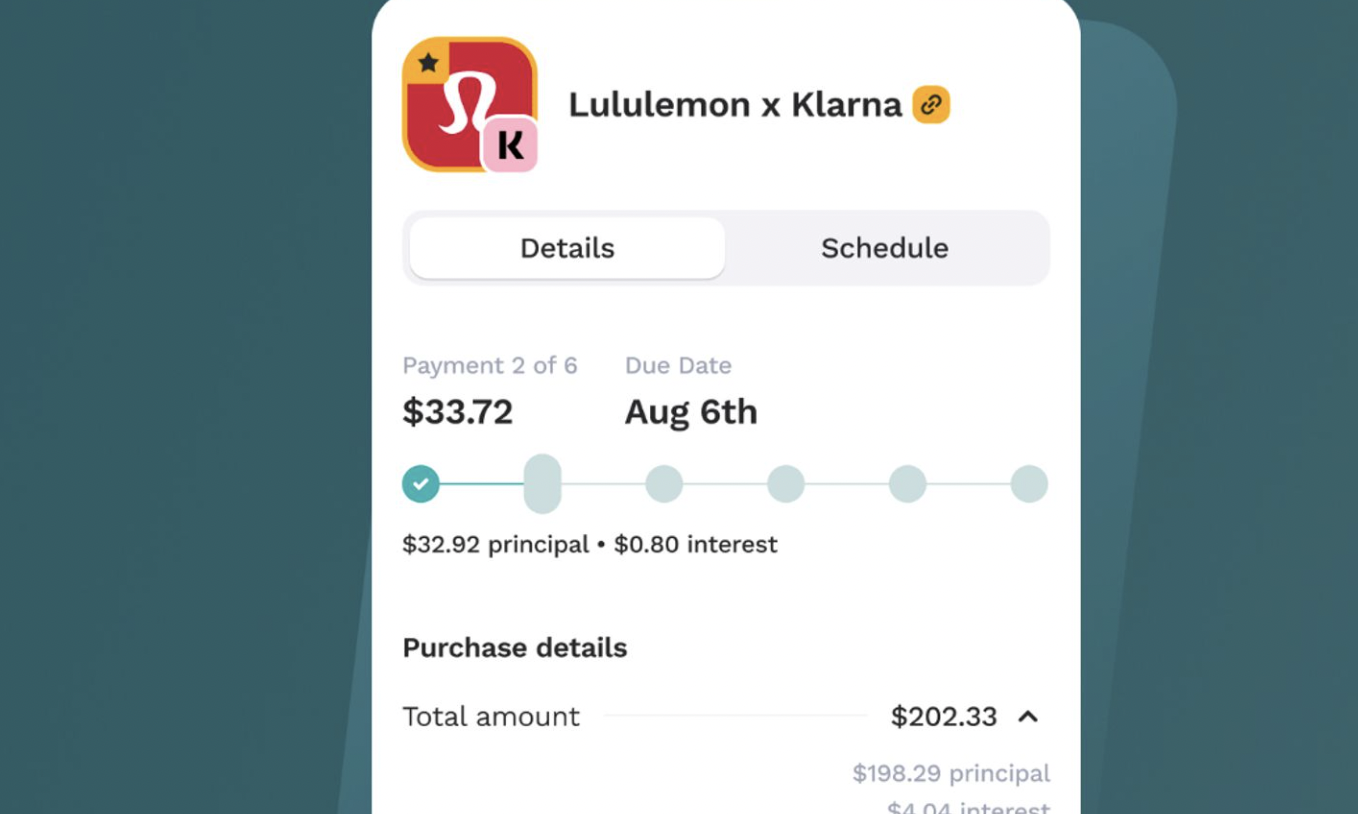

So Cushion has give you a novel concept – as an alternative of including to the rising variety of BNPL suppliers, why not create a platform to prepare those shoppers have already got?

Now, this sounds easy, however most BNPL suppliers use phone-based authentication as an alternative of accounts, making them tough to scrape. A lot of them additionally don’t report back to credit score bureaus, making a false view of the shoppers’ credit score profile. So, how does one get an understanding of what BNPL loans and the place?

Customers’ inboxes – which in itself requires a complete different set of audits. So at present’s featured article isn’t solely a narrative of innovation and perseverance to attempt to assist shoppers make sense of the various fee choices they’ve at present, but in addition could be seen as a touch upon the BNPL sector’s strategy to shopper safety.

Sure, its ease of entry has opened credit score out to a complete new demographic of people who find themselves usually ignored of the credit score system – implausible. However as using BNPL evolves right into a fee possibility for on a regular basis purchases, maybe the convenience of entry with out many guardrails is making a worsening difficulty for the shoppers the sector seeks to serve.

FEATURED

Retaining monitor of a number of BNPL loans? There’s an app for that.

Cushion CEO Paul Kesserwani felt overwhelmed when he tried to maintain monitor of a number of BNPL loans directly, so he shifted his fintech’s focus to assist others in the identical boat.

FROM FINTECH NEXUS

Amidst Market Turmoil, Fiat Advisory Market is Born

Lengthy Take: How Decentralized Bodily Infrastructure (DePIN) impacts finance and the machine financial system

When do the robots take over, we’re prepared already

PODCAST

Podcast: MoneyLion’s evolution from neobank to finance tremendous app, with CMO Cynthia Kleinbaum Milner

Pay attention now (43 minutes) | Hello Fintech Architects, Welcome again to our podcast collection! For those who wish to subscribe in your…

EDITORIAL CARTOON

WEBINAR

Tendencies in digital lending for 2024: AI, automation, embedded finance and extra

Oct 10, 9am EDT

As we start to look to 2024, we are able to anticipate expertise to proceed to have a profound impression on shopper lending. Whereas there…

ALSO MAKING NEWS