Lower than every week after Vitalik Buterin, one of many co-founders of Ethereum, offered his Maker (MKR) stash for ETH, one crypto whale has performed the alternative. On-chain information on September 4 exhibits that one Ethereum holder offered 694 ETH, value roughly $1.13 million when writing, for 1,010 MKR. On the time of the swap, MKR was altering palms at $1,122.

Whale Swaps ETH For MKR

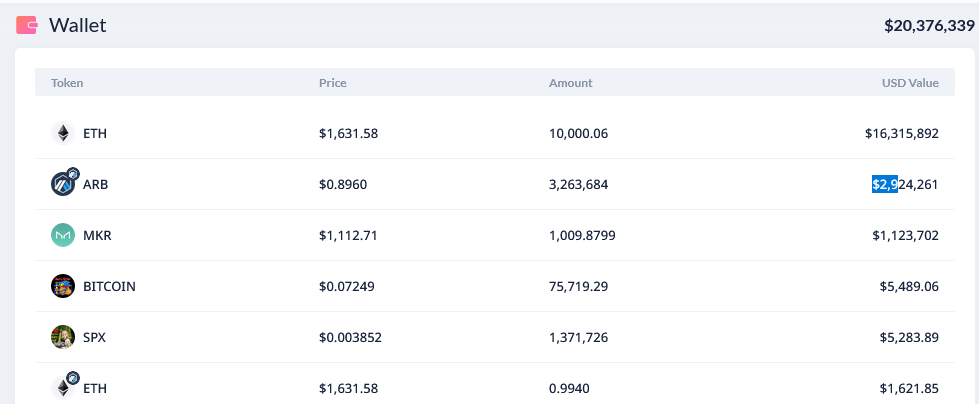

As of September 4, the handle, “0x3737,” had over $20.37 million value of belongings. Whereas the whale trades in opposition to Vitalik and doubles down on MKR, zooming in on the handle’s portfolio exhibits that the most important holding is ETH.

The handle holds 10,000 ETH value $16.3 million at spot charges, representing over 75% of the entire portfolio. In the meantime, a few of his different main holdings embody Arbitrum (ARB), value $2.9 million, and MKR, value $1.1 million.

MKR, the token issued by MakerDAO, the decentralized autonomous group (DAO) that controls the minting of DAI, a stablecoin on Ethereum, has been ripping increased in the previous couple of months.

MKR performs a key position in stabilizing DAO and is used as a final resort. Holders take part in governance, voting on proposals that finest stabilize the algorithmic stablecoin, deciding collateral varieties accepted, stability charge changes, and others.

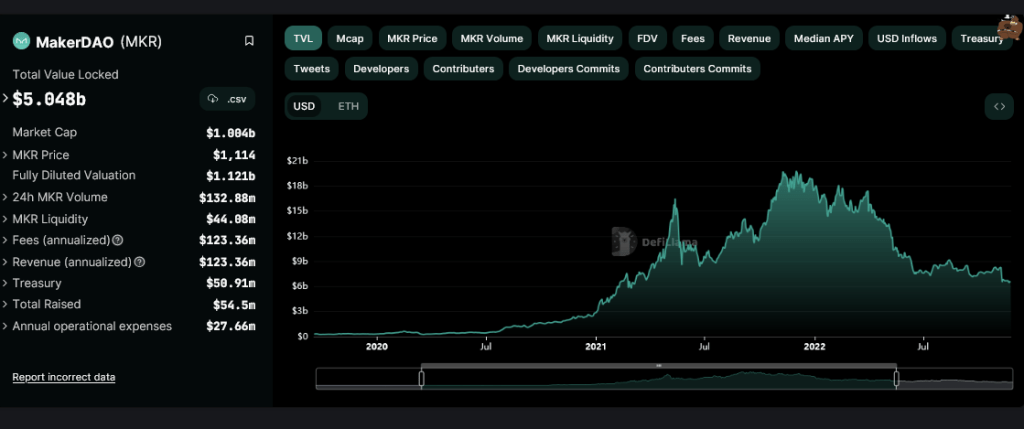

From June, MKR has greater than doubled, rising 125% to peak at round $1,300 in early August. It’s now buying and selling at over $1,100, up 13% from August lows.

Maker Presents Endgame

The token’s surge has been attributed to a number of elements, particularly the discharge of the “Endgame” roadmap. Below this plan, MakerDAO plans to, amongst different issues, launch their blockchain, rebrand, and introduce two extra tokens.

This transfer is important as a result of MakerDAO is among the many first decentralized finance (DeFi) protocols. In accordance with DeFiLlama information, the protocol has a complete worth locked (TVL) of over $5 billion. It’s the largest decentralized cash market on the earth.

In the meantime, DAI, its algorithmic yield-earning stablecoin, has been secure not too long ago and is the most important in Ethereum. At press time, DAI had a market cap of $5.3 billion, perched at twelfth on the leaderboard. At this tempo, DAI is the third-largest stablecoin after USDT and USDC.

Vitalik Buterin, regardless of the stellar efficiency of MKR relative to the broader crypto market, liquidated $580,000 value of MKR after MakerDAO’s co-founder, Rune Christensen, mentioned it was contemplating launching a brand new blockchain bridging to Ethereum that’s based mostly on Solana’s code. The brand new blockchain, dubbed NewChain, is a part of MakerDAO’s roadmap, “Endgame”.

Characteristic picture from Canva, chart from TradingView