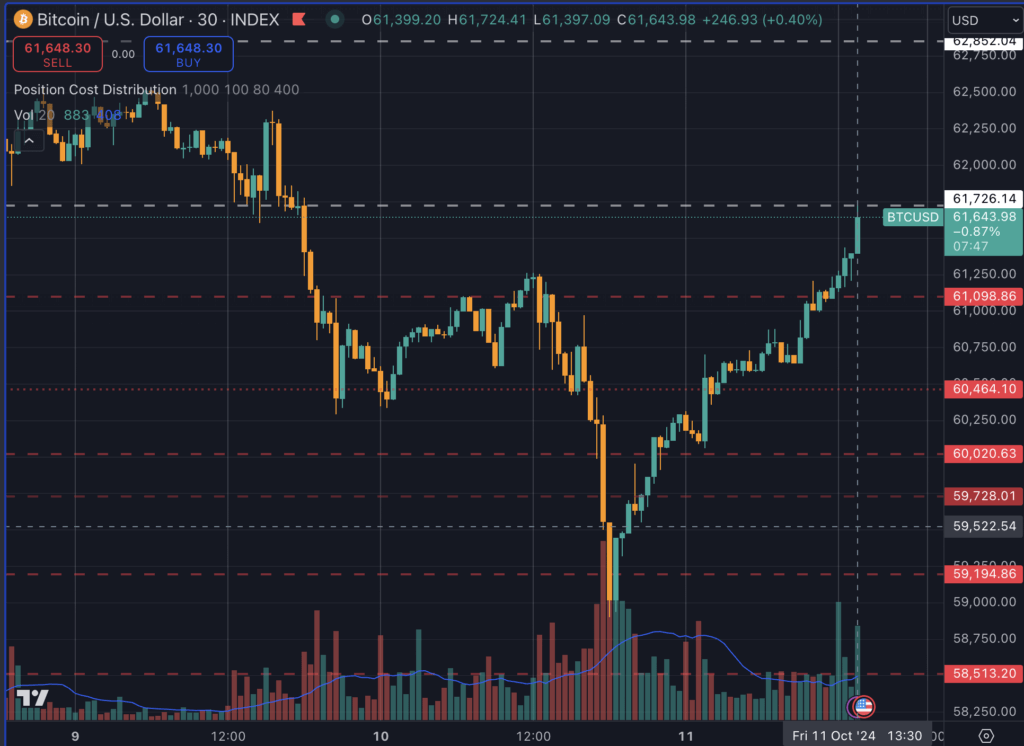

Bitcoin briefly fell beneath $59,000 final night time earlier than rebounding to reclaim the crucial $61,000 degree in a fast V-shaped restoration. Historic information signifies that comparable swift recoveries on a 30-minute decision have constantly led to both increased positive aspects or sideways buying and selling, with few cases of additional declines.

Final week, Bitcoin dropped from $62,000 to round $61,000 earlier than shortly rebounding and buying and selling above $61,000 for a number of days, finally reaching $62,800.

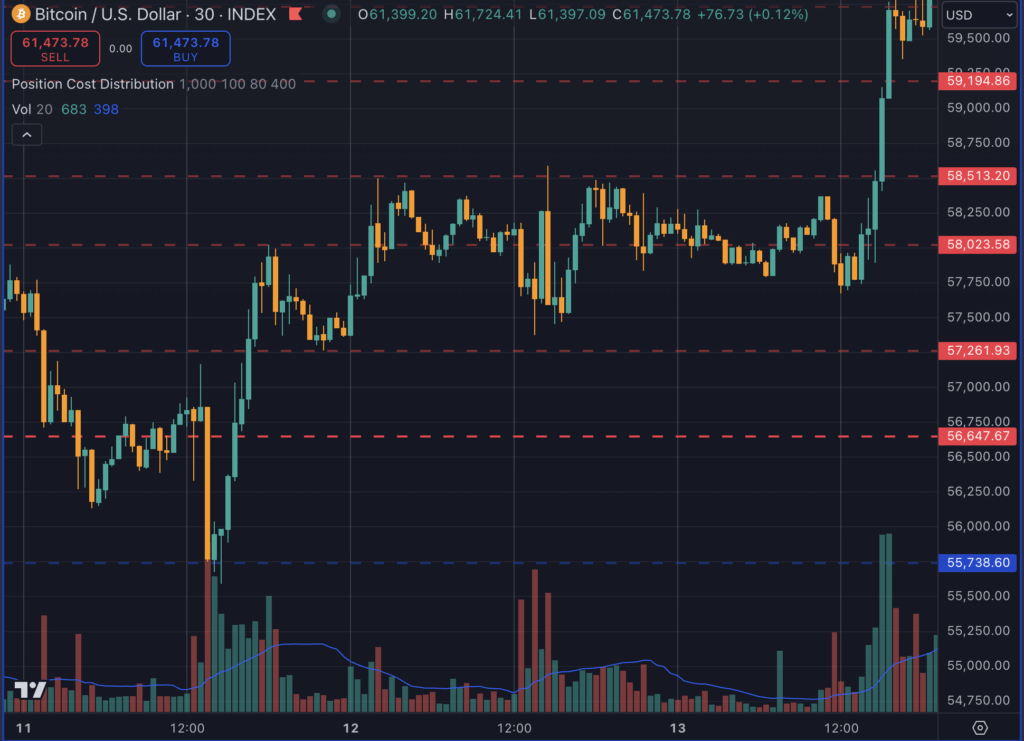

In late September, after the same drop to $63,800, Bitcoin fashioned a V-shaped restoration, surging to $65,400.

Earlier that month, on Sept. 11, Bitcoin fell from $56,600 to $55,700, solely to get well inside two hours and regain its place close to $60,000 over the next two days.

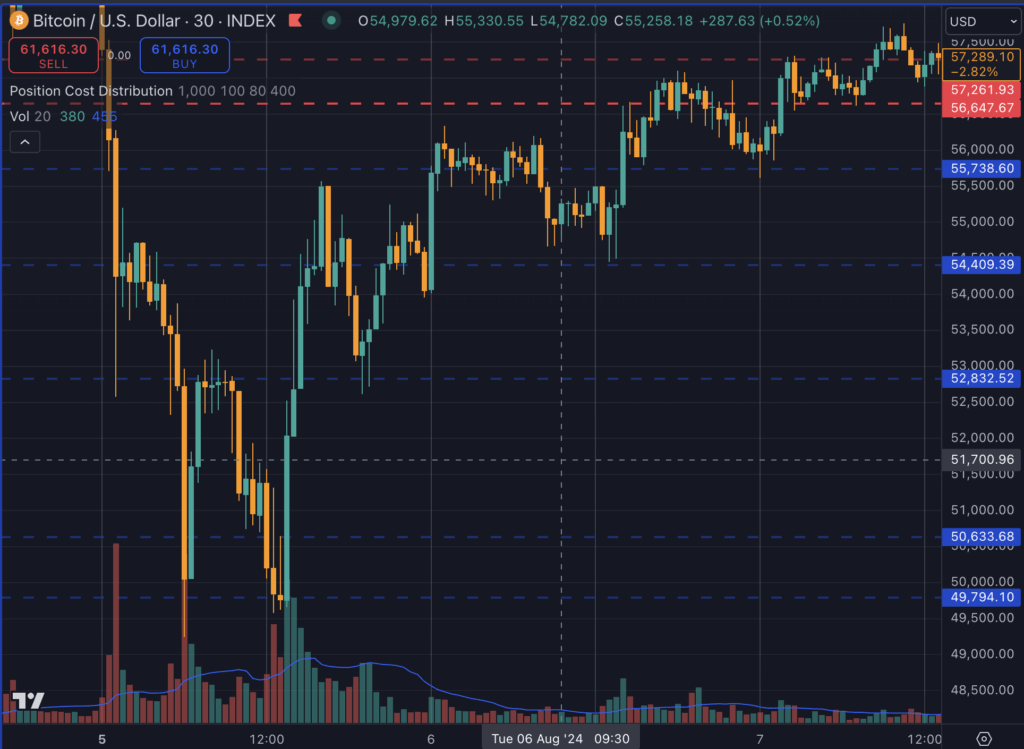

This sample may also be traced again to August, when Bitcoin skilled a big drop from $52,800 to $49,700 on Aug. 5. A V-shaped restoration that afternoon pushed it again to $54,000, with momentum persevering with over the following two days, driving the value as much as $58,000.

Immediately’s dip beneath $59,000, adopted by a possible retest of the $61,700 resistance degree, suggests Bitcoin is as soon as once more following this acquainted sample of fast restoration and upward motion, reinforcing the importance of those sharp rebounds in signaling future value motion.

Whereas previous efficiency shouldn’t be indicative of future outcomes, the recurring nature of those recoveries alerts potential stability or bullish momentum following such sharp dips. Monitoring Bitcoin’s habits inside this timeframe might present insights into potential market actions within the coming days.

This sample has been noticed since a minimum of June of this yr, suggesting that the 30-minute decision is a key indicator for assessing Bitcoin’s short-term market strikes, particularly after the launch of Bitcoin spot ETFs.

This information reinforces the concept traders ought to stay attentive to short-term patterns, significantly on decrease timeframes, to gauge Bitcoin’s near-term trajectory.