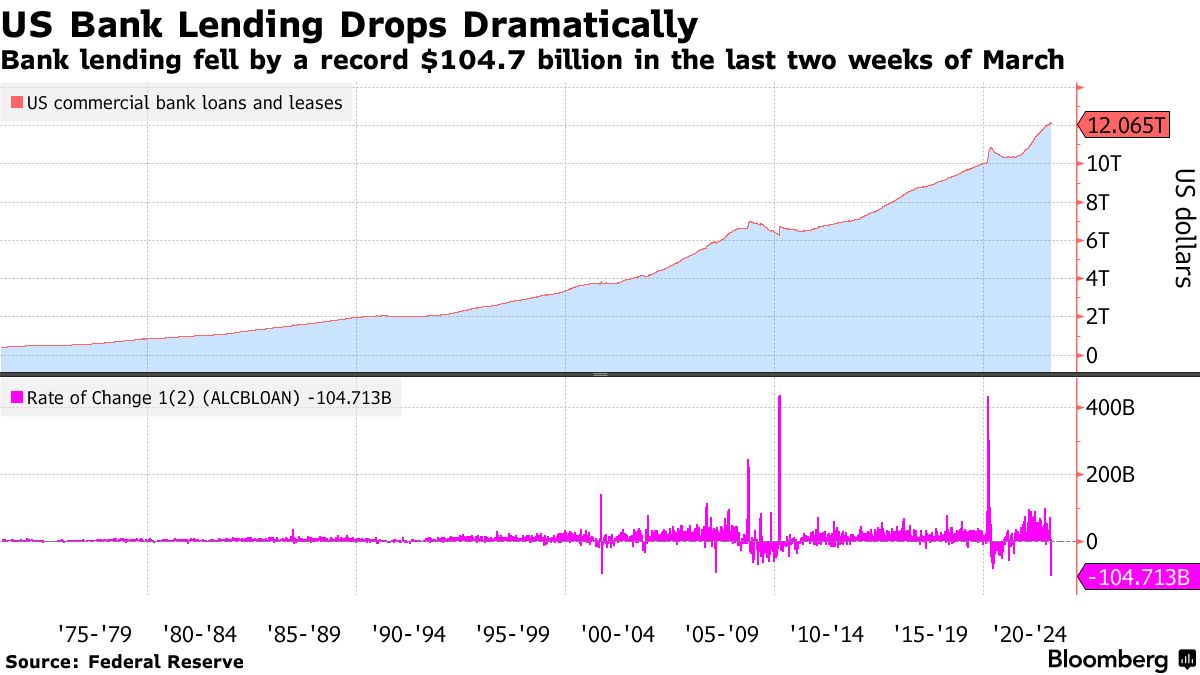

The banking business in america continues to be struggling after the collapse of three main banks. Based on statistics, financial institution lending within the U.S. has dropped by near $105 billion within the final two weeks of March, which is the most important decline on report. Moreover, Elon Musk, a Tesla government and proprietor of Twitter, not too long ago commented on trillions of {dollars} being withdrawn from banks into cash market funds, and he insists that the “development will speed up.”

Statistics Nonetheless Present Obtrusive Indicators of U.S. Financial institution Weaknesses; Musk Points Warning

There are nonetheless loads of indicators displaying that the U.S. banking system is feeling the aftermath of a number of high-profile financial institution collapses. Throughout the first week of March, Silvergate Financial institution, Silicon Valley Financial institution (SVB), and Signature Financial institution (SBNY) closed down operations. Each SVB and SBNY have been positioned beneath authorities management. The U.S. Federal Reserve, Treasury, and Federal Deposit Insurance coverage Company (FDIC) bailed out SBNY and SVB’s uninsured depositors and made all depositors entire.

Since then, the banking contagion has unfold throughout america and internationally, with monetary establishments like SVB UK and Credit score Suisse faltering. Based on a current report revealed by Bloomberg, the final two weeks of March noticed the most important contraction in lending on report after the collapses. The Federal Reserve’s knowledge on the topic solely goes again to 1973, and within the final two weeks of March 2023, nearly $105 billion was erased.

Alexandre Tanzi from Bloomberg explains that loans consisted of business, business, and actual property loans. Moreover, final week noticed $64.7 billion in business financial institution deposits faraway from monetary establishments, which marked the tenth straight weekly decline in deposits. One other signal of hassle is the spike in Federal House Mortgage Financial institution (FHLB) bond issuance in March. Jack Farley, a journalist and macro researcher for Blockworks, shared a chart displaying FHLB bond issuance surging final month “to simply beneath 1 / 4 trillion {dollars}.” Farley added:

That is over six occasions the post-GFC common for the month of March and it signifies banks’ scramble for money.

Furthermore, the favored Twitter account Wall Road Silver (WSS) shared a video of economist Peter St. Onge explaining {that a} vital quantity of financial institution deposits are shifting to cash market accounts. WSS tweeted, “Trillions of {dollars} are draining out of the banks… into cash market funds. That weakens the banks. Concern that the banks are in danger is driving this development and thus making the banks even weaker.” The economist’s video assertion and WSS’s tweet sparked a response from Twitter’s proprietor, Elon Musk. The Tesla government warned:

This development will speed up.

This isn’t the primary time Musk has cautioned the general public concerning the U.S. banking system, as he has criticized the U.S. Federal Reserve on a number of events. In November 2022, Musk warned that the U.S. would see a extreme recession and urged the Fed to slash the federal funds price. In December 2022, the proprietor of Twitter mentioned {that a} recession would amplify if the Fed raised the rate of interest and the central financial institution elevated the speed. Musk additionally insisted in December that the Fed’s fast price hikes would go down in historical past as one of many “most damaging ever.” After the three main U.S. banks failed in March, Musk lambasted the Fed’s knowledge latency and referred to as for a direct drop in rates of interest.

What do you assume the long-term results of the current financial institution collapses and reduce in lending shall be on the U.S. economic system? What do you concentrate on Elon Musk’s warning? Share your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Bloomberg Chart,

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.