Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will talk about creating crypto-linked funding merchandise in a bear market, the temper amongst her purchasers and her lon…

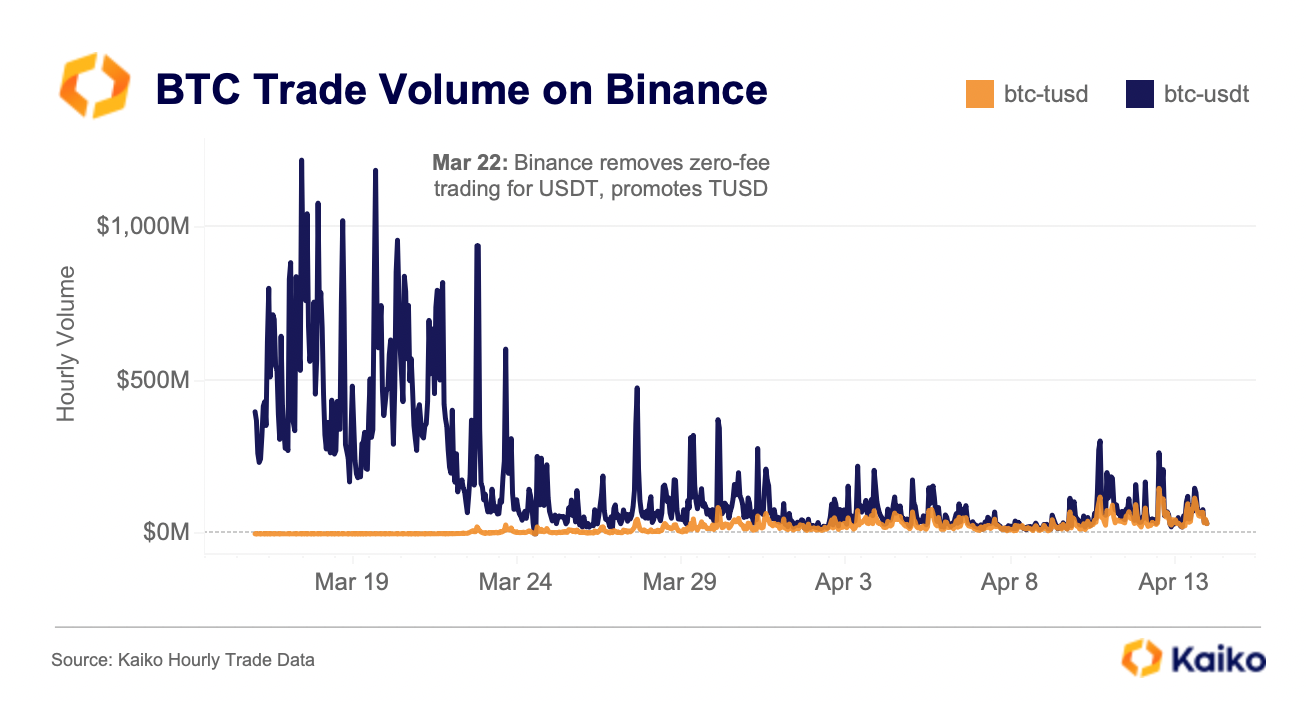

The TrueUSD (TUSD) stablecoin’s market share in bitcoin (BTC) buying and selling quantity on Binance is catching as much as Tether’s USDT following the trade’s zero payment buying and selling low cost, however knowledge reveals merchants are nonetheless reluctant to make use of TUSD, in accordance with crypto knowledge agency Kaiko.

Between Binance’s BTC-TUSD and BTC-USDT buying and selling pairs, TUSD’s market share rose to 49%, virtually equalling Tether’s.

“This can be a huge improve over just some weeks,” Clara Medalie, head of analysis at Kaiko, mentioned.

Nevertheless, TUSD’s development couldn’t offset the fast decline within the BTC-USDT pair’s buying and selling quantity after Binance waived its zero payment low cost for Tether, in accordance with Kaiko knowledge. Furthermore, bigger purchase and promote orders are nonetheless positioned for the USDT pair, per Kaiko.“This means that merchants are nonetheless reluctant to make use of TUSD regardless of zero charges,” Medalie added.

(Kaiko)

TUSD’s rise has come as Binance, the world’s largest crypto trade by buying and selling quantity, picked the token as inheritor of its most popular Binance USD (BUSD) stablecoin issued by Paxos Belief.

The trade restored buying and selling with TUSD after a six-month pause after Paxos’ choice to cease issuing BUSD and assigned its zero-fee buying and selling low cost to the BTC-TUSD pair and waived the promotion from BUSD and USDT beginning on March 22.

The $132 billion stablecoin market is present process a significant upheaval stemming from a regulatory crackdown and a banking disaster within the U.S. In February, the New York Division of Monetary Providers (NYFDS), the state’s high monetary regulator, compelled Paxos to stop minting BUSD, the third largest stablecoin with a $16 billion market cap. Final month, the collapse of crypto-friendly Silicon Valley Financial institution, reserve associate of the second largest stablecoin USDC, despatched shockwaves by means of the market. Within the aftermath, USDC suffered greater than $10 billion in outflows.

Tether’s USDT and TUSD have emerged as clear winners of the disaster. TUSD has change into the crypto market’s fifth largest stablecoin with a $2 billion market cap. USDT’s circulating provide has grown $10 billion prior to now months and is closing in on its all-time excessive.

Stablecoins are a vital factor within the crypto ecosystem, facilitating buying and selling on exchanges and serving as a bridge between government-issued fiat cash and digital property.

TUSD is a dollar-pegged stablecoin issued by crypto agency ArchBlock, beforehand referred to as TrustToken. Its worth is totally backed by fiat property, in accordance with blockchain knowledge supplier ChainLink’s proof-of-reserve monitoring instrument. In 2020, a little-known Asian conglomerate Techteryx acquired TUSD’s mental property rights, TrustToken mentioned on the time.