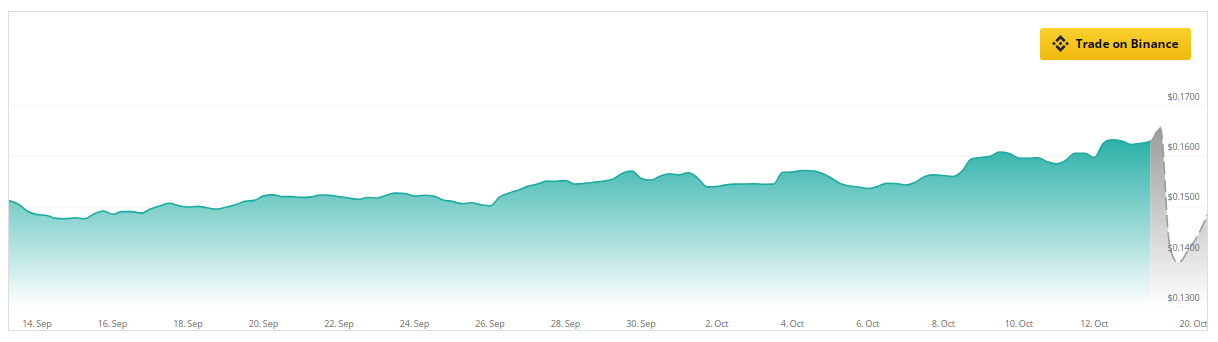

TRON (TRX) just lately garnered consideration by incinerating over 10 million tokens, demonstrating its dedication to a deflationary strategy meant to reinforce its worth. Presently, TRX is buying and selling at roughly $0.1605, indicating a small improve.

Analysts specific optimism on TRON’s future, forecasting a 57% worth improve in the course of the subsequent three months, and an much more exceptional 208% rise over six months, figures from CoinCheckup present. This optimistic perspective signifies that TRX could also be poised for a considerable upward trajectory within the cryptocurrency market.

A Strong Technical Basis

The technical indicators for TRX are converging in direction of a constructive sentiment. The worth chart demonstrates a modest upward development, whereas the Relative Power Index (RSI) is presently at 57.58. This statistic signifies that TRX is approaching overbought space, nonetheless there nonetheless potential for extra positive factors.

The Stochastic indicator, at the moment at 66.63, reinforces this bullish perspective by demonstrating momentum with out indicating imminent exhaustion. Collectively, these components counsel that TRX might maintain its upward development within the quick future, rendering it an interesting alternative for buyers.

Growing Enthusiasm For TRON

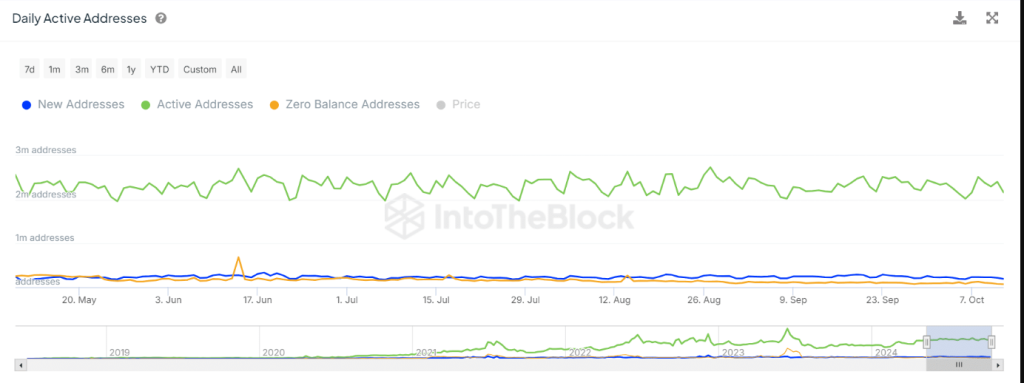

Alongside the token burn, TRON has had an honest improve in day by day lively addresses, indicating a rising investor curiosity, knowledge from IntoTheBlock reveals. Though the overall development appears fixed, this minor uptick means that extra persons are getting into the market.

This rising participation might improve the token’s upward trajectory, significantly when coupled with the present deflationary methods. As TRON endeavors to decrease its circulating provide, these parts might set up a basis for heightened costs.

Market Sentiment And Buying and selling Conduct

Regardless of the constructive statistics, merchants stay extraordinarily cautious. The Lengthy/Brief Ratio reveals shorts barely outstrip longs with 54% shorts and 46% of longs. It is a ‘wait-and-see’ perspective by merchants whereas awaiting a attainable volatility within the worth motion of TRX.

The TRX OI-Weighted Funding Fee is at roughly 0. That signifies that the steadiness of longs to shorts is impartial, and therefore it might additionally replicate positively on market sentiment pending short-term variability for TRX’s worth.

Current burning of tokens by TRON and the regular improve in lively addresses can increase the momentum TRX must publish stable progress charges for the following couple of months.

Technical indicators depict a constructive development and stable worth projections, which reveals TRX will achieve considerably within the quick time period.

Featured picture from Pixabay, chart from TradingView