Welcome to a brand new publication of the Market’s Compass Developed Markets Nation (DMC) ETF Research. It continues to focus on the technical modifications of the 22 DMC ETFs that we monitor on a weekly foundation and share our technical opinion on, each three weeks. There are three ETF Research that embrace the Market’s Compass US Index and Sector (USIS) ETF Research, the Developed Markets Nation (DMC) ETF Research and the Rising Markets Nation (EMC) ETF Research. The three Research will individually be revealed each three weeks and despatched to paid subscriber’s electronic mail. An excerpt can be despatched to free subscribers. The EMC ETF Research can be revealed subsequent week.

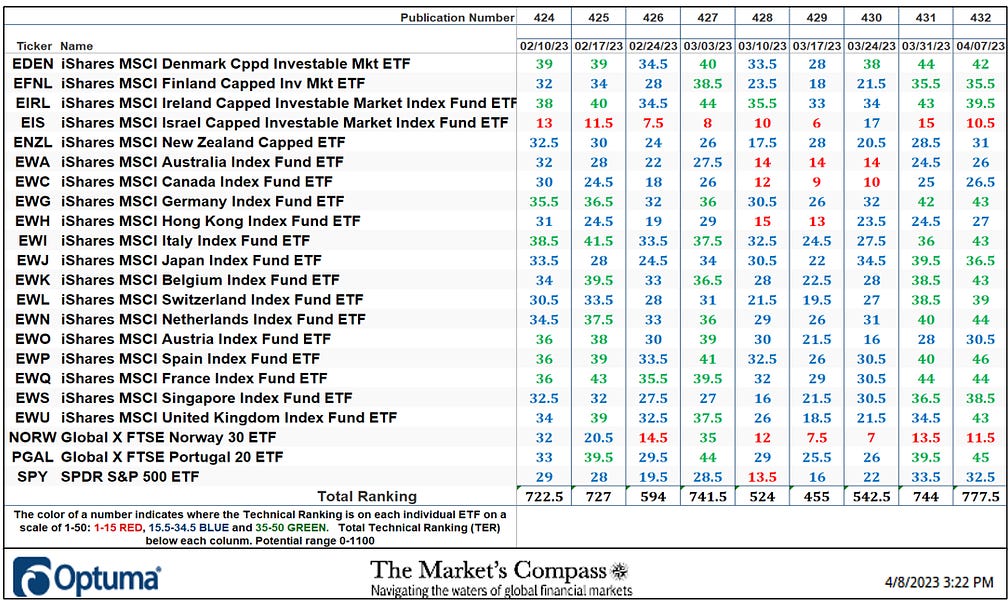

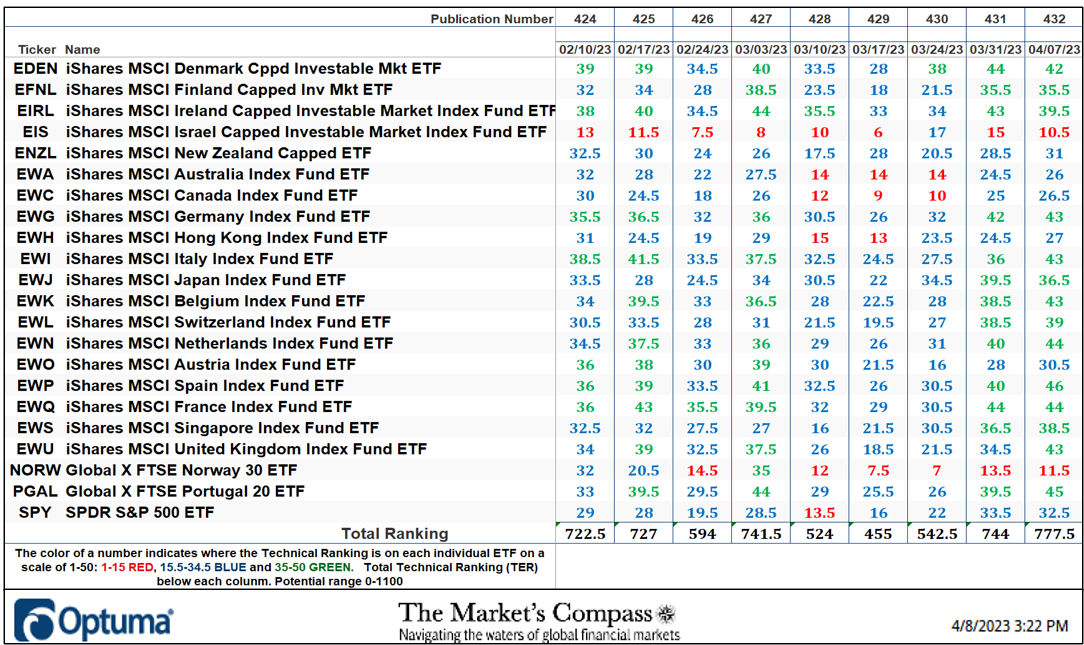

This Week’s and eight Week Trailing Technical Rankings of the 22 Particular person ETFs

The Excel spreadsheet beneath signifies the weekly change within the goal Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a wholly quantitative strategy that makes use of a number of technical issues that embrace however are usually not restricted to development, momentum, measurements of accumulation/distribution and relative energy. If a person ETFs technical situation improves the Technical Rating (“TR”) rises and conversely if the technical situation continues to deteriorate the “TR” falls. The “TR” of every particular person ETF ranges from 0 to 50. The first take-away from this unfold sheet must be the development of the person “TRs” both the continued enchancment or deterioration, in addition to a change in course. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity may be seen as an overbought situation however with due warning over offered circumstances can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply turn out to be extra overbought. A sustained development change must unfold within the particular person TR for it to be actionable.

The regular enchancment in particular person TRs (in addition to the Complete ETF Rating) for the reason that Market’s Compass Developed Markets Nation ETF Research that I revealed on February twentieth (Publication #429) for the week ending February seventeenth, may be seen at a look within the unfold sheet above. That is allowed by the “warmth map” traits of the unfold sheet.

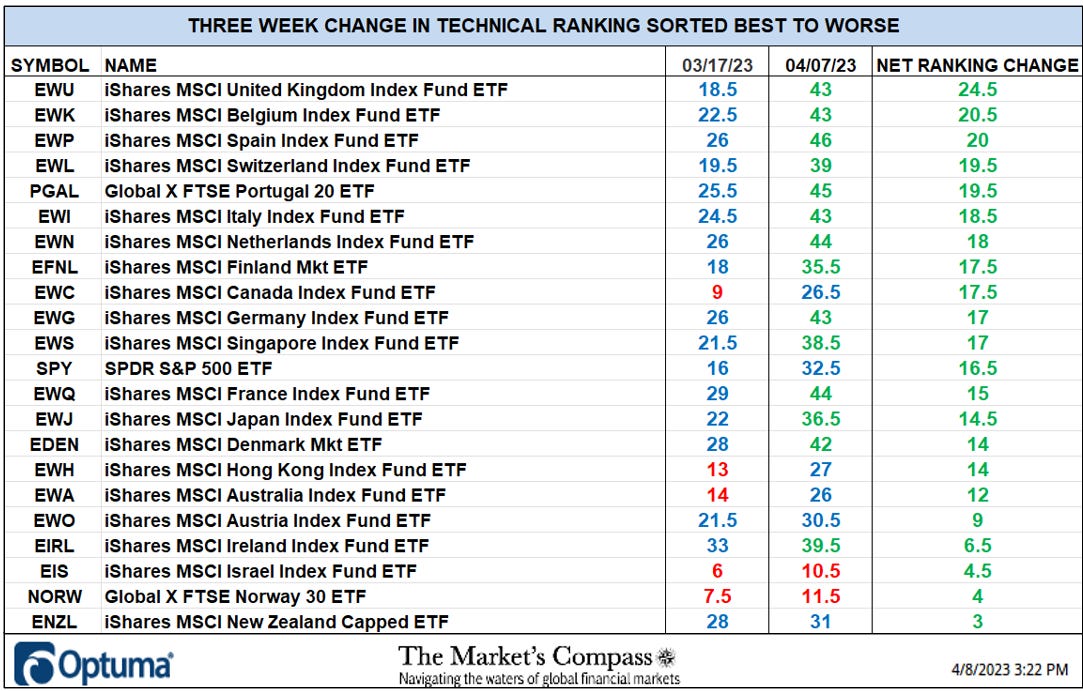

The broad based mostly enchancment in particular person TRs for the reason that week ending March seventeenth, may be seen at a look within the unfold sheet beneath with all TRs gaining floor, the iShares MSCI United Kingdom Index Fund ETF (EWU) gained essentially the most over the previous three weeks by rising +24.5 “handles” to 43 from 18.5. That achieve was adopted by the iShares MSCI Belgium Index Fund ETF (EWK) which jumped by +20.5 to 43 from 22.5 and the iShares MSCI Spain Index Fund ETF (EWP) which rose +20 to 46 from 26. The typical TR achieve over the previous three weeks was +14.65.

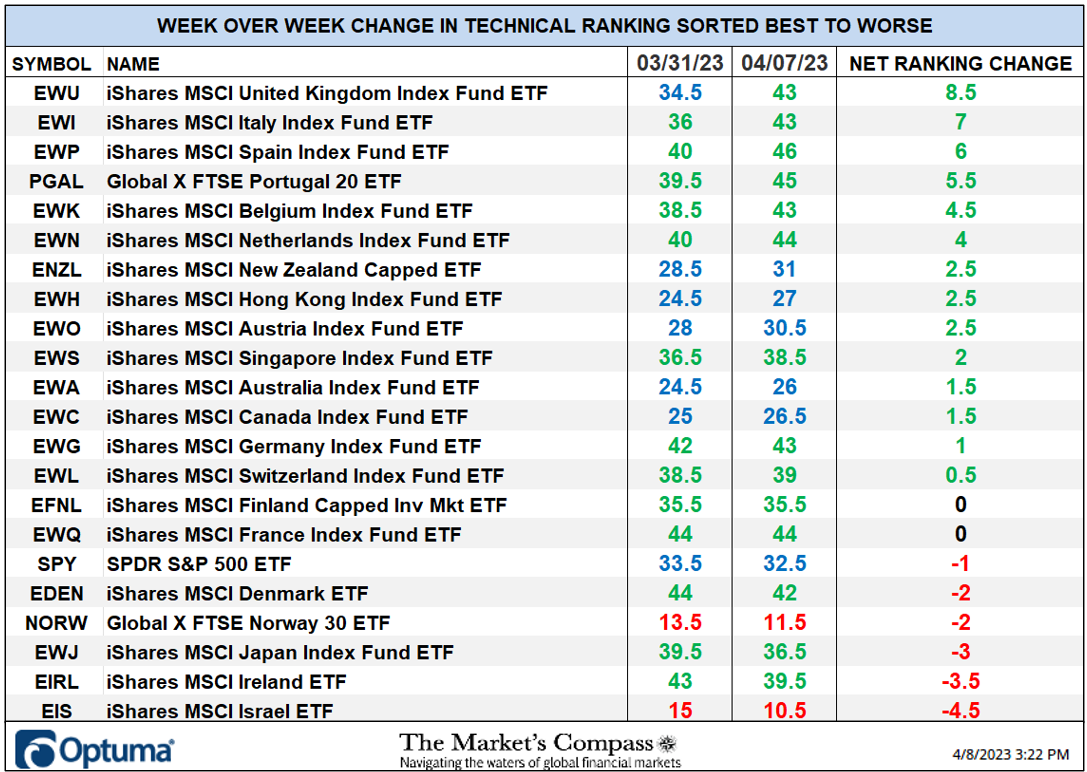

As may be seen beneath on the finish of final week there fourteen ETF TRs within the “inexperienced zone”, six ETFs had been within the “blue zone” (15.5 to 34.5) and two had been within the “pink zone” (0 to fifteen). This was versus the week earlier than when 13 ETFs had TRs within the “inexperienced zone”, 7 had been within the “blue zone” and two had been within the “pink zone”. The identical two ETF had been within the “pink zone” two weeks in a row. The World X FTSE Norway 30 ETF (NORW) fell -2 “handles” to 11.5 from 13.5 and the iShares MSCI Israel ETF (EIS) fell -4.5 to 10.5 from 15. The WoW common TR achieve was +1.52

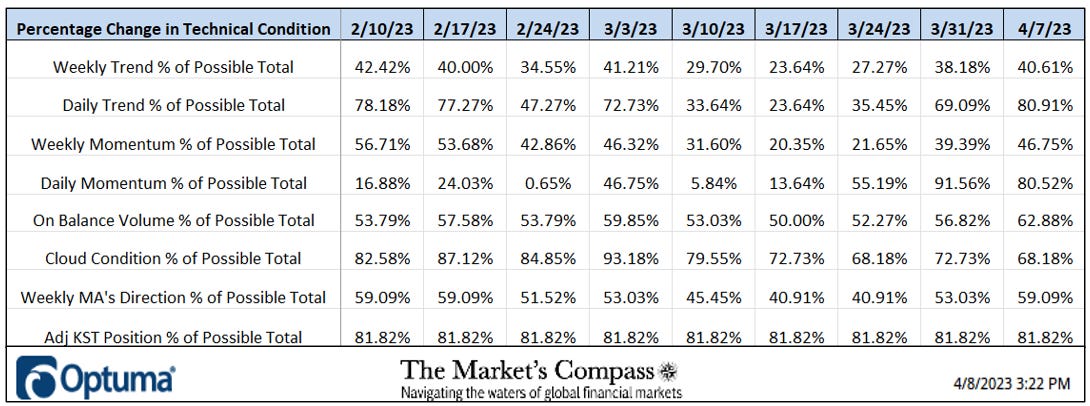

The Technical Situation Issue modifications over the previous week and former 8 weeks

There are eight Technical Situation Components (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is optimistic a further level is added to the person TR. Conversely if the technical query is adverse, it receives a “0”. A number of TCFs carry extra weight than the others such because the Weekly Development Issue and the Weekly Momentum Consider compiling every particular person TR of every of the 22 ETFs. Due to that, the excel sheet above calculates every issue’s weekly studying as a % of the potential whole. For instance, there are 7 issues (or questions) within the Every day Momentum Technical Situation Issue (“DMTCF”) of the 22 ETFs (or 7 X 22) for a potential vary of 0-154 if all 22 ETFs had fulfilled the DMTCF standards the studying can be 154 or 100%.

This previous week a 80.52% studying within the DMTCF was registered for the week ending April seventh, or 124 of a potential whole of 154 optimistic factors. Once we final revealed the DMTCF studying has simply recovered from a deeply oversold studying of 0.65% or 1 out of 154 optimistic factors from the week ending February twenty fourth. It had since risen to 91.56% two weeks in the past leaving the DMTCF within the overbought vary between 85% and 100% earlier than final week’s pullback to 80.52%.

As a affirmation device, if all eight TCFs enhance on per week over week foundation, extra of the 22 ETFs are bettering internally on a technical foundation, confirming a broader market transfer increased (consider an advance/decline calculation). Conversely, if extra of the 22 TCFs fall on per week over week foundation, extra of the ETFs are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week 5 TCFs rose, two fell and one was unchanged.

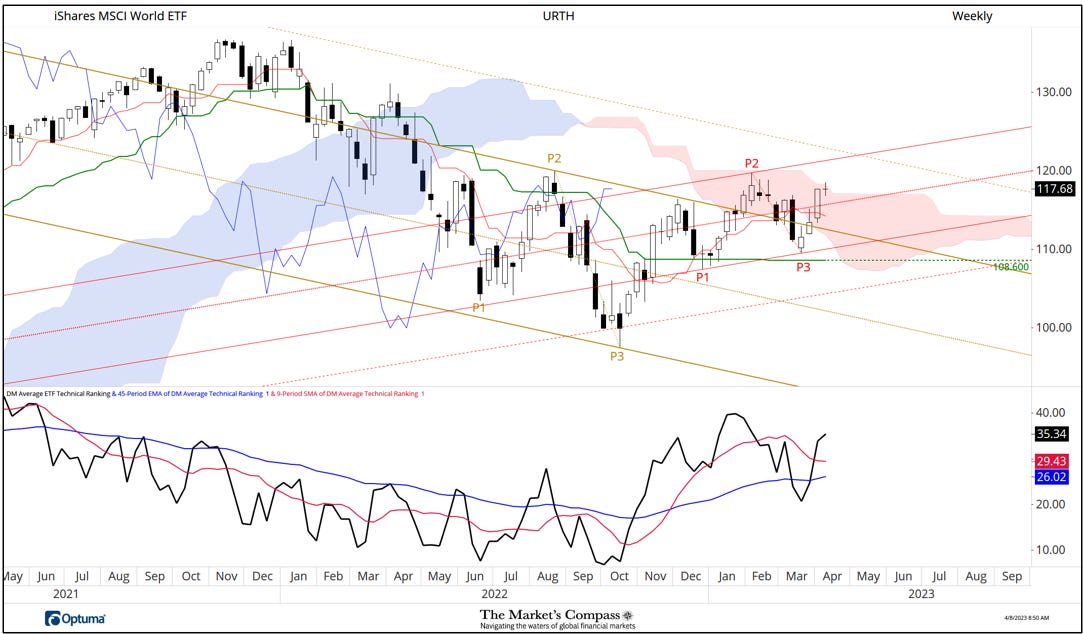

The URTH with This Week’s Complete ETF Rating “TER” Overlaid

The Complete Technical ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and may be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence device: If the broader market as measured by the iShares MSCI World Index ETF (URTH) continues to rally with no commensurate transfer or increased transfer within the TER the continued rally within the URTH turns into more and more in jeopardy. Conversely, if the URTH continues to print decrease lows and there may be little change or a constructing enchancment within the TER a optimistic divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 degree (all 22 ETFs having a TR of fifty) “issues can’t get significantly better technically” and a rising quantity particular person ETFs have turn out to be “stretched” the extra of an opportunity of a pullback within the URTH. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential transferring common in Pink smooths the unstable TER readings and analytically is a greater indicator of development.

As was seen earlier on this Weblog there was a gentle enchancment within the TER because it reached a low at 455 on the finish of the week, March seventeenth. The URTH closed out final week simply shy of -0.50 factors of the February third weekly closing excessive at 118.17. If the ETF is ready to print a weekly shut above that degree I’ll to see a commiserate transfer to a brand new weekly closing excessive within the TER (above 875) to declare a affirmation of the value transfer. That mentioned, if there’s a transfer above above that degree will place the TER within the space of “overbought territory”. The 13-Week Shifting Common of the TER (pink line) had began to hook increased however has stalled giving nary a touch at future development.

The Common Technical Rating of the 30 US Index and Sector ETFs

The weekly Common Technical Rating (“ATR”) is the typical Technical Rating of the 22 Developed Markets Nation ETFs we monitor. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator. It’s charted within the panel beneath the Weekly candle chart beneath.

After I final revealed the DMC ETF Research on March twentieth for the week ending March seventeenth, I introduced consideration to the value break that violated assist on the earlier overtaken resistance on the Higher Parallel (strong gold line) of the longer-term Schiff Pitchfork (gold P1 by way of P3). My concern on the time was that there can be comply with by way of to that nasty week and that the Kijun Plot can be in jeopardy of being damaged however a value pivot developed above that degree and two weeks later the bottom above that Higher Parallel was retaken. That value pivot was the genesis of the brand new short-term Customary Pitchfork (pink P1 by way of P3) whose Median Line (pink dotted line) was promptly overtaken, however costs stalled on the prime of the Cloud final week, marking the second time this 12 months that the Higher Span of the Cloud capped costs this time with a traditional Doji candlestick sample, signaling market individuals non permanent indecision.

One technical concern is that despite the fact that the ATR stays above each its shorter and long run transferring averages the indicator at 35.34 is greater than 11% beneath the current January increased excessive at 39.77. This whereas the URTH closed final week at a nominal increased excessive suggesting a budding non-confirmation. Extra on my ideas of the short-term technical situation of the URTH later within the Weblog, however first…

The Weekly Absolute and Relative Worth % Change*

*Doesn’t embrace dividends

Fifteen of the Developed Markets Nation ETFs we monitor in these pages had been up on an absolute foundation final week. The typical absolute achieve of all 22 ETFs was +0.70% versus a +0.01% achieve within the URTH. Due to the de minimis achieve within the URTH the 15 ETFs that outperformed on absolute foundation additionally outperformed on a relative foundation. On an absolute foundation the World X FTSE Portugal 20 ETF (PGAL) was on the prime of the “pack” gaining +4.10% adopted by its geographic neighbor the iShares MSCI Spain Index Fund ETF (EWP) which gained 2.80%.

Ideas on the short-term technical situation of the URTH*

*Of curiosity to scalpers, merchants, and technicians

Every week in the past final Wednesday the URTH overtook the Median Line (dotted pink line) of the newly drawn Schiff Modified Pitchfork (pink P1 by way of P3). The next day it overtook the Higher Parallel (strong purple line) of the long term Customary Pitchfork (purple P1 by way of P3). Final Friday costs accelerated increased however for all intents and functions failed on the Higher Parallel of the shorter-term Pitchfork through the vacation shortened buying and selling week.

As may be seen by the overbought degree reached by the DM Nation ETF Every day Momentum Oscillator (decrease panel) there was not sufficient upside “momentum gasoline within the tank” left to overhaul the Higher Parallel and unsurprisingly through the backing and filling that adopted upside momentum slowed as witnessed by MACD. Regardless of Thursday’s bounce on the Median Line (pink dotted line) I don’t suppose that the present brief time period consolidation/ retracement has run its course. Additional technical proof that this doubtless the case may be seen by trying on the RRG chart that follows…

The Relative Rotation Graph, generally known as RRGs had been developed in 2004-2005 by Julius de Kempenaer. These charts are a singular visualization device for relative energy evaluation. Chartists can use RRGs to investigate the relative energy developments of a number of securities in opposition to a typical benchmark, (on this case the URTH) and in opposition to one another over any given time interval (within the case above weekly for the reason that center of March. The ability of RRG is its capability to plot relative efficiency on one graph and present true rotation. We all know that there’s rotation between Nation ETFs pushed by many elements together with however not restricted to underlying forex actions, particular person nation financial fundamentals, and political climates, however attempting to visualise that “rotation” on linear charts is sort of inconceivable. All RRGs charts use 4 quadrants to outline the 4 phases of a relative development. The Optuma RRG charts makes use of, From Main (in inexperienced) to Weakening (in yellow) to Lagging (in pink) to Bettering (in blue) and again to Main (in inexperienced). True rotations may be seen as securities transfer from one quadrant to the opposite over time. That is solely a short clarification of the way to interpret RRG charts. For individuals who have an curiosity and wish to study extra, Mathew Verdouw at Optuma has two video tutorials that delve deeper into RRGs. I urge my Weblog readers to avail themselves of those. The hyperlinks to these movies are posted on the finish of this Weblog.

Though there are a number of of the ETFs we monitor in these pages are starting to show and a few whose descent are slowing nearly all of DMC ETFs are monitoring decrease within the Weakening Quadrant. The one one that’s persevering with to grudgingly attempt to enhance is the SPY. This could add credence to the thesis that extra brief time period consolidation and value retracement within the DMC ETFs is within the playing cards.

The iShares MSCI Spain Index Fund ETF has taken the pole place YTD relative to the URTH which is up +7.72% YTD, The EWP is up +10.77% YTD on a relative foundation from up+ 4.50% after we final revealed. The iShares MSCI Eire ETF (EIRL) has slipped on a relative foundation into the quantity two spot to being up +10.52% from +10.94% since we final revealed on March twentieth for the week ending March seventeenth.

Charts are courtesy of Optuma whose charting software program allows anybody to visualise any knowledge together with RRG Charts and our Goal Technical Rankings.

The next hyperlinks are an introduction and an in depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

tbrackett@themarketscompass.com