USDT issuer Tether plans to launch a brand new stablecoin pegged to the United Arab Emirates Dirham (AED) in collaboration with the Phoenix Group and Inexperienced Acorn, in keeping with an Aug. 21 assertion shared with CryptoSlate.

This new asset will probably be a digital illustration of the UAE Dirham, pegged 1:1 and backed by reserves held inside the UAE.

The introduction of this Dirham-pegged stablecoin goals to supply customers with seamless entry to AED whereas leveraging the transparency and effectivity of blockchain know-how. This initiative is predicted to spice up worldwide commerce and remittances, decrease transaction charges, and supply a hedge towards foreign money fluctuations.

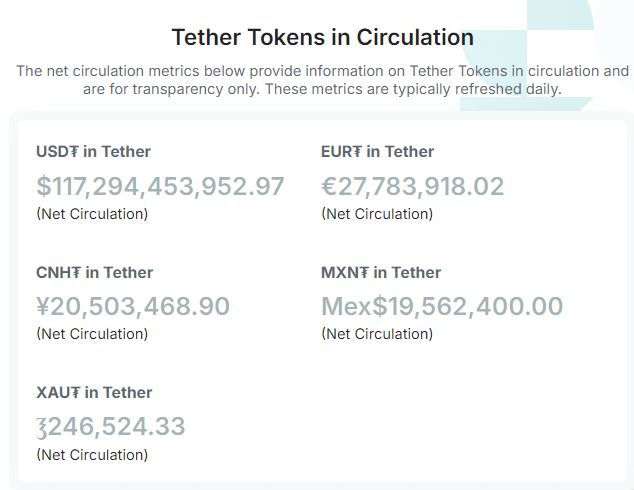

As soon as launched, the stablecoin will be part of Tether’s current portfolio of fiat-based tokens, together with USDT, EURT, CNHT, MXNT, XAUT, and aUSDT.

Why Tether is launching an AED stablecoin

Tether CEO Paolo Ardoino cited UAE’s standing as a world financial hub as a key issue behind the launch. He emphasised the significance of making a Dirham-pegged token to facilitate regional transactions.

Ardoino acknowledged:

“Tether’s Dirham-pegged stablecoin is ready to turn into a vital software for companies and people in search of a safe and environment friendly technique of transacting within the United Arab Emirates Dirham whether or not for cross-border funds, buying and selling, or just diversifying one’s digital belongings.”

The stablecoin’s launch coincides with Abu Dhabi’s Monetary Providers Regulatory Authority (FSRA) proposing a regulatory framework for fiat-referenced tokens (FRTs).

On Aug. 20, FSRA outlined that FRT issuers proposed that the stablecoin issuers’ reserve belongings ought to equal or exceed the par worth of all excellent FRTs on the finish of every enterprise day.

Moreover, the FSRA recommends that issuers of a number of FRTs keep separate swimming pools of reserve belongings for every token and handle them independently.

Additional, the regulator acknowledged that the FRT should not be promoted as nor thought of to be an funding or a financial savings product. Nonetheless, it is not going to prohibit an issuer from accruing and distributing revenue earned from Reserve Belongings to the FRT holder.

This initiative displays the fast growth of the crypto market within the UAE, which has skilled important development in recent times.