Solana (SOL) has been on a rollercoaster trip of late, with its its worth seeing erratic shifts and even retreating in lots of cases.

Associated Studying

For Solana, the sharp swings available in the market have introduced a troublesome image; nonetheless, specialists nonetheless have optimism. They see this as a passing part even with the downward pressures. The altcoin’s technical developments level to an attention-grabbing future.

On the time of writing, SOL was buying and selling at $150, down 6.2% and 17.1% within the each day and weekly frames, knowledge from Coingecko exhibits.

Even throughout the turmoil, the latest buying and selling quantity of $9.80 billion over the previous 24 hours demonstrates a notable diploma of exercise and investor curiosity.

Technical Indicators And Bullish Patterns

Ali Martinez, a well-known crypto analyst, lately talked about Solana’s doable return, which makes sellers and consumers very .

Martinez’s examine signifies on Solana’s 4-hour chart a bullish megaphone sample creating. This development, which exhibits rising volatility, often comes earlier than vital value will increase.

I do know, the dip retains dipping!

Nevertheless, #Solana is perhaps forming a bullish megaphone on the 4-hour chart. The latest correction to the 61.8% Fibonacci stage and oversold RSI recommend it might be a superb time to purchase $SOL.

Take into account inserting your stop-loss round $156-$154 and… pic.twitter.com/ylnaPAf2EV

— Ali (@ali_charts) August 1, 2024

One of many major indicators that would validate Solana’s constructive outlook is the digital asset’s adaptation to the 61.8% Fibonacci retracing stage. Extremely essential in technical evaluation, the Fibonacci retrace aids within the estimation of possible help and resistance ranges. Particularly the stated stage is seen as a tipping level when regular market fluctuations are anticipated.

To scale back danger, Martinez recommends establishing a stop-loss order between $156 and $154, due to this fact guaranteeing that, ought to the worth fall to this predefined stage, holdings are immediately liquidated. This method seeks to reduce doable losses and set buyers to revenue from the anticipated rising development.

Conversely, Martinez’s take-profit goal is from $200 to $259, due to this fact offering a major revenue margin for these prepared to barter the current dynamics of the market with measured dangers.

Lengthy-Time period Prospects And Strategic Positioning

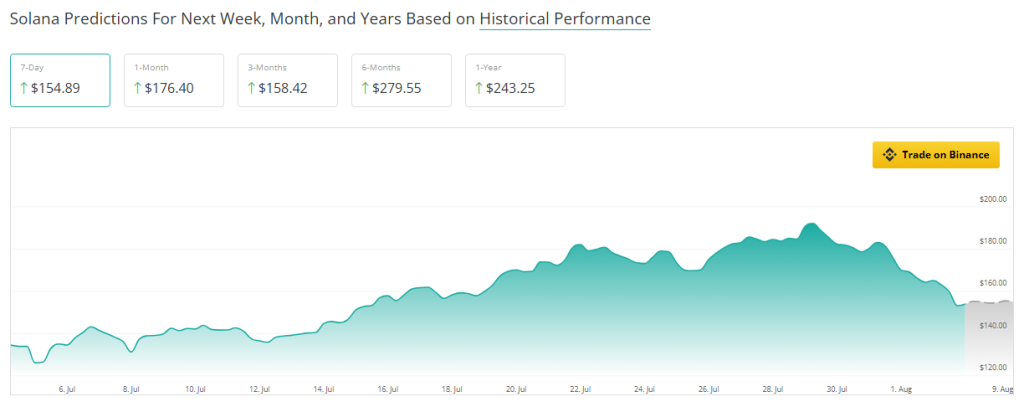

Though the marketplace for cryptocurrencies is inherently risky, Solana’s long-term prospects are very vivid. SOL is promoting at a 14.59% low cost to its anticipated estimate for the following month based mostly on knowledge from the crypto prediction device CoinCheckup. This underperformance factors to doable undervaluation, thereby providing buyers prepared for a comeback a window of alternative.

From what CoinCheckup can inform, costs will go up by 2.91 p.c over the following three months. That is the beginning of a therapeutic time. Despite the fact that this projected rise is small, it units the stage for larger ones.

Associated Studying

Issues are trying up for Solana: prediction knowledge present it’s poised to rally 80% over the following six months. This projection might be based mostly on the notion that the community will enhance, extra individuals will use it, and the market can be rising.

Featured picture from Chainalysis, chart from TradingView