Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

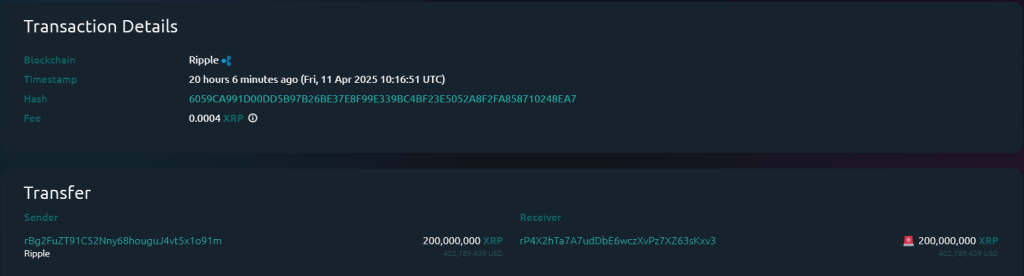

San Francisco-based Ripple has transferred 200 million XRP tokens, price roughly $400 million, between company-controlled wallets. The huge motion occurred in the present day and was first noticed by cryptocurrency monitoring service Whale Alert.

Associated Studying

Monitoring The Cash Path

The transaction initially gave the impression to be heading to an unknown vacation spot when Whale Alert reported the funds shifting to an unidentified tackle ‘rP4X2…sKxv3’. However blockchain analytics platform Bithomp later clarified that each the sending and receiving wallets belong to Ripple.

The receiving pockets was created by Ripple on October 2, 2023, with an preliminary funding of 70 million XRP. Since its creation, this pockets has solely interacted with different Ripple-linked addresses, strengthening the proof that this was an inside switch quite than funds shifting to an out of doors entity or change.

200,000,000 #XRP (402,739,474 USD) transferred from #Ripple to unknown pocketshttps://t.co/cZz7k5fum8

— Whale Alert (@whale_alert) April 11, 2025

Why The Massive Cash Transfer

In accordance with crypto group determine XRP_Liquidity, who tracks Ripple’s token actions, the transaction represents customary treasury administration – Ripple merely shifting cash between its personal accounts. The 200 million XRP tokens stay untouched on the receiving tackle, suggesting no speedy plans for his or her use.

The receiving pockets now holds round 290 million XRP tokens, valued at about $577 million as of the present XRP value of $2.04 per token, based mostly on figures by Coingecko.

In accordance with historic developments, the funds can be utilized for varied functions in Ripple’s enterprise operations. They can be utilized to finance On-Demand Liquidity (not too long ago renamed Ripple Funds), finance exchange-traded merchandise that mirror XRP’s worth, or give liquidity to cryptocurrency exchanges the place XRP is listed.

The Larger Monetary Image

The sending pockets didn’t empty its money register with this switch. It nonetheless incorporates 200 million XRP tokens. That pockets had acquired 300 million XRP on April 2 from one other Ripple-linked tackle, which itself had acquired 500 million XRP from Ripple’s month-to-month escrow launch.

Ripple maintains most of its XRP holdings in escrow accounts, with programmed releases occurring month-to-month. The April launch confirmed uncommon timing in comparison with Ripple’s customary follow.

Associated Studying

Breaking From Routine

Ripple broke from its conventional first-of-month schedule for its April token launch. As an alternative of unlocking the funds on April 1, the corporate first returned 700 million XRP to escrow, then launched 1 billion XRP on April 3.

This shift in schedule runs counter to Ripple’s established custom of releasing tokens on the primary day of every month, though the corporate has not commented publicly on its reasoning for this timing change.

The pockets transactions are important, as XRP trades at over $2 per token, giving the cryptocurrency such a excessive valuation that even regular transfers are price a number of lots of of tens of millions of {dollars}.

These large transfers are often adopted carefully by crypto market watchers, as they will every so often be indicative of any potential future market transfer or strategic choice taken by the corporate.

Featured picture from Gemini Imagen, chart from TradingView