Digital asset analysis agency Kaiko finds that knowledge from crypto exchanges suggests giant merchants within the US drove shopping for demand of XRP after Ripple received a partial courtroom victory over the U.S. Securities and Change Fee (SEC) in July.

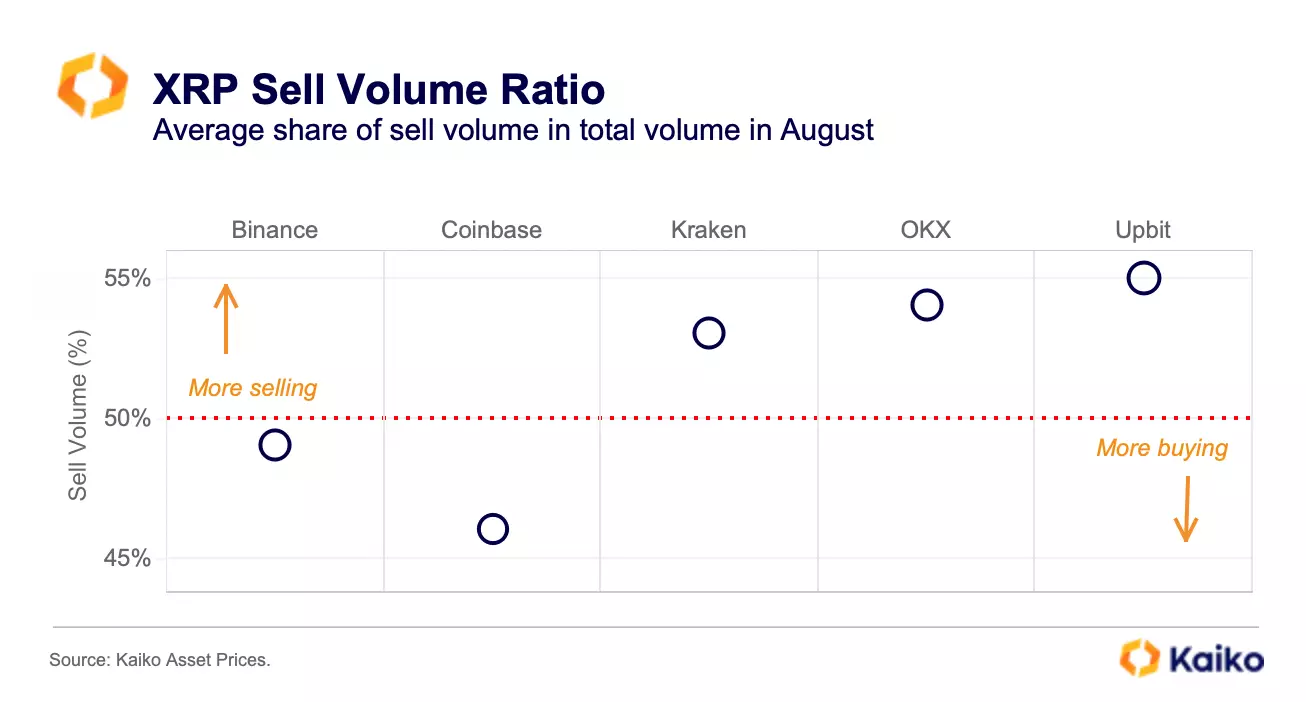

In a brand new evaluation, Kaiko notes that the Korean trade Upbit and the Seychelles-based trade OKX witnessed the strongest promoting stress for XRP in August.

Kaiko additionally finds that Coinbase, the highest crypto trade within the US, noticed stronger ranges of shopping for.

The crypto analysis agency additionally notes that XRP’s common commerce dimension elevated on Coinbase, surpassing all prime ten altcoins, excluding Ethereum (ETH).

“This might counsel that purchasing demand was pushed by giant merchants within the US as buyers re-gained entry to the token after the July courtroom ruling. General, the share of XRP traded on US markets stays decrease than on offshore exchanges. XRP is barely the sixth-most-traded altcoin within the US by cumulative commerce quantity whereas it tops the checklist on offshore markets.”

The SEC sued Ripple in late 2020, alleging the San Francisco funds firm was promoting XRP as an unregistered safety.

In July, District Decide Analisa Torres dominated that Ripple’s automated, open-market gross sales of XRP, known as programmatic gross sales, didn’t represent safety choices, opposite to what the SEC alleged.

The decide did, nevertheless, aspect with the SEC’s declare that Ripple’s sale of XRP on to institutional consumers constituted a securities providing.

XRP shot up from buying and selling round $0.47 previous to the ruling to a excessive of round $0.82 later in July. The Fifth-ranked crypto asset market cap has since misplaced most of these features and is buying and selling round $0.504 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney