Digital assets-focused funding agency Pantera Capital is highlighting key causes for why they imagine the altcoin market is depressed.

In its newest Blockchain Letter, Pantera Capital portfolio supervisor Cosmo Jiang says that macroeconomic situations are hurting the crypto market together with fears over a provide overhang and a rise in altcoin initiatives.

Jiang additionally says that the U.S. Securities and Trade Fee’s (SEC) current actions towards blockchain growth firm Consensys and decentralized change (DEX) Uniswap (UNI) over alleged securities legislation violations created regulatory uncertainty for alt initiatives.

“We level to some macro-related and crypto-specific causes for the decline. The principle macro headwind in early April was the markets started repricing a situation of higher-for-longer charges because of a still-strong economic system and excessive inflation, in distinction to the prior view that there can be a speedy lower in charges.

On the crypto aspect, the markets have been weighed down primarily because of fears of a provide overhang. For Bitcoin, the German authorities started liquidating its $3 billion place and the timeline of the $9 billion Mt. Gox distributions was confirmed. Lengthy-tail tokens have confronted provide headwinds each from the rise in new token launches, diversifying buyers’ consideration and restricted capital, in addition to ongoing vesting of personal buyers from newly-launched tokens over the past 12 months.

As well as, SEC investigations into Consensys and Uniswap created some uncertainty for sure protocols.”

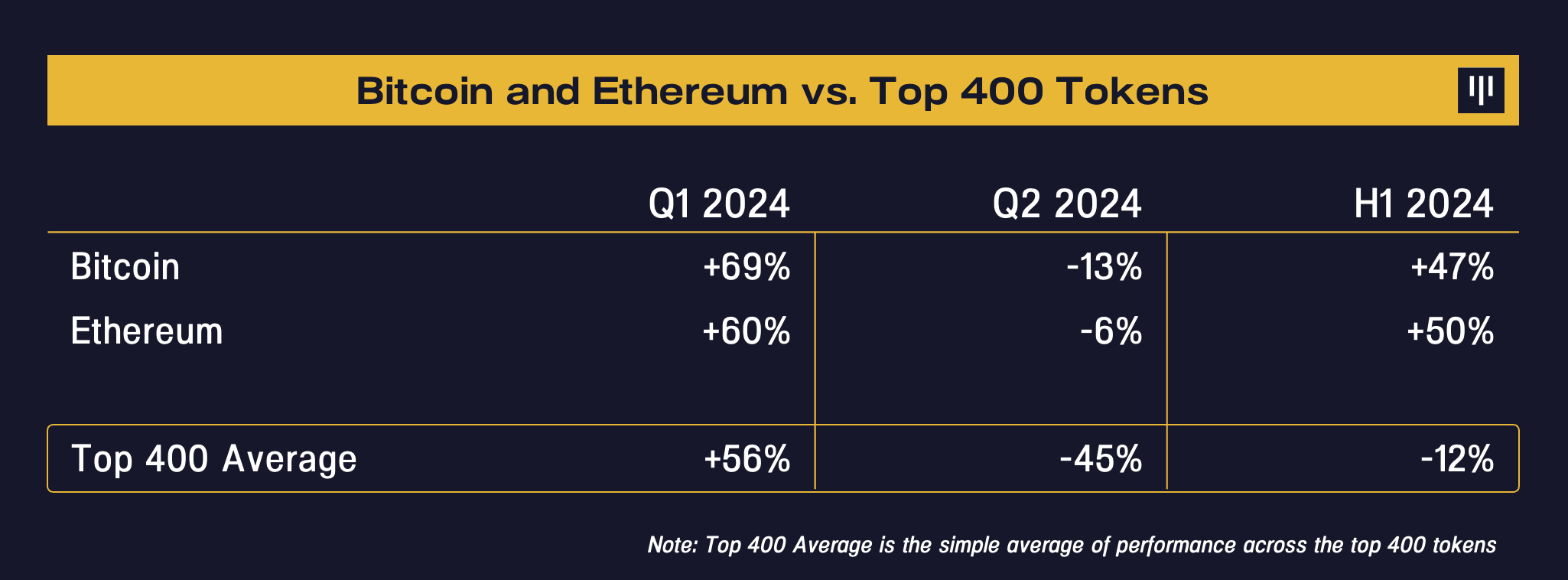

Jiang says that Bitcoin (BTC) and Ethereum (ETH) have considerably outperformed the broader crypto market to date in 2024.

“Total, breadth has been slender and there was significant underperformance year-to-date throughout the broader crypto panorama relative to Bitcoin and Ethereum, which is analogous to the dynamic in equities this 12 months, the Magnificent 7 versus the remainder. To assist illustrate this level, now we have included under the distributions of returns for the top-400 tokens by market capitalization this 12 months.”

Bitcoin is buying and selling for $65,314 at time of writing, up 1.6% within the final seven days. In the meantime, Ethereum is buying and selling for $3,327 at time of writing, down almost 2% within the final week.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE3