The cryptocurrency market’s current dominance by Bitcoin has decreased beneath 50%, indicating a possible antagonistic pattern as retail exercise will increase. This variation prompts inquiries concerning market dynamics and investor sentiment.

Bitcoin’s dominance has been a essential indicator of whether or not the market is in a bull or damaging cycle all through historical past. As Bitcoin’s dominance is rising, normally, it means a defensive market the place buyers would like the comparatively safer various of Bitcoin relatively than altcoins.

Associated Studying

Whereas a fall normally means the investor is prone to enhance his threat and fairly often prefers to put money into altcoins for potential greater returns.

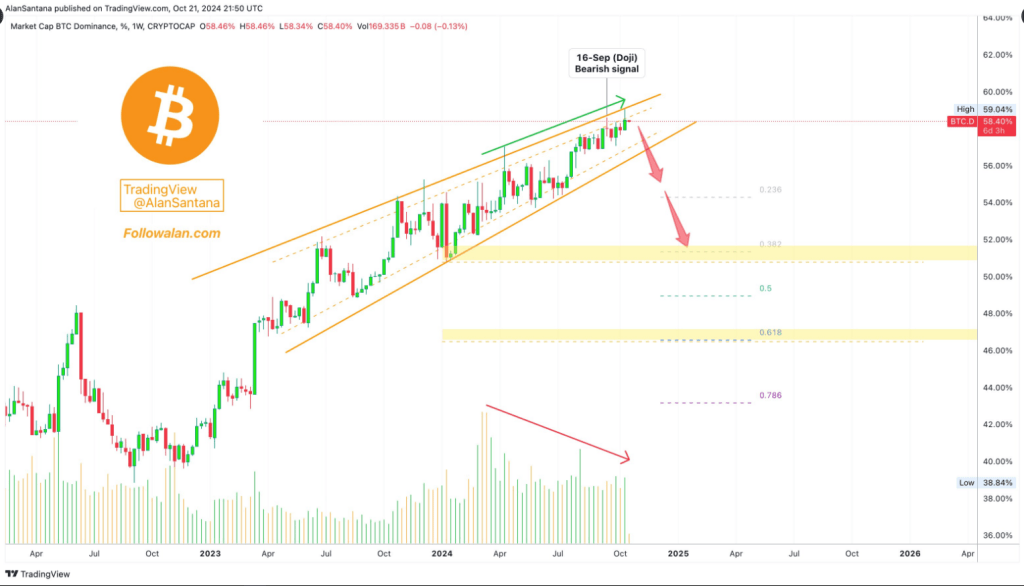

Crypto analyst Alan Santana recognized three vital warning indicators for Bitcoin’s dominance in an X put up on Tuesday, as retail buyers resumed buying and selling after an prolonged interval of inactivity.

#BTCdominance 🅱️ 3 Bitcoin Dominance Bearish Indicators + Fibonacci Time Calculations

I wish to present right here primarily three indicators that may be thought-about bearish on this chart, Bitcoin Dominance (BTC.D).

1) There’s a Doji on the sixteenth of September. Coming on the high of a pattern… pic.twitter.com/enQAeVo5MB

— Alan Santana (@lamatrades1111) October 21, 2024

The Improve In Retail Exercise

As Bitcoin’s supremacy wanes, retail buyers are getting more and more lively. Often, this rise in retail involvement comes with a decline in Bitcoin’s market share since these buyers switch to altcoins in quest of higher earnings.

The present state of affairs is paying homage to earlier cycles, throughout which the rise in retail curiosity resulted in a considerable lower in Bitcoin’s dominance. For instance, Bitcoin’s dominance declined considerably throughout the 2021 bull market as new altcoins gained momentum, diverting consideration from the unique cryptocurrency.

Common Shift In Investor Temper

Market consultants say that this pattern isn’t only a one-time factor; it’s an indication of bigger adjustments in how buyers act. As non-fungible tokens (NFTs) and decentralized finance (DeFi) have grown, altcoins have turn out to be extra interesting.

Loads of buyers suppose that networks like Ethereum, which help good contracts and decentralized apps, are extra versatile than Bitcoin lately. This variation might be an indication of an even bigger shift in how individuals take into consideration and use cryptocurrencies.

Associated Studying

Fluctuation Tendencies

Bitcoin has seen a pattern of fluctuations in dominance since its inception in 2009. Beginning with an virtually 100% market share, it started to say no slowly with the introduction of extra altcoins.

Bitcoin fell crucially throughout each the ICO increase of 2017 and the DeFi surge of 2021, at which period it fell to beneath 40% dominance. Given such historic precedents, this would possibly signify one other such section the place altcoins do outperform Bitcoin, particularly when retail curiosity is rising.

Consultants consider that this will trigger the crypto markets to turn out to be much more unstable sooner or later if this continues. Declines in dominance are sometimes precursors to speculative buying and selling, which subsequently causes costs of each Bitcoin and altcoins to fluctuate wildly.

The present degree of Bitcoin dominance capabilities as a gauge of the final market sentiment. Many speculators are reassessing their methods because it continues to say no.

Featured picture utilizing Dall.E, chart from TradingView