In right this moment’s digital world, 93% of workers obtain their revenue funds by way of direct deposit.

Initially created as a comfort for workers, direct deposit is a superb set-it-and-forget-it solution to obtain a paycheck — till you need to change it.

Changes akin to switching direct deposit accounts and splitting a paycheck between accounts at totally different banks are cumbersome, paper-laden processes.

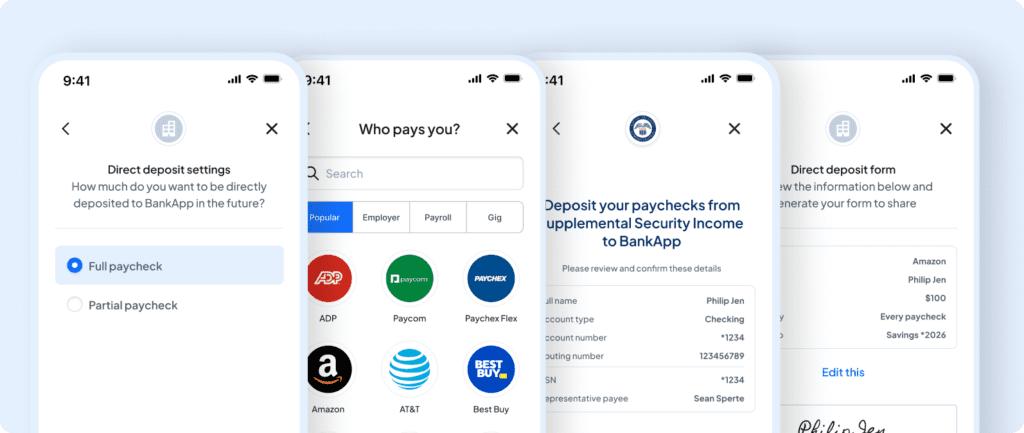

Pinwheel’s new Direct Deposit Change 2.0 units out to vary all that. DDS 2.0 permits shoppers to change their direct deposits seamlessly from one establishment to a different with out paper types or speaking to HR.

Direct Deposit Change 2.0 affords common protection

Pinwheel permits 100% of direct deposit customers to vary their payroll and revenue settings seamlessly. This universality is an enormous step for the business, which is stricken by interoperability points between monetary establishments, employers, and payroll suppliers.

The common attain of DDS 2.0 is particularly engaging to neighborhood banks, credit score unions, and neobanks — all of which have had hassle capturing the direct deposits essential to forging long-lasting, worthwhile buyer relationships.

With this benefit in thoughts, neobank Varo has change into an early adopter of Pinwheel’s DDS 2.0.

“Pinwheel’s Deposit Change 2.0 will permit us to broaden the attain of our trusted on-line banking companies and improve our relationship with our clients considerably,” stated Anton Chakhmatov, Director of Product at Varo, in a press launch.

“Not solely can Varo Financial institution now help automated direct deposit switches for 100% of the inhabitants receiving revenue by way of direct deposits, however this answer additionally strengthens our potential to hone in on the distinctive wants of our clients and supply extra tailor-made options.”

DDS 2.0 a win for banks

Any financial institution’s main aim is to seize the common inflow of money by way of direct deposit. With Pinwheel’s new mobility for direct deposits, billions of payroll {dollars} are up for grabs. DDS 1.0 has been instrumental in rising banks’ direct deposits by 75% with out the 100% protection that DDS 2.0 affords.

One other benefit of DDS 2.0 is tapping into verified shopper knowledge in real-time.

“Pinwheel creates some extent of connectivity to a shopper’s permissioned payroll and revenue knowledge,” explains Lauren Crossett, Chief Income Officer for Pinwheel.

Associated:

“Pinwheel provides clients with actionable knowledge on behalf of the patron, akin to how a lot they’ve earned, what they’re projected to earn, or whether or not an worker is salaried or hourly. That is instrumental for decision-making in lending, rental purposes, and extra.”

Crossett additionally calls Pinwheel’s answer “a robust fraud prevention measure. Uploaded paystubs are simple sufficient to pretend. However whenever you’re connecting on the user-permissioned credential degree, there’s further authentication that protects the financial institution and the patron.”

DDS 2.0 creates seamless shopper expertise

Pinwheel’s DDS 2.0 has vital implications for the consumer expertise at banks giant and small. Crossett explains that “due to DDS 2.0’s universality, nobody is left with no path for transferring their direct deposit to a different account or financial institution. Shoppers are not hamstrung when switching from a checking account they signed up for years in the past.”

This seamless switching permits clients to pick financial institution accounts with the specified personalized options, akin to early entry to paychecks, engaging rates of interest, or loyalty perks. Since a direct deposit is a prerequisite to obtain most of those options, a streamlined, digital system to vary payroll settings is essential for consumer satisfaction.

Not solely does this make for comfortable clients, however it additionally encourages competitors and innovation amongst monetary establishments.