Japanese funding firm Metaplanet has made its largest variety of Bitcoin purchases to this point, following the acquisition of 107.913 BTC for round 1 billion yen (equal to $6.9 million), as per an Oct. 1 assertion.

This marks Metaplanet’s eleventh Bitcoin acquisition since its first buy on April 23, in response to knowledge from Bitcoin Treasuries.

With this newest buy, the agency’s whole Bitcoin holdings now quantity to 506.745 BTC, price roughly $32.2 million. The corporate’s latest disclosure reveals that it has spent 4.75 billion yen (round $31.9 million) on its Bitcoin purchases, with a median acquisition price of 9.37 million yen (roughly $64,931) per BTC.

In the meantime, Simon Gerovich, Metaplanet’s CEO, hinted at additional Bitcoin acquisitions and revealed the agency’s subsequent aim is to build up 1,000 BTC. He mentioned:

“As we begin the second week of rights warrant train, please assist us stand up on the checklist of prime company holders of Bitcoin. Subsequent goal is to personal greater than 1000 Bitcoin.”

Presently, Metaplanet ranks because the second-largest institutional Bitcoin holder in Asia, trailing solely Hong Kong’s Meitu Inc., which holds 940.9 BTC, in response to Bitcoin Treasuries.

In the meantime, the Michael Saylor-led MicroStrategy stays the most important company Bitcoin holder globally, with 252,220 BTC.

Metaplanet shares outperforms

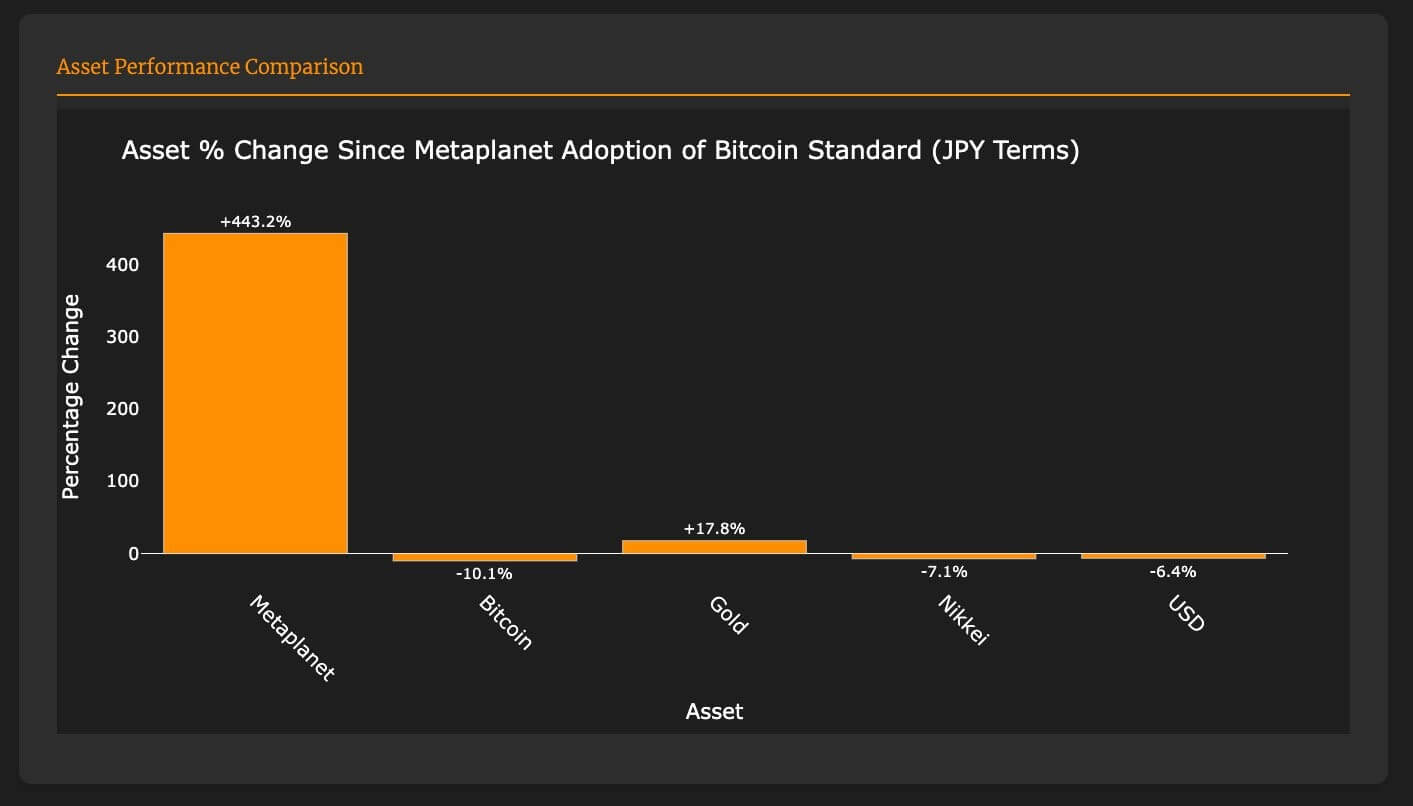

Metaplanet’s Bitcoin transfer has confirmed largely profitable and helped the corporate shares outperform conventional monetary belongings just like the US {Dollars}, Gold, and Japan’s Nikkei share index

On Sept. 19, Gerovich shared that the corporate’s inventory has surged by 443% since adopting the Bitcoin commonplace. Compared, the Nikkei index, the US Greenback, and Bitcoin itself have all seen declines of seven.1%, 6.4%, and 10.1%, respectively. Gold, nevertheless, has risen by 17% throughout this era.

Market observers have linked this robust efficiency with the agency’s Bitcoin-only treasury technique, which it adopted in Might to hedge towards the volatility of the Japanese yen. Since then, Metaplanet has made common Bitcoin purchases, positioning itself among the many prime 25 institutional Bitcoin holders globally.