Market Outlook #249 (eleventh December 2023)

Good day, and welcome to the 249th instalment of my Market Outlook.

On this week’s submit, I will likely be masking Bitcoin, Ethereum, Polygon, Uniswap, Optimism, Alchemix, Altered State Machine and Raini.

As ever, when you have any requests for subsequent week, ship them throughout.

Bitcoin:

Weekly:

Each day:

Value:

Market Cap:

Ideas: If we start by BTC/USD, on the weekly timeframe we are able to see that final week closed at contemporary yearly highs, via $42k resistance on rising quantity. Value closed out the week simply shy of $44k and early buying and selling this week has seen value dump again beneath $42k however maintain above $39.7k as help, pushing up from that space again in the direction of $42k, the place it’s presently sat. Taking a look at this, there’s little or no to counsel any slowdown, significantly after final week’s shut via that confluence of resistance. While we proceed to carry above $39.7k this week, I believe we see this consolidation round $42k result in additional enlargement subsequent week into the 61.8% retracement degree and prior resistance at $48k, the place it’s possible we begin to kind a neighborhood prime. If, nonetheless, this sell-off continues later this week and we shut the week again beneath $39.7k, it’s possible the native prime has shaped right here and we are able to search for additional draw back subsequent week into $36k to retest all that prior resistance as help; beneath that degree, we filter out all of the untapped lows into $33k. That’s the roadmap from each views going into 2024.

Turning to the each day, we are able to see that value bought off sharply yesterday in one thing of a mini liquidation cascade, taking it from up close to $44k down into $40k, earlier than bouncing and now consolidating proper beneath that $42k degree. At current, $42k is each day resistance, so reclaiming that over the subsequent day or two would counsel an extra restoration of that cascade and sure a march to contemporary highs from there; if, nonetheless, $42k continues to behave as resistance this week, we could have additional to fall but earlier than discovering a backside, with $39.6k but untested – a second leg decrease into that degree adopted by a $42k reclaim can be a pleasant backside formation to search for longs. As talked about above, till we shut the upper timeframes beneath $39.6k, I don’t assume this uptrend is finished fairly but. And above $45k there’s solely air into $48k.

Ethereum:

ETH/USD

Weekly:

Each day:

ETH/BTC

Weekly:

Each day:

Value:

Market Cap:

Ideas: Starting with ETH/USD, we are able to see that value closed firmly via resistance at $2170 final week, pushing as excessive as $2400 earlier than closing at $2350 on good quantity. We have been inches shy of that $2425 degree however value has rejected that resistance early this week, clearing out the prior weekly low into prior resistance turned help at $2170 and bouncing off it. If we are able to now maintain above that degree, that appears very very similar to a bit of flush earlier than enlargement past the 38.2% fib and reclaimed resistance at $2426, with $2650 the subsequent degree of curiosity above that. If we shut the weekly again beneath $2170, I might count on $1850 to be retested earlier than a backside is discovered, the place there’s loads of confluence. Turning to the each day, we are able to see how the pair depraved proper into that prior resistance cluster earlier than bouncing onerous yesterday, so holding above $2137 over the subsequent day or two is paramount for this construction to stay legitimate as resistance turned help; begin closing again inside these resistances and the image appears to be like much less fairly, with a load of untapped lows seen earlier than that $1850 degree comes into view, the place the 200dMA can also be sat…

Trying now at ETH/BTC, final week retested 0.051 as help and held as soon as once more, bouncing off that to shut at 0.0537, however remaining firmly capped by 0.0551 as resistance. As talked about final week, the image could be very clear right here: beneath 0.051 we take out 0.04877 earlier than discovering a backside; and above 0.0551 and the 200wMA we pattern in the direction of trendline resistance. No have to make it any extra difficult than that. An extended-term reversal solely turns into excessive likelihood as soon as we flip that multi-year trendline into help, for my part.

Polygon:

MATIC/USD

Weekly:

Each day:

MATIC/BTC

Weekly:

Each day:

Value:

Market Cap:

Ideas: Starting with MATIC/USD, we are able to see on the weekly that value bounced off that 200wMA final week and rallied again into help turned resistance at $0.92, closing proper at that confluence of resistance. Early this week, the pair has bought off, holding above the 200wMA and now sat in no man’s land throughout the prior weekly vary. Till we get a weekly shut above $0.93, we are able to’t make certain of additional enlargement / pattern continuation, however given the construction right here and the response off the 200wMA I’m leaning in the direction of a breakout quickly. If we drop into the each day, we are able to see that value additionally held above the 200dMA, front-running it as help earlier than reversing. So long as we now kind a higher-low above $0.77, I might count on the subsequent crack at $0.93 to present manner and for the pair to then broaden in the direction of $1.30 within the coming weeks.

Turning to MATIC/BTC, we are able to see that value rallied off of help final week, wicking in the direction of 1717 satoshis earlier than closing the week at highs round 2100. This can be a promising signal for bulls, and if we are able to now maintain above 2000 I might count on the vary to get stuffed in in the direction of the 200wMA and prior help turned resistance at 2450. Dropping into the each day, we are able to see how value faked out above the 200dMA earlier than retracing into that help cluster and now turning each day construction bullish on the newest bounce. Acceptance above 2100 on the each day right here is vital, as that might make it very possible we break past the 200dMA once more, and often the second breakout from a bottoming formation is just not a fakeout, so we may count on to see 2450 satoshis adopted by 2950.

Uniswap:

UNI/USD

Weekly:

Each day:

UNI/BTC

Weekly:

Each day:

Value:

Market Cap:

Ideas: Starting with UNI/USD, we are able to see on the weekly that value poked above $6.30 final week, pushing in the direction of $7.50 earlier than closing again close to $6.60. We positively have bullish construction right here however UNI stays inside a 580-day vary, having spent a lot of 2023 chopping round above vary help and beneath $7.50. From right here, I want to see this space round $6.30 maintain as help and value to shut the weekly via $7.50 later in December; that for me is the start of the subsequent cycle for UNI, given how that degree has capped the pair since September 2022. Above it, I believe we take out the $9.90 excessive and proceed into the 23.6% fib retracement of the bear market at $13.87 earlier than discovering any significant resistance. Trying on the each day, on this timeframe it’s key we maintain above $5.65 as reclaimed help; a pleasant wick beneath $5.84 into that degree adopted by a reclaim of $6.30 later within the week can be a very nice sign for additional upside, in my opinion.

Turning to UNI/BTC, we are able to see that value is now consolidating above multi-year help at 14k satoshis after deviating beneath it. While this degree continues to carry as reclaimed help, I believe it appears to be like very very similar to the underside has shaped right here and we are able to count on a transfer via 17.5k satoshis to return sooner fairly than later; above that, weekly construction turns bullish and I might expect outperformance for UNI all the best way again in the direction of that 26.7k satoshis space. Dropping into the each day we are able to see how the 200dMA continues to cap the rallies just lately, so a transfer via 17.5k would additionally flip that into help, offering confluence for additional upside.

Optimism:

OP/USD

Each day:

OP/BTC

Each day:

Value:

Market Cap:

Ideas: As Optimism has solely been buying and selling for round 18 months I’ll focus right here on the Greenback pair.

Taking a look at OP/USD, we are able to see that value could be very a lot in an uptrend, having marked out a backside in June and a macro higher-low in October, then breaking via trendline resistance from the all-time excessive, flipping the 200dMA as help and persevering with to tear increased. Final week noticed the pair push via the $2 space as resistance into reclaimed resistance proper round $2.40, beneath which it presently sits. That is arguably a very powerful resistance on the chart at current, with it being each the 61.8% fib retracement of the bear market and the double prime from 2022. Settle for above this degree as reclaimed help and I believe we get a parabolic transfer in the direction of all-time highs from there, with a excessive likelihood that this second bull cycle takes OP into value discovery past $3.30 given the market circumstances.

Alchemix:

ALCX/USD

Each day:

ALCX/BTC

Each day:

Value:

Market Cap:

Ideas: As each pairs look an identical right here for ALCX, let’s give attention to the Greenback pair.

Taking a look at ALCX/USD, we are able to see that value had shaped a long-term backside at $16.42, earlier than breaching it to kind a double backside at $13.46 in 2023. Subsequently, in August 2023, we deviated beneath that double backside, shaped a contemporary all-time low at $10.27 after which consolidated for a number of months between that low and prior help turned resistance, additionally discovering resistance on the 200dMA, above which the pair had not discovered help (past a short fakeout) for a number of years. Value has since emerged from this vary, reclaiming each $13.46 and $16.42 as help, turning each day construction bullish. Concurrently, we’ve turned the 200dMA into help, above which a higher-low has shaped. Value rallied from that low into $26.44 final week earlier than rejecting and now retracing again into prior resistance at $18.70. So long as the pair can proceed to carry above $16.42 right here, I might count on to see continuation increased, as that is very a lot a classical cyclical backside at current and any transfer above $26 will possible be the start of the subsequent bull cycle for ALCX. For targets on spot baggage, $73 can be the primary space of curiosity after the hole fill, adopted by $178 after which $478 as main resistance.

Altered State Machine:

ASTO/USD

Each day:

ASTO/BTC

Each day:

Value:

Market Cap:

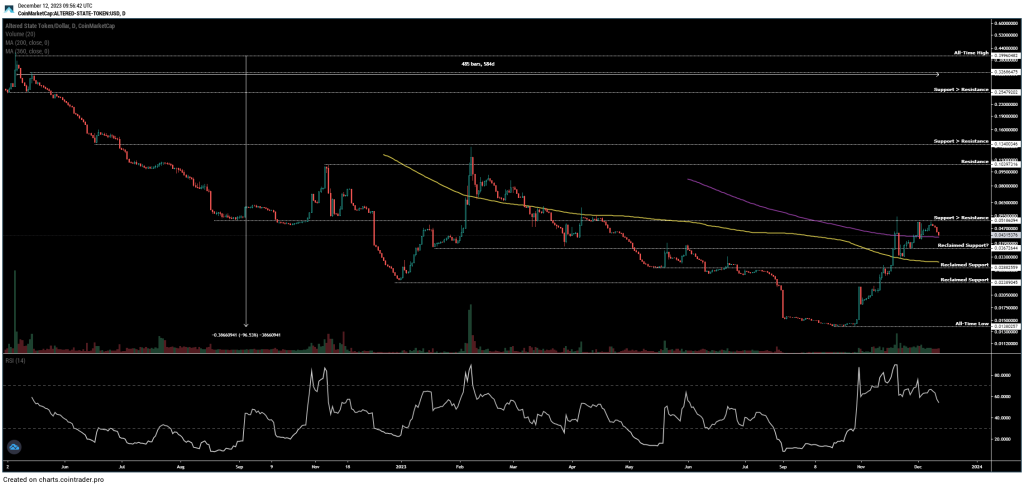

Ideas: Once more, as ASTO has solely been buying and selling for round 18 months, let’s focus right here on the Greenback pair.

Taking a look at ASTO/USD, we are able to see that value has concluded its first bear cycle, shedding 97% of its worth from the all-time highs at $0.40. Value backside in October at $0.014 earlier than starting a pointy rally since, reclaiming a number of ranges of help and shutting firmly above the 200dMA, which acted as help in November. Value is now sandwiched between help turned resistance at $0.052 and reclaimed help at $0.037, sitting marginally above the 360dMA at current. So long as the $0.037 space holds as help, I believe the construction right here is okay regardless of the divergence in momentum; shut beneath that and we possible retraced again in the direction of $0.029 to seek out help once more, with $0.024 because the golden alternative for a spot entry if that comes. If this construction does maintain and value merely consolidates inside this vary, I might look to purchase spot on acceptance above $0.052, as there’s principally no resistance above that for an additional 100% rally, and no resistance past $0.13 all the best way into $0.25. I believe when this one rips, it’ll actually rip, with contemporary highs past $0.40 possible in 2024.

RAINI:

RAINI/USD

Weekly:

Each day:

RAINI/BTC

Weekly:

Each day:

Value:

Market Cap:

Ideas: Starting with RAINI/USD, we are able to see that value closed final week at contemporary yearly highs for 2023, marginally via resistance at $0.05. We now have since continued to push increased early this week with $0.05 performing as help. If that degree can proceed to behave as help this week, there isn’t any actual resistance on the weekly timeframe again into the 38.2% fib of the bear market and reclaimed resistance at $0.08-$0.088. That will be the place I might count on a neighborhood prime to start to kind, from which we could get the primary main correction for Raini of this new cycle. If, nonetheless, we deviate above $0.05 this week after which shut again beneath it, it’s possible the native prime is in right here and I might search for a higher-low to kind above $0.035 earlier than continuation into that vary above. In the end, that is one I’m trying to maintain for a lot of extra months but, with expectations of contemporary all-time highs past $0.20 in 2024, significantly given the Beam narrative.

Turning to RAINI/BTC, we are able to see that value is presently sat proper round that 38.2% fib however there isn’t an historic degree right here for confluence. I might count on 156 satoshis to be retested as resistance if we are able to maintain above 121 right here. Past that degree, contemporary yearly highs are on the best way via 183, with 230 satoshis the extent to observe for past that. Once more, should you’re in a spot place like me, I’m now sitting on my fingers till we hit 280 satoshis as main resistance, promoting a partial after which letting the remaining experience for contemporary all-time highs.

And that concludes this week’s Market Outlook.

I hope you’ve discovered worth within the learn and thanks for supporting my work!

As ever, be at liberty to go away any feedback or questions beneath, or e-mail me immediately at nik@altcointradershandbook.com.