Fast Take

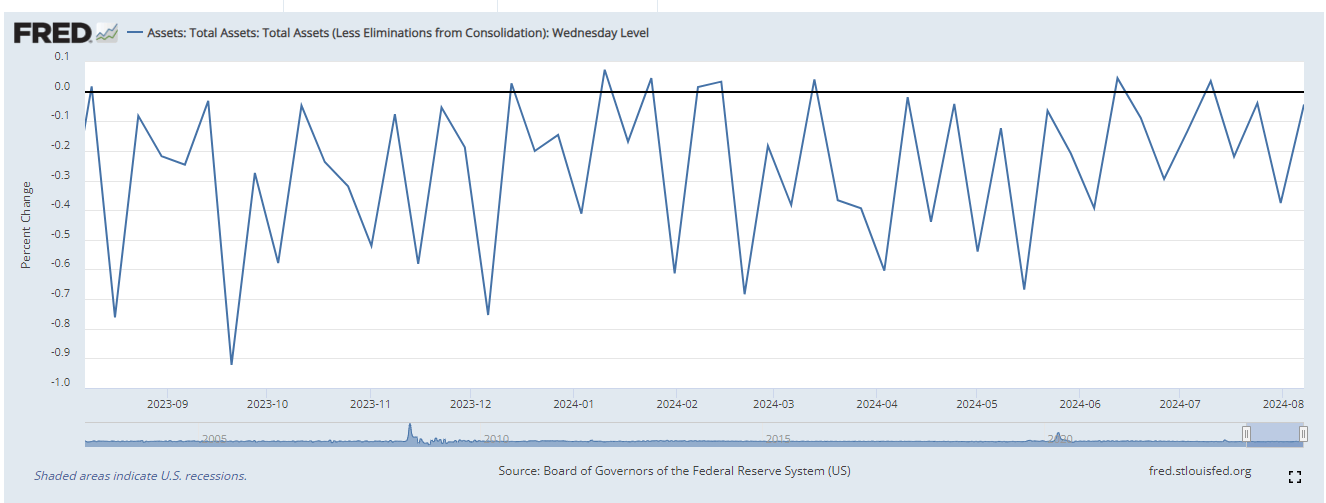

FRED exhibits that the Federal Reserve’s steadiness sheet continues to expertise gradual quantitative tightening (QT), with a negligible $3.1 billion decline, bringing the entire to $7.2 trillion. This marks one of many smallest QT strikes up to now yr, indicating a cautious strategy by the Fed. Whereas the general development is a long-term lower, there have been cases of quantitative easing (QE) the place the steadiness sheet elevated week-over-week.

In the meantime, US debt continues its fast ascent, surpassing $35.1 trillion, highlighting ongoing fiscal challenges. The M2 cash provide, which incorporates money in hand and short-term deposits, stands at $21 trillion, in line with FRED, that means the US has extra debt excellent than cash in circulation—a regarding metric for financial stability.

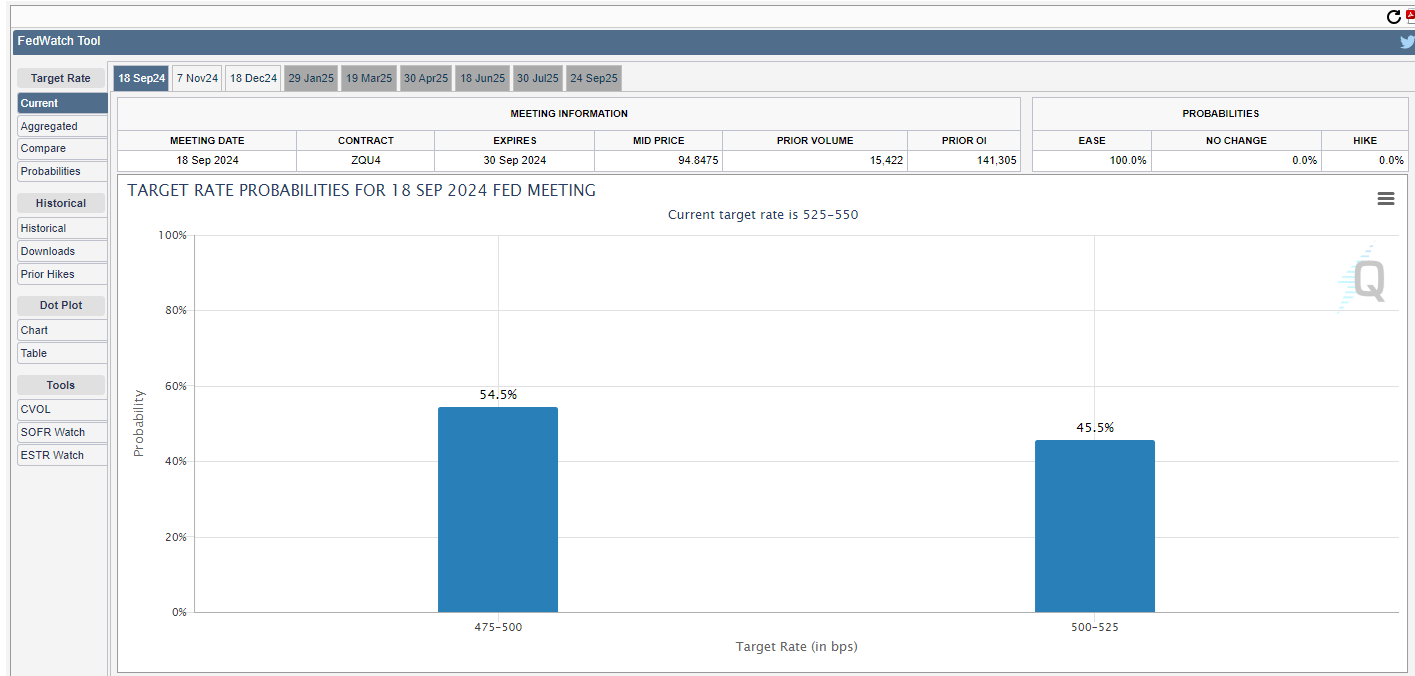

Within the monetary markets, latest volatility has seen a rally following a sharp drop earlier within the week. Buyers are actually pricing a 100% probability of a charge minimize on the upcoming Federal Reserve assembly on Sept. 18. The market is break up between anticipating both 50 foundation factors (bps) or a 25 bps minimize, reflecting uncertainty concerning the Fed’s subsequent transfer in its financial coverage. This uncertainty continues to maintain market members on edge.

Bitcoin is presently buying and selling round $60,000, reflecting a 4% improve over the previous week.

The put up Market braces for charge cuts as Fed’s Quantitative Tightening slows appeared first on CryptoSlate.