The most important cryptocurrency on the earth, Bitcoin has plunged a dramatic 11% from its all-time excessive. Though some buyers may discover this worth devaluation alarming, historic knowledge signifies that it’s actually small in respect to the opposite market cycles of the cryptocurrencies.

The previous worth tendencies of Bitcoin present a number of abrupt declines and rises; volatility is all the time current. One has to think about the context of this most up-to-date decline with a purpose to consider its future course.

Associated Studying

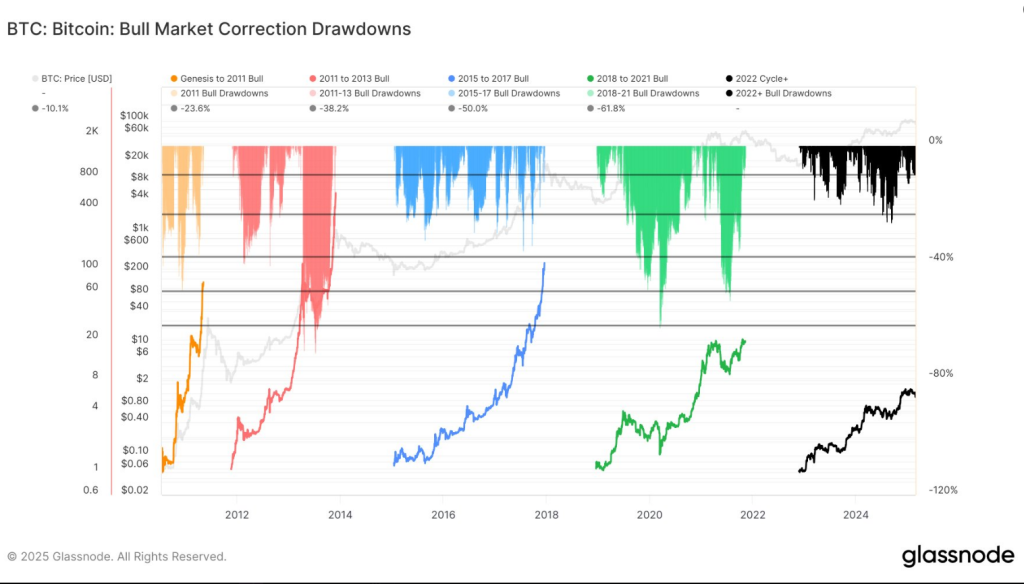

Historic Context Of Bitcoin Corrections

Bitcoin has seen many corrections since its inception. For example, Between January 2012 and December 2017, the worth of the alpha coin dropped greater than 10% on no less than 13 events. Some corrections have brought about market worth losses of billions of {dollars} earlier than making first rate rebounds; some have even reached 20% or extra.

The truth that the present Bitcoin market cycle is much less risky than earlier bull runs is amongst its most noteworthy options. The next patterns of drawdown are seen in historic knowledge from prior cycles:

This cycle continues to be the least risky of all:

🔹2011-2013: Avg. -19.19%, Max. -49.45%

🔹2015-2017: Avg. -11.49%, Max. -36.01%

🔹2018-2021: Avg. -20.41%, Max. -62.62%https://t.co/isZhpa3caS pic.twitter.com/JfhMa5J3kv— glassnode (@glassnode) February 26, 2025

Over time, Bitcoin has proven its capacity to get better and set new report highs; these swings are inevitable within the nature of its market motion. Even in bull markets, Bitcoin recurrently undergoes transient declines that assist to shake off weak palms earlier than it picks again up its rising trajectory.

Current Market Situations

On February 27, 2025, Bitcoin was buying and selling at $85,800, representing a 4% lower from the day gone by’s shut. The intraday excessive was $89,230 and the intraday low was $82,460. The latest 15% decline within the weekly body surpasses the cycle’s common drawdown of 8.50% however is considerably lower than the 26% decline in earlier cycles.

In comparison with different corrections, which have typically lasted for months, this one could be very modest. Many analysts argue that it’s not an indication of deeper market concern, however quite a pure a part of Bitcoin’s cycle.

In the meantime, in keeping with on-chain evaluation, until Bitcoin swiftly bounces again over the $92,000 degree, there’s a likelihood that decrease lows will persist within the close to future.

This barrier is essential, because it represents the juncture at which the vast majority of short-term merchants obtain profitability. Alternatively, as they mitigate their losses, Bitcoin might retrace to $70,000, or $71k.

Elements Influencing The Latest Decline

The value of Bitcoin has gone down for various causes. As all the time, sentiment is an enormous issue within the bitcoin market, and even small adjustments in investor belief could cause massive worth swings.

There has additionally been panic promoting due to worries about safety, particularly after the Bybit hack, which price the crypto trade $1.5 billion in losses.

Inflation fears, central financial institution insurance policies, and world financial uncertainty have additionally brought about buyers to be extra cautious with threat property. These exterior pressures typically drive Bitcoin’s volatility, making its worth extremely reactive to altering monetary situations.

Associated Studying

Based mostly on the way it has behaved prior to now, Bitcoin’s progress cycle appears to incorporate dips, despite the fact that it’s presently taking place. It slowly obtained higher after years of losses and reached its highest level after consolidations.

Featured picture from Reuters, chart from TradingView