In his newest video evaluation titled “BITCOIN’S One Indicator Signaling LAST Main Dip,” Dan Gambardello, a famous crypto analyst with 370,000 subscribers on YouTube, delves into the most recent worth motion of Bitcoin to forecast what may probably be the ultimate main dip. After dropping as little as $60,000 on Wednesday, the concern of one other deeper worth crash has grabbed the Bitcoin market.

Why This Might Be The Last Leg Down For Bitcoin

Gambardello emphasizes the importance of the every day and six-hour charts. On the every day chart, Bitcoin is at the moment testing the 50-day transferring common, a stage that always serves as a litmus take a look at for short-term market sentiment.

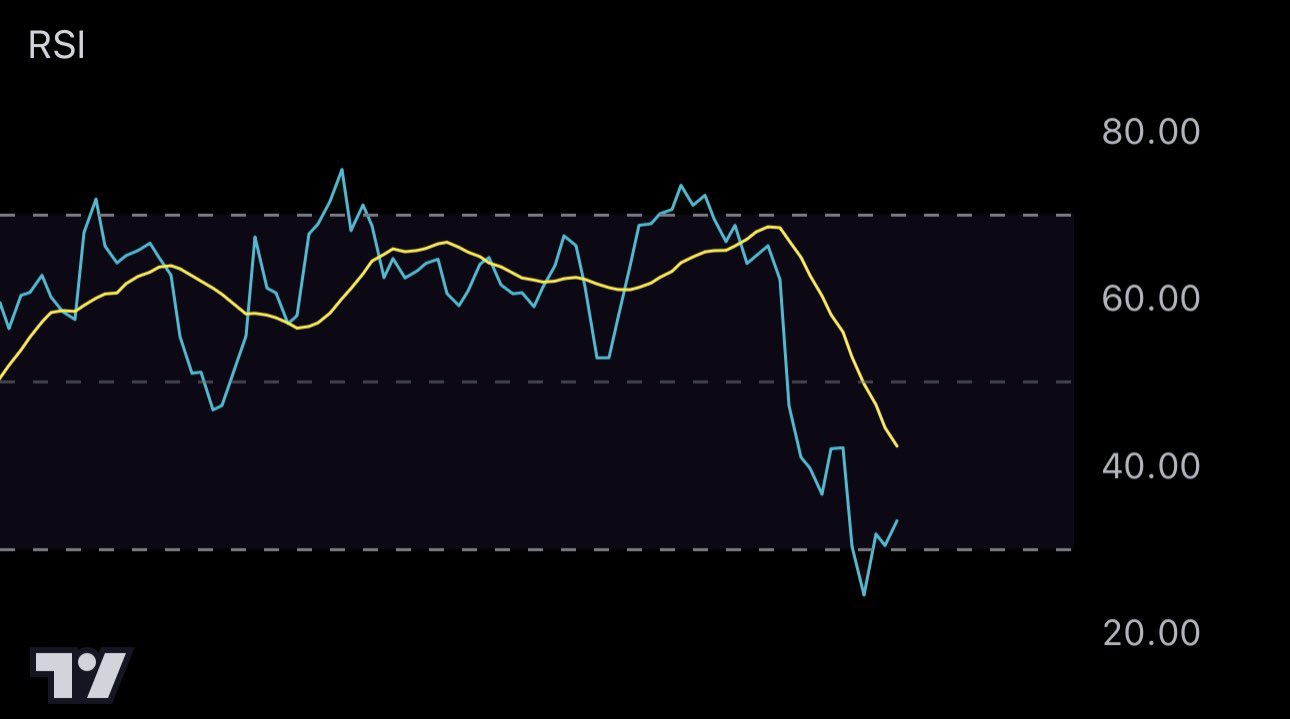

Nonetheless, the analyst’s major focus is on the six-hour chart’s Relative Power Index (RSI), a momentum oscillator used to measure the velocity and alter of worth actions, which has hit oversold ranges. In response to Gambardello, the RSI reaching oversold territory is historically seen as a bullish sign, probably indicating an approaching finish to the present worth dip.

Associated Studying

“The underside is definitely, I believe, shut. There may very well be some kind of capitulation within the very quick time period, however I believe there may very well be a really sturdy bounce after that occurs,” Gambardello famous, suggesting that regardless of the quick market turmoil following the Israel-Iran battle information, the basics level in direction of an eventual sturdy restoration.

By way of X, Gambardello added, “Nothing like a 6 hour oversold RSI at first of bull season. Additionally nice throughout bull season.”

This assertion is grounded in his evaluation of previous market behaviors throughout related situations, reinforcing the cyclical nature of Bitcoin’s market dynamics. Drawing parallels to historic information, Gambardello highlights the behavioral tendencies of Bitcoin in earlier Octobers, noting a sample of preliminary declines adopted by sturdy recoveries by the tip of the month.

“October will shut inexperienced. It’s at all times [like this] with the dip. Persons are simply freaking out. I assume that’s it, however this offers us somewhat time. We’re getting all these pink candles going into October, give us one other week, perhaps even two and we may get a pump, a breakout to the upside to finish October,” Gambardello claims.

Associated Studying

Additional deepening the evaluation, Gambardello discusses the potential situations round Bitcoin’s decrease pattern line, a recurrent help stage over the previous six months. He speculates that if Bitcoin approaches this pattern line once more, it may successfully function a sturdy help stage, probably marking the final important downturn earlier than a sustained upward pattern.

Notably, one ultimate contact of the trendline may carry down the BTC worth as little as $50,000. Nonetheless, Gambardello thinks that this can be a much less seemingly state of affairs because the 6-hour RSI has already hit oversold territory whereas BTC is at the moment bouncing off the 50-day transferring common.

Furthermore, Gambardello refers to Bitcoin’s efficiency in previous halving years, that are usually adopted by bull markets, as seen in 2016 and 2020. Gambardello means that the present yr may observe an identical trajectory. “This can be a Halving yr. We’ve seen what’s occurred in Halving years in 2020 and 2016 in October. Is it going to repeat?”

At press time, Bitcoin traded at $60,899.

Featured picture created with DALL.E, chart from TradingView.com