Right here’s what the historic pattern of the Bitcoin Market Worth to Realized Worth (MVRV) Ratio suggests concerning whether or not the present bull run is over or not.

Bitcoin MVRV Ratio May Trace At The place BTC Is In Present Cycle

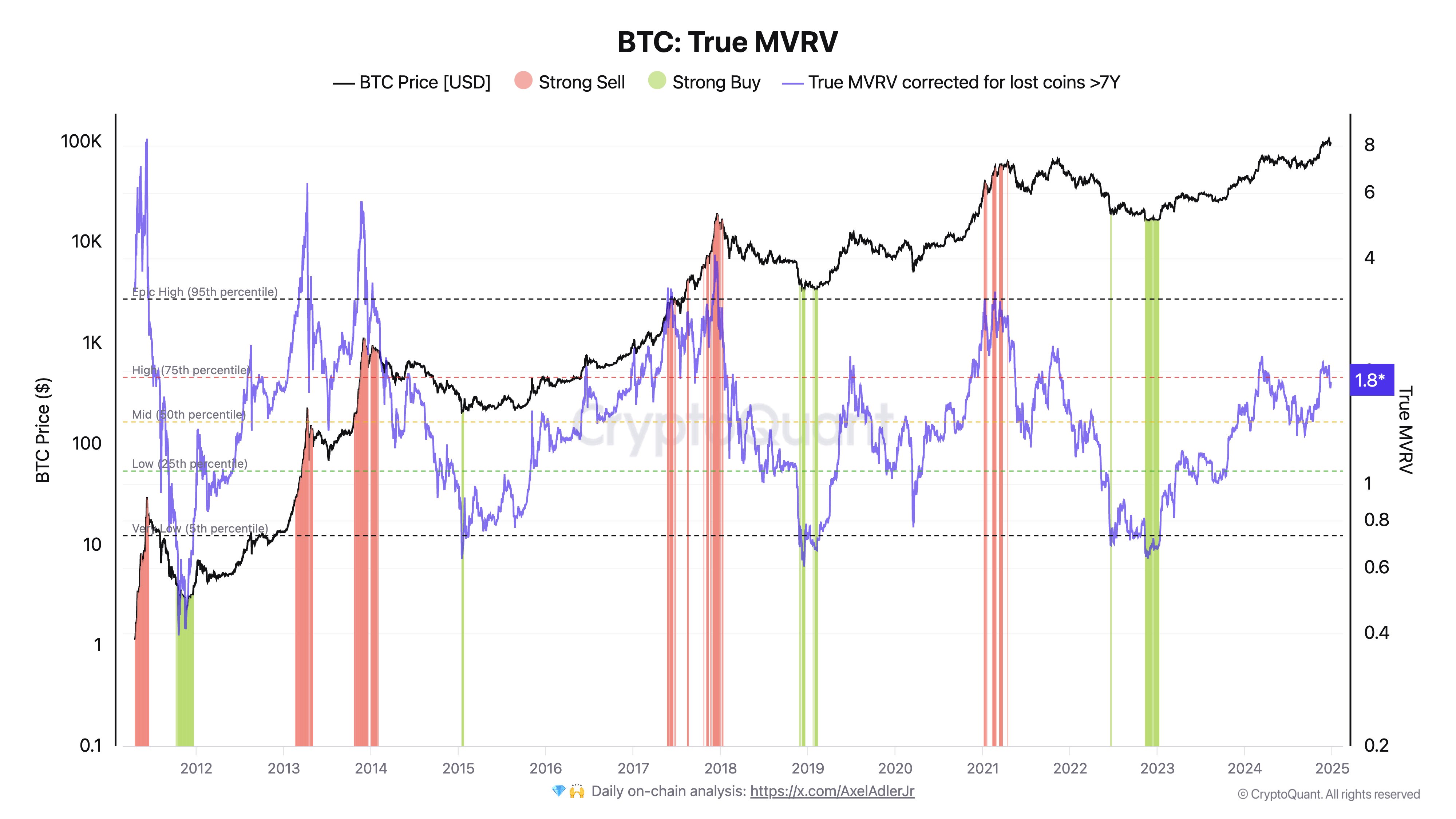

In a brand new put up on X, CryptoQuant founder and CEO Ki Younger Ju shared a chart showcasing the previous sample within the Bitcoin MVRV Ratio. The MVRV Ratio refers to a preferred on-chain metric that, briefly, retains monitor of how the worth held by the BTC buyers (that’s, the market cap) compares in opposition to the worth that they initially put into the asset (the realized cap).

When the worth of the ratio is bigger than 1, it means the buyers as an entire might be assumed to be in a state of revenue. Then again, it’s underneath the mark, implying the dominance of loss out there.

The model of the MVRV Ratio posted by Younger Ju isn’t the atypical one, however quite a modified type known as the “True MVRV.” This variation takes under consideration for less than the information of the cash that had been concerned in some sort of transaction exercise throughout the previous seven years.

Cash which are older than seven years might be assumed to be misplaced perpetually, both attributable to being forgotten or due to having their pockets keys misplaced. As such, the True MVRV, which excludes these cash which are possible to by no means return again into circulation, can present a extra correct image of the sector than the conventional model of the metric.

Now, here’s a chart that exhibits the pattern on this Bitcoin indicator over the historical past of the cryptocurrency:

As displayed within the above graph, the Bitcoin True MVRV has climbed to comparatively excessive ranges throughout this bull run. This suggests the common investor is carrying notable income.

Traditionally, the upper the holder good points get, the extra doubtless they develop into to take part in a mass selloff with the motive of profit-taking. Thus, at any time when the MVRV Ratio rises excessive, a prime can develop into possible for BTC.

From the chart, it’s seen that the tops throughout the previous cycles occurred when the indicator surpassed a particular line. Up to now, the metric hasn’t come near retesting this degree within the newest epoch.

In line with the CryptoQuant founder, the explanation the market cap hasn’t overheated relative to the realized cap but is that there’s nonetheless $7 billion in capital inflows getting into the Bitcoin market each week.

If the present cycle goes to point out something just like the earlier ones, then the True MVRV being excessive, however not extraordinarily excessive, may probably recommend room for BTC left within the present bull run.

BTC Value

Bitcoin has retraced its Christmas rally as its worth is now again all the way down to $95,700.