Bitcoin value fluctuations are regularly evaluated utilizing on-chain metrics, technical indicators, and macroeconomic traits. Nevertheless, one of the underappreciated but vital elements in Bitcoin’s value motion is World Liquidity. Many traders could also be underutilizing this metric and even misunderstanding the way it impacts BTC’s cyclical traits.

Affect on Bitcoin

With rising discussions on platforms like Twitter (X) and analysts dissecting liquidity charts, understanding the relationship between World Liquidity and Bitcoin has grow to be essential for merchants and long-term traders alike. Nevertheless, latest divergences recommend that conventional interpretations may require a extra nuanced method.

World M2 cash provide refers back to the complete liquid cash provide, together with money, checking deposits, and simply convertible near-money property. Historically, when World M2 expands, capital seeks higher-yielding property, together with Bitcoin, equities, and commodities. Conversely, when M2 contracts, threat property typically decline in worth attributable to tighter liquidity situations.

Traditionally, we’ve seen Bitcoin’s value comply with the World M2 growth, rising when liquidity will increase and struggling throughout contractions. Nevertheless, on this cycle, we’ve seen a deviation: regardless of a gradual enhance in World M2, Bitcoin’s value motion has proven inconsistencies.

12 months-on-12 months Change

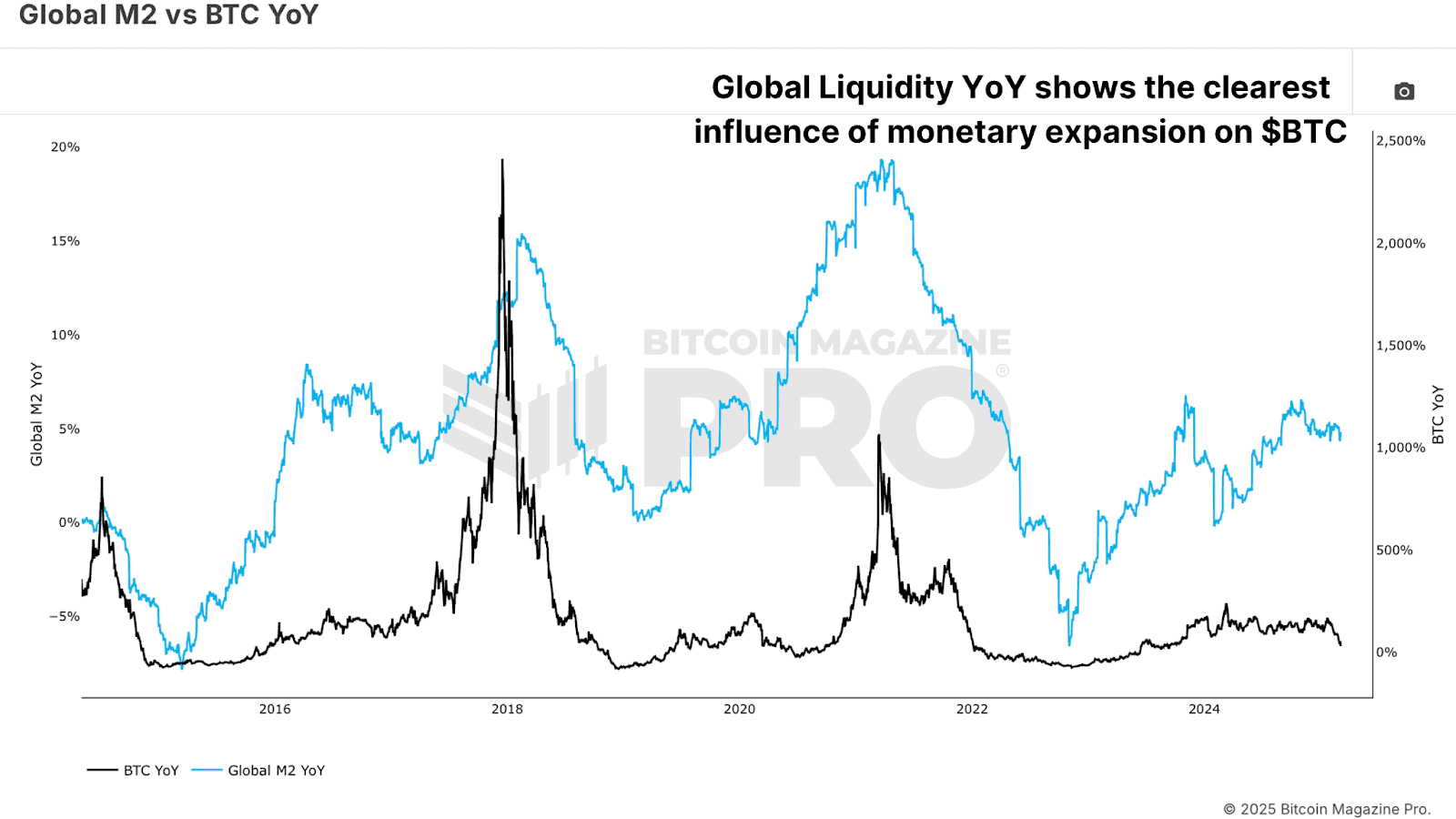

Somewhat than merely monitoring absolutely the worth of World M2, a extra insightful method is to research its year-on-year price of change. This methodology accounts for the speed of liquidity growth or contraction, revealing a clearer correlation with Bitcoin’s efficiency.

After we examine the Bitcoin 12 months-on-12 months Return (YoY) with World M2 YoY Change, a a lot stronger relationship emerges. Bitcoin’s strongest bull runs align with durations of speedy liquidity growth, whereas contractions precede value declines or extended consolidation phases.

For instance, throughout Bitcoin’s consolidation section in early 2025, World M2 was steadily rising, however its price of change was flat. Solely when M2’s growth accelerates noticeably can Bitcoin escape in the direction of new highs.

Liquidity Lag

One other key remark is that World Liquidity doesn’t impression Bitcoin immediately. Analysis means that Bitcoin lags behind World Liquidity modifications by roughly 10 weeks. By shifting the World Liquidity indicator ahead by 10 weeks, the correlation with Bitcoin strengthens considerably. Nevertheless, additional optimization means that essentially the most correct lag is round 56 to 60 days, or roughly two months.

Bitcoin Outlook

All through most of 2025, World Liquidity has been in a flattening section following a major growth in late 2024 that propelled Bitcoin to new highs. This flattening coincided with Bitcoin’s consolidation and retracement to round $80,000. Nevertheless, if historic traits maintain, a latest resurgence in liquidity progress ought to translate into one other leg up for BTC by late March.

Conclusion

Monitoring World Liquidity is a vital macro indicator for anticipating Bitcoin’s trajectory. Nevertheless, quite than counting on static M2 information, specializing in its price of change and understanding the two-month lag impact affords a way more exact predictive framework.

As World financial situations evolve and central banks modify their financial insurance policies, Bitcoin’s value motion will proceed to be influenced by liquidity traits. The approaching weeks will likely be pivotal; Bitcoin could possibly be poised for a serious transfer if World Liquidity continues its renewed acceleration.

Loved this? Discover extra on Bitcoin value shifts and market cycles in our latest information to mastering Bitcoin on-chain information.

Discover stay information, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.