It was solely Thursday of final week when our lead story was in regards to the challenges banks have been going through within the Banking-as-a-Service house.

Then Friday we discovered that Blue Ridge Financial institution was hit with its second regulatory motion in lower than 18 months and is now deemed to be in a “troubled situation”.

Kudos to our unofficial fintech regulatory watchdog, Jason Mikula, for breaking this story. American Banker additionally picked it up on Friday.

Blue Ridge Financial institution is a $3.3 billion-asset financial institution based mostly in Virginia and was an early mover within the BaaS house. The consent order got here out of the OCC’s June examination and Blue Ridge claims to have made vital progress since then.

The banks must ramp up its AML controls, capital place and third get together administration.

It’s attention-grabbing that trade skilled Jonah Crane mentioned “each financial institution with a big BaaS program will see some kind of regulatory motion over the subsequent 12 months.”

For the fintech corporations that depend on these banks for banking companies, that is unhealthy information. Constructing redundancy into your banking partnerships is now important.

Featured

OCC says Blue Ridge in ‘troubled situation’ over BaaS

By Catherine Leffert

The Virginia financial institution is one in all three which were publicly admonished by regulators this week as a consequence of issues associated to their banking-as-a-service applications.

From Fintech Nexus

> What your B2B buyer actually desires

By Tony Zerucha

As B2B fee know-how catches as much as different areas of fintech, TreviPay CEO Brandon Spear mentioned thrilling developments are rising. In late 2023, TreviPay launched the B2B Patrons Funds Choice Examine. It updates comparable analysis carried out in 2019.

> The Evolution of Funds Rails: Shaping the Way forward for Monetary Providers

By Sameer Danave

The funds panorama is present process a major shift proper approach with new funds rails gaining extra market share. And we have now solely simply begun.

Podcast

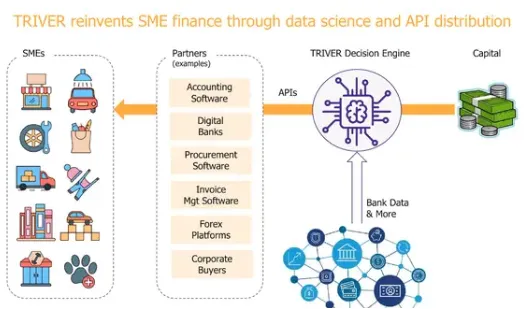

Podcast: Constructing fashionable digital lending throughout Capital One, Barclaycard, Funding Circle, and TRIVER, with TRIVER CEO Jerome Le Luel

Hello Fintech Architects, Welcome again to our podcast sequence! For people who need to subscribe in your app of alternative, you may…

Additionally Making Information

To sponsor our newsletters and attain 220,000 fintech lovers along with your message, contact us right here.