It was three in the past final week when LendingClub closed its acquisition of Radius Financial institution. At the moment LendingClub entered into an working settlement with the OCC that imposed capital restraints and progress limits on the fintech pioneer.

Final week that settlement expired and LendingClub will now be much less constrained and can pursue choices to reap the benefits of its capital place. After all, it’s nonetheless a regulated financial institution, so there are customary constraints that apply to all banks.

An analyst famous that LendingClub has about $400 million in extra capital, cash it will probably now use to purchase again inventory or for different initiatives. One instance may very well be an enlargement of its structured certificates program, a securitization program that LendingClub launched final 12 months.

LendingClub has come a great distance from its begin as a peer-to-peer lending platform and is now one of many largest private mortgage suppliers within the nation.

This 12 months will mark the 10-year anniversary of its IPO however its valuation remains to be a fraction of its IPO value. The corporate isn’t anticipated to regain that valuation any time quickly however a minimum of it should have fewer constraints on its progress now.

P.S. Right this moment is your final day to get tickets to Fintech Meetup so you possibly can participate in its well-known conferences program. Use code NXGA2995 to get $500 off.

Featured

LendingClub exits OCC settlement, sees path for quicker progress

By Catherine Leffert

The San Francisco firm entered right into a pact with its regulator when it acquired Radius Financial institution three years in the past. “The working settlement, by design, in some methods slows you down,” stated CEO Scott Sanborn.

From Fintech Nexus

> Rental contracts in crypto: Milei’s agenda sparks sector optimism in Argentina

By David Feliba

Javier Milei’s deregulation agenda raises hopes within the sector, with rental contracts settled in crypto. However the economic system stays in dire form.

Podcast

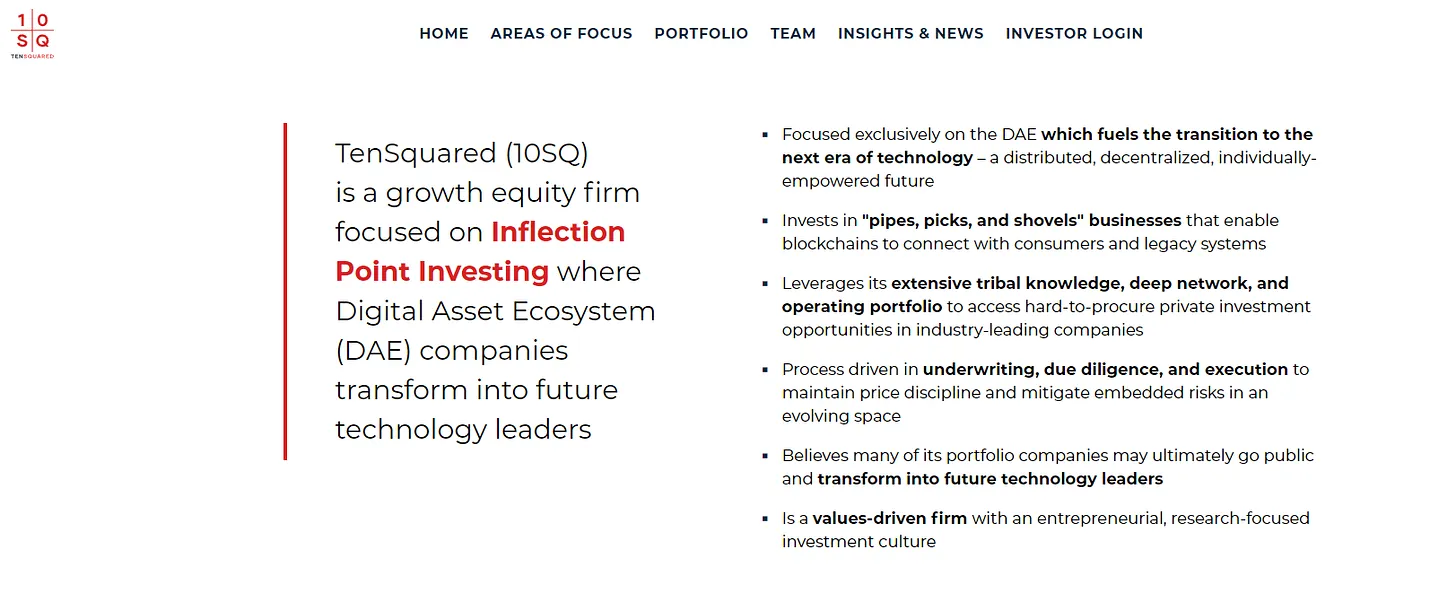

Investing in frontier capital markets, from Japanese Europe to ICOs, and tokenized securities, with TenSquared Capital Managing Associate, Stan Miroshnik

Hello Fintech Architects, Welcome again to our podcast sequence! For those who wish to subscribe in your app of alternative, you possibly can…

Additionally Making Information

- USA: ProducePay raises $38M to sort out produce provide chain waste

Meals waste is a significant drawback. Within the U.S. alone, roughly 30% to 40% of the availability leads to landfills. A United Nations report estimated that round one-third of the world’s meals is wasted yearly, including as much as 1.3 billion tons — value virtually $1 trillion.

- USA: A startup’s plan to disrupt the gasoline card trade

Taking purpose at a market dominated by decades-old private-network gasoline card gamers, the San Francisco-based agency AtoB is teaming with Mastercard to launch an open-loop funds platform for trucking companies and fleet operators.

- USA: Huge Financial institution discontinues crypto cell app

The Tulsa, Oklahoma-based lender informed prospects their digital property can be liquidated and accounts can be closed. Clients will obtain stranded property through cashier’s test, the financial institution stated.

To sponsor our newsletters and attain 220,000 fintech fanatics together with your message, contact us right here.