Final week, we launched our newly revamped Statistics web page, designed to present you clear, constant, and up-to-date insights into Bondora’s lending and funding exercise. Test it out right here in case you missed it.

We promised that extra knowledge was on the way in which, and we meant it. Till the web page is absolutely automated, we’ll preserve sharing vital portfolio statistics proper right here on the weblog.

So, let’s check out the newest updates:

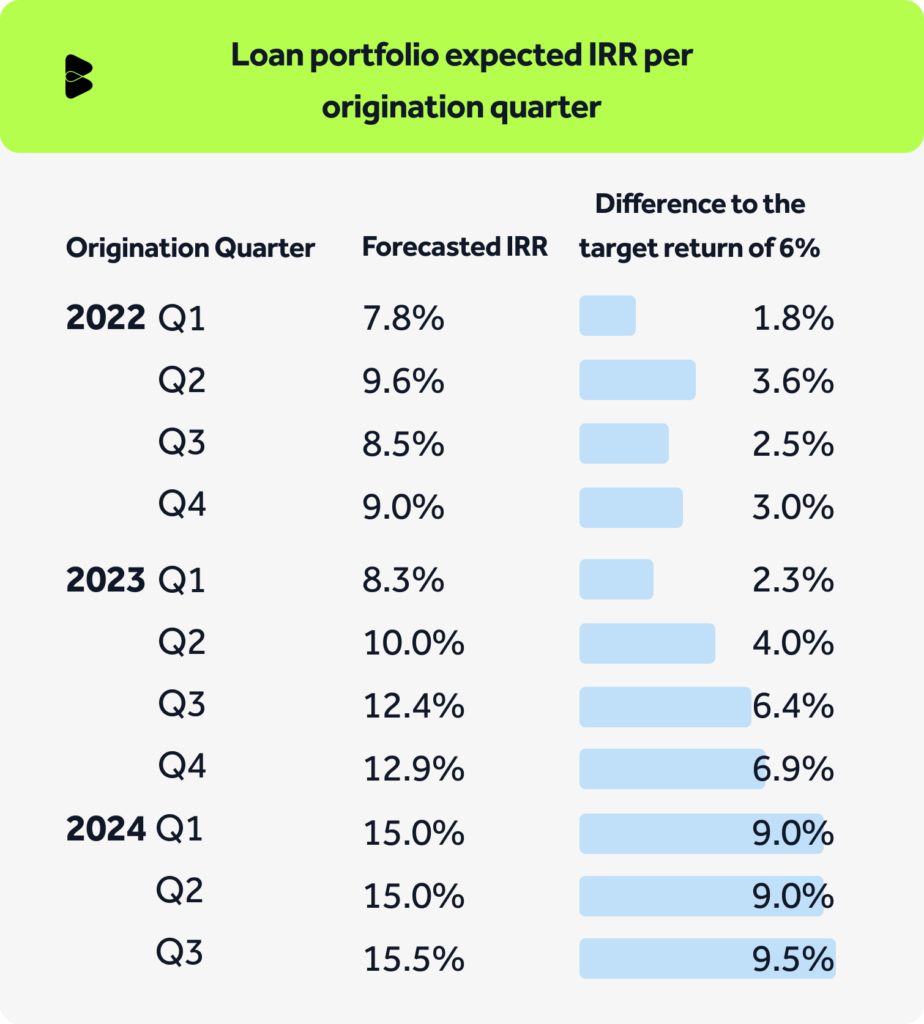

Mortgage portfolio anticipated IRR per origination quarter

One of the vital invaluable indicators of efficiency is the anticipated inner price of return (IRR) on the mortgage portfolio. These quarterly figures replicate the returns our portfolios are anticipated to generate and are the muse from which the Go & Develop goal return is delivered.

How can we forecast IRR?

Our forecasted IRR is predicated on a mixture of historic efficiency knowledge and the present habits of lively loans. Right here’s the way it works:

- We analyze the IRR from previous loans we’ve issued.

- We carefully monitor how present loans are performing, particularly key indicators like default charges at completely different phases of the mortgage lifecycle.

- Primarily based on this knowledge, we mission how the present mortgage portfolio is prone to carry out and draw our anticipated IRR.

Why it issues:

These statistics provide you with direct perception into the underlying energy of the portfolio.

As a result of many of the loans we’ve issued lately fall inside low-risk ranges (as shared final week), and present efficiency indicators are sturdy, we’re optimistic concerning the anticipated IRR going ahead.

In reality, our present forecasted IRR reveals a powerful outlook, with a cushty buffer above the 6% goal return. This constructive unfold helps scale back investor dangers and displays ongoing enhancements in portfolio efficiency.

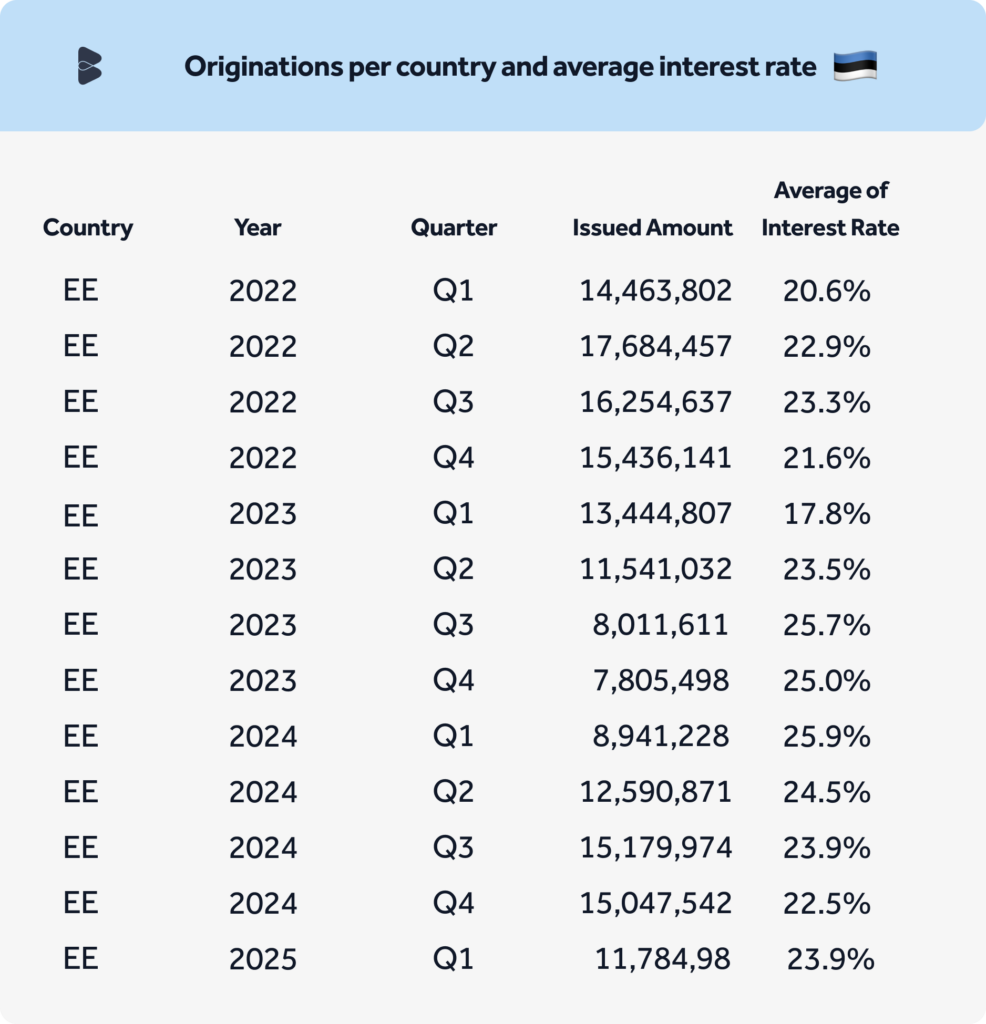

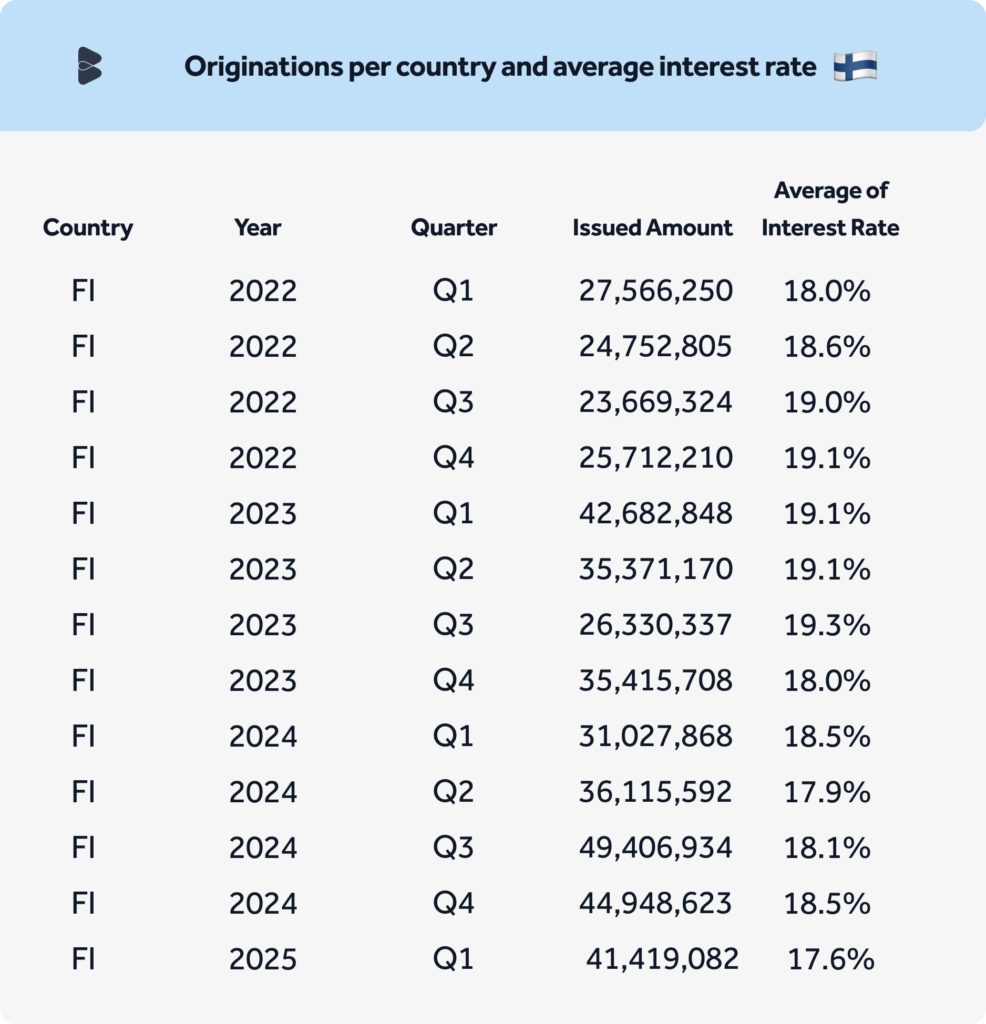

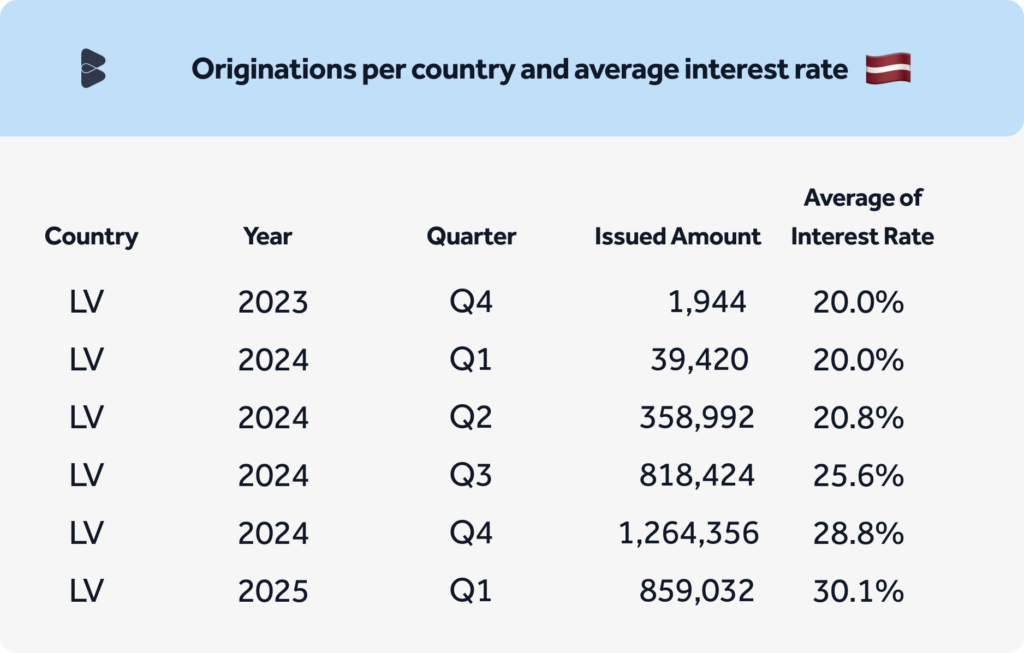

Extra statistics: Originations and rates of interest per nation

One other vital issue for understanding portfolio well being is the place loans are being issued, at what common rate of interest, and the way that aligns with European banking rules.

What it is best to know:

- Bondora Group’s mortgage originations are diversified throughout a number of EU markets, serving to to unfold and handle danger.

- Rates of interest are tied to Central Financial institution rules. For instance:

- Within the Netherlands, borrower charges had been at 10.5% in 2024 however dropped to 9.7% in 2025 resulting from decrease regulatory limits.

- In Finland, common charges on Go & Develop-linked loans have additionally barely diminished from over 18% to 17.6%.

- Our charges replicate truthful, regulated lending – not extreme or opportunistic practices.

What this implies for our buyers

When you think about these new knowledge factors alongside those shared final week, a transparent image begins to emerge:

Bondora’s profitability and portfolio efficiency have continued to strengthen over time. This progress is a results of steady refinements in our danger administration, pricing fashions, and market diversification.

We would like you to really feel assured in your funding selections, so we’re dedicated to preserving you knowledgeable each step of the way in which with clear, well timed, and significant updates.

Extra statistics updates are coming

We’ll proceed rolling out new knowledge to the Statistics web page and thru weblog posts like this one.

On the backside of the Statistics web page, you’ll discover a survey the place you may share your suggestions and tell us what extra knowledge can be most precious to you!

Haven’t seen the revamped Statistics web page but? Discover it right here »

P.S. Our audited annual monetary report shall be printed quickly, providing you with a broader have a look at Bondora’s monetary efficiency in 2024. Keep tuned!