Yield administration protocol Pendle Finance has attracted over $50 million amid renewed curiosity from merchants seeking to passively seize market returns.

The whole locked worth (TVL) of property on the platform has risen over 300% for the reason that begin of this 12 months, DeFiLlama information reveals. $26 million of which has been captured on the Ethereum community, $21 million on the Arbitrum community and just below $1 million on Avalanche.

Staked ether (stETH) dominates the holdings, taking over 27% of all capital on Pendle, adopted by GMX protocol’s glp tokens at 18% and by dai (DAI) stablecoins at 16%.

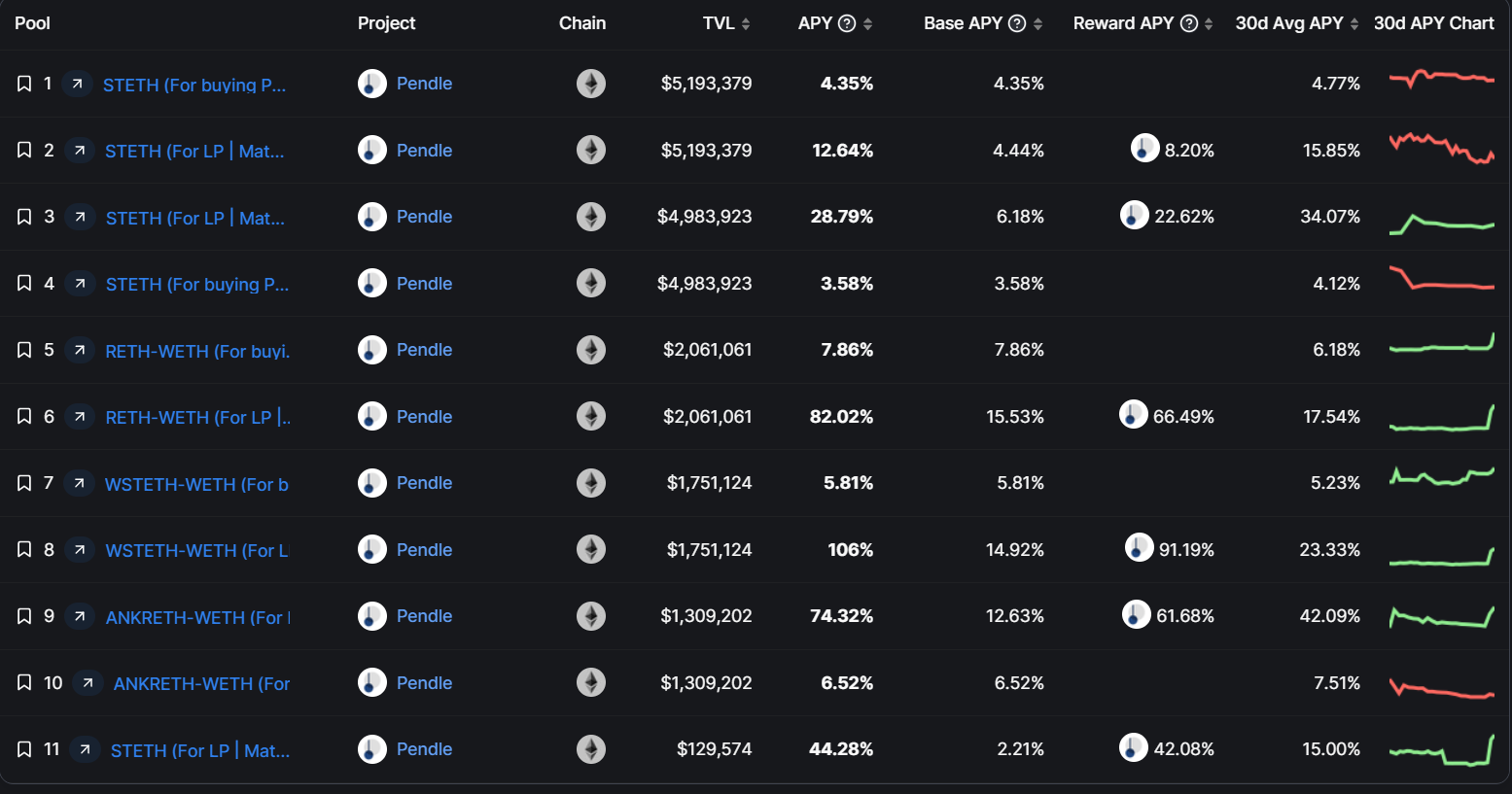

Some methods are providing as a lot as 82% annualized on ether and ether spinoff tokens. These have a maturity interval that ends in late 2023 or early 2024.

Pendle can be letting traders buy ether at a 5.88% low cost as of Thursday. This ether will be claimed on December 26, 2024, the place the low cost will likely be made up for by capturing future anticipated yields on the precept quantity.

Ether yields on Pendle. (DeFiLlama)

Extra subtle methods that make the most of ether derivatives supplied by different tasks, corresponding to Frax, are providing as a lot as 441% in yields over a 624-day interval.

Pendle makes use of a dual-token mannequin that breaks up and represents any funding right into a decentralized finance (DeFi) protocol, corresponding to Compound or Aave, into two elements: one, the preliminary precept put up by an investor, and two, the long run yield anticipated to be earned on that place within the type of token rewards.

That is carried out by wrapping yield-bearing tokens right into a standardized yield token, that token is then wrapped right into a principal token (PT) and yield token (PT) which will be traded on the open market.

“Almost each pool in DeFi offers you a yield-bearing place in return for staking or depositing tokens,” states Pendle in its technical paperwork. “1 PT offers you the correct to redeem 1 unit of the underlying asset upon maturity. 1 YT offers you the correct to obtain yield on 1 unit of the underlying asset from now till maturity, claimable in real-time.”

This enables Pendle to supply a number of merchandise to customers – corresponding to the flexibility to lock in anticipated mounted yields, purchase yields within the hopes of upper returns sooner or later, or swap between a number of methods to repeatedly acquire from yields supplied by numerous protocols.

Pendle’s native governance tokens, PENDLE, commerce at 50 cents at press time on Thursday. These accrue worth over time, paperwork present, and may in the end profit from the expansion and adoption of the underlying platform.

Edited by Oliver Knight.