Fast Take

The current surge in Bitcoin holdings amongst short-term holders (STHs), outlined as traders who’ve held Bitcoin for lower than 155 days, factors to a noticeable enhance. Since December, STHs have beefed up their Bitcoin portfolios by roughly 450,000 BTC. Nevertheless, opposite to standard market conduct, delicate indicators like Google traits recommend that we’re not close to market euphoria regardless of the aggressive accumulation from STHs.

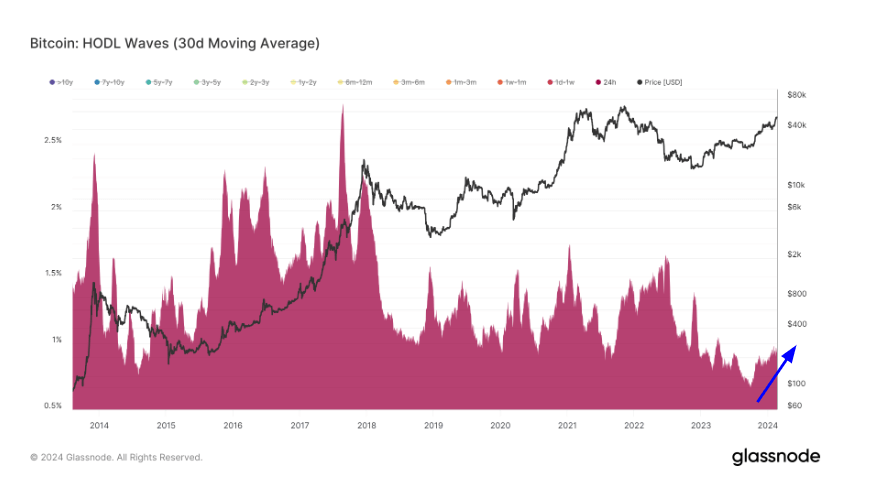

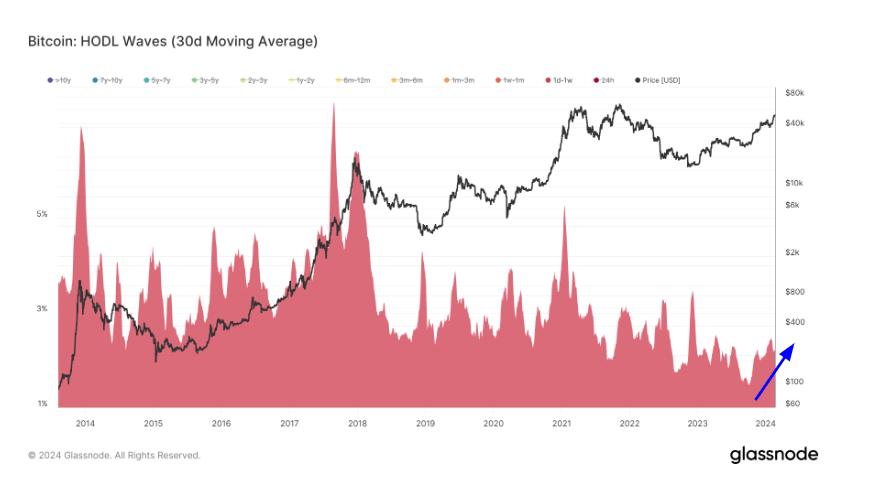

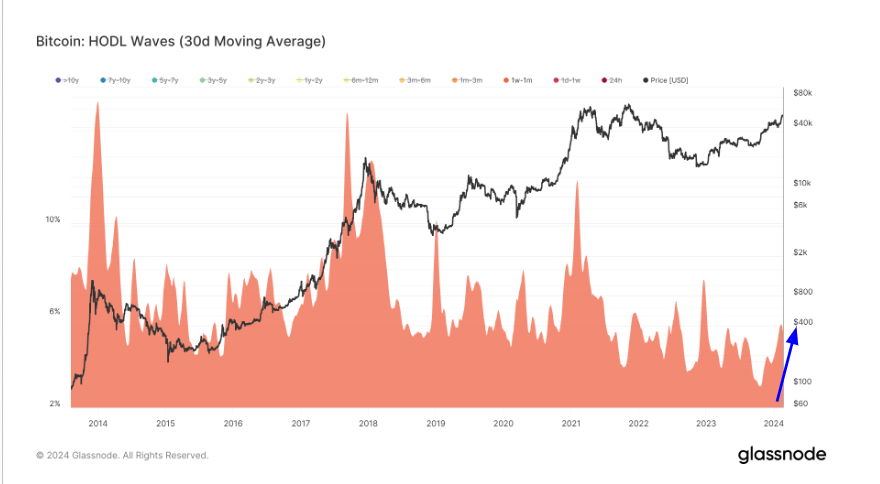

This intriguing sample is additional illuminated by inspecting HODL waves, a metric representing totally different age bands of lively provide. HODL waves for the extraordinarily short-term hypothesis bands – 24 hours, at some point to 1 week, and one week to 1 month – have been at an all-time low in October 2023, simply as Bitcoin launched into its journey from $25,000 to $53,000.

Though these cohorts have grown considerably, they nonetheless signify extraordinarily low percentages in comparison with historic information. This factors to a definite lack of maximum short-term hypothesis.

Moreover, these cohorts sometimes wield a a lot bigger proportion provide on the peak of bull markets when hypothesis is highest. This explicit information suggests there may be substantial room for development on this cycle.

The put up Evaluation of HODL waves reveals a speculative market at play appeared first on CryptoSlate.