After a chronic downtrend relative to bitcoin (BTC), Ethereum’s ether (ETH) is displaying indicators of a resurgence.

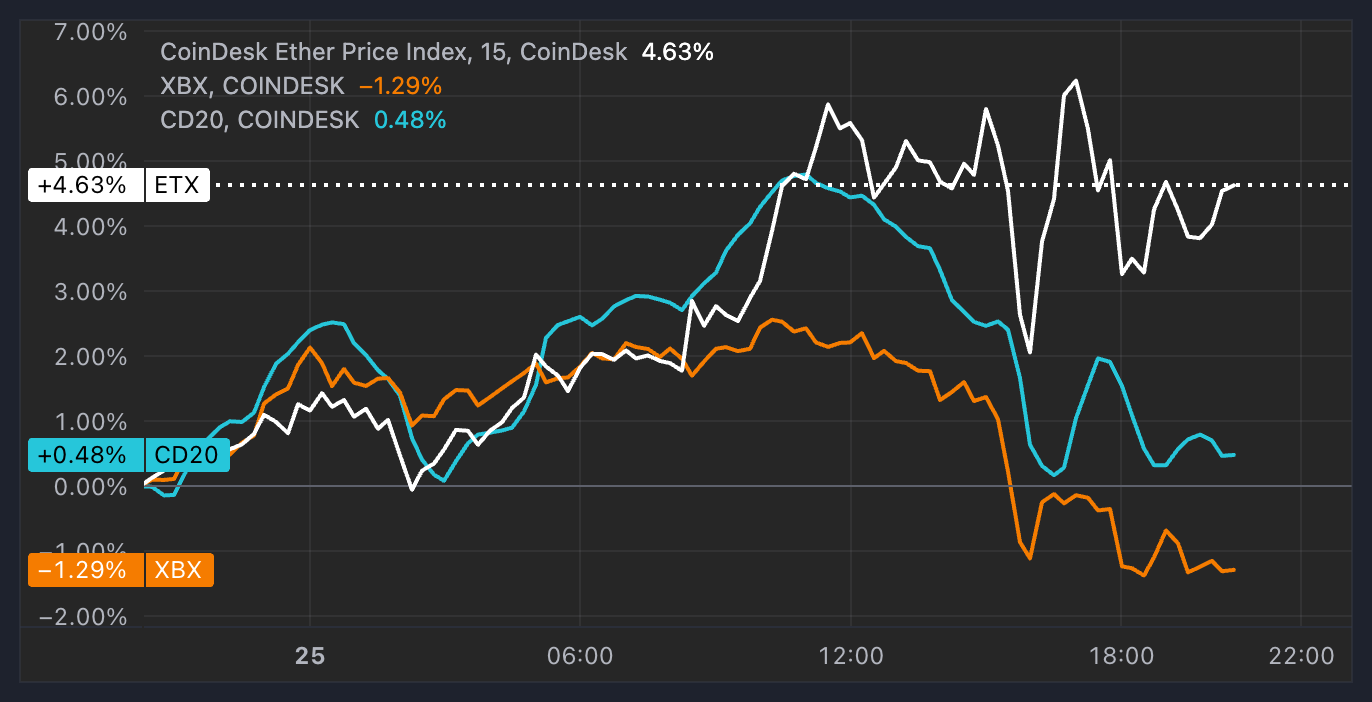

ETH, the second-largest cryptocurrency in the marketplace, gained over 4% prior to now 24 hours, whereas BTC misplaced 1.5% throughout the identical time, dipping beneath $95,000 in the course of the Monday session. ETH even outperformed the broad-market CoinDesk 20 Index, which was up 0.5%.

The outperformance occurred as buyers began to rotate capital to smaller, riskier cryptocurrencies over the weekend following the stall of bitcoin’s near-vertical surge since Donald Trump’s election victory. The ETH/BTC ratio, which measures ether’s energy vs. bitcoin, plummeted to as little as 0.0318 on Thursday, its weakest studying since March 2021, however the gague has gained 15% since to 0.3660 at press time.

“The market appears to be anticipating BTC to commerce sideways till December as consideration shifts in direction of ETH within the close to time period,” digital asset hedge fund QCP mentioned in a Monday observe.

On the choices markets, ETH danger reversals are closely skewed in favor of frontend calls, in the meantime BTC calls appear to be extra bid solely from the top of December 2024 onwards, QCP famous. The positioning implies that merchants anticipate ether to carry out properly within the short-term, whereas bitcoin may decide up tempo subsequent yr. Danger reversal is a method that includes buying concurrently a name choice (bullish guess) and a put choice (bearish guess) for a particular risk-reward profile.

ETH poised for a rebound vs. bitcoin

“We’re seeing some rotation from BTC to ETH coming from crypto-native hedge funds and household places of work,” Joshua Lim from Arbelos Markets mentioned.” Josh Lim, co-founder of crypto derivatives prime brokerage agency Arbelos Markets, mentioned in a telegram message.

U.S.-listed spot ETH ETFs noticed their first web inflows on Friday, led by $99 million allocation into BlackRock’s ETHA product, following six days of steady outflows, knowledge compiled by Farside Buyers reveals. Holders of ETHA embody “the most important names in finance” together with $80 billion hedge fund Millenium, analytics agency Kaiko mentioned in a Monday report.

There may very well be extra beneficial properties in retailer for ether in opposition to bitcoin within the coming interval. The ETH/BTC ratio hit a key help stage on Thursday and rebounded, whereas final week’s candle prompt a pattern reversal, well-followed crypto dealer Pentoshi famous.

“Fairly doable the low is in right here and that a minimum of a brief time period reversal is coming,” Pentoshi mentioned in an X publish.

Bitcoin Stalls at $100K

Now prolonged far above its each day transferring averages, bitcoin is probably going commerce sideways for some time as buyers digest the steep rally since Donald Trump’s election victory, mentioned Paul Howard, senior director at crypto buying and selling agency Wincent.

“There’s a important promote wall on the psychological $100K stage,” Howard instructed CoinDesk. “I’d count on we oscillate round these ranges till the brand new yr. Staying market impartial and shopping for draw back safety right here is at all times a wise danger reward,” he added.