Ethereum (ETH) is as soon as once more within the information, however this time it’s excellent news for consumers. Latest information reveals that over 90% of Ethereum customers are actually being profitable as a result of the worth of the cryptocurrency has risen to spectacular ranges. In response to IntoTheBlock, this upward pattern is one of the best time in 5 months for individuals who personal ETH to make income.

Impressed by Bitcoin’s comeback above $96,000, the token jumped to $3,680, its greatest degree since June. Whereas Bitcoin cleared the trail, Ethereum’s momentum is clearly seen because it broke boundaries with ease. Although buying and selling 25% beneath its all-time excessive (ATH) of $4,890, Ethereum’s fundamentals and market vibe level to a vivid future forward.

90.8% of $ETH holders are actually in revenue, the very best since June.

Apparently, the 9.2% of holders nonetheless at a loss maintain simply 2.8% of the whole provide. This means that potential promote stress from this group could have a restricted impression as $ETH continues to pattern upward. pic.twitter.com/qG4Xgi0Cq3

— IntoTheBlock (@intotheblock) November 28, 2024

Whale Confidence And Lengthy-Time period Holding

Extra constructive information comes from nearer examination of the funding patterns of Ethereum. Solely 9.2% of ETH holders are at the moment shedding cash, and so they maintain solely 2.8% of your complete token depend. Which means that the market is unlikely to be a lot affected by any promoting stress these buyers create.

On prime of that, Ethereum’s long-term holder base can also be sturdy. The variety of ETH holders holding a couple of 12 months has risen to roughly 74%, which signifies confidence within the token’s long-term worth. Contemplating that solely 23% of ETH have been bought final 12 months and solely 3% final month, many of the buyers appear to be holding out for the long term.

Reducing Provide, Bullish Momentum

One more reason giving a bullish outlook to Ethereum is the declining provide on centralized exchanges. In response to analysts, it has continued to say no since final 12 months, lowering ETH on centralized reserves. The extra demand there’s that outpaces the provision throughout a bull run, the upper the costs go.

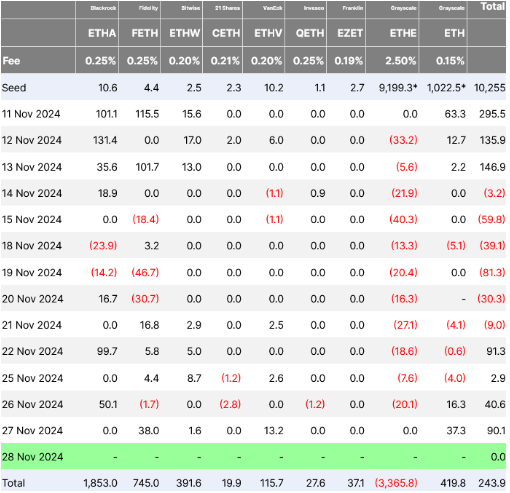

Ethereum’s latest surge has additionally been aided by enormous inflows into spot ETFs, which have over $90 million. These institutional investments reveal rising belief in Ethereum’s future.

Ethereum: Path To ATH Seems Clear

ETH is already outperforming the bigger crypto market, with a weekly achieve of 12%. Its ETH/BTC ratio has risen by 18%, indicating energy relative to Bitcoin. Analysts really feel that if Ethereum can retest and surpass the $4,000 resistance, the trail to its all-time excessive would grow to be extra convincing.

With 5.92% elevated values over the day past, its value has decreased barely to $3,610, as of writing. From the indications and market’s sentiment, Ethereum tends to rewrite the earlier excessive to additional break floor.

Featured picture from DALL-E, chart from TradingView