Ethereum is present process its most extended inflationary interval, with over 350,000 ETH (price round $1.1 billion) added to its provide for the reason that March Dencun improve, in keeping with Ultrasound.cash information. Ethereum’s present inflation price is 0.35%.

The rise has introduced the overall provide to 120.4 million ETH, leaving slightly below 95,000 ETH to match the degrees seen on the Ethereum Merge in Sept. 2022.

ETH’s almost two years of provide discount have been worn out in simply seven months since EIP-4844, also referred to as Dencun or Proto-Danksharding.

How Dencun altered Ethereum’s provide dynamics

The Dencun replace launched important adjustments that diminished Ethereum’s base payment burn price.

By allocating particular block house for layer-2 networks to course of bundled transactions, often known as blobs, competitors for mainnet block house was diminished. Moreover, the proto-danksharding mechanism made information availability extra environment friendly, inflicting base charges to drop sharply.

These occasions have severely impacted the blockchain community transaction charges, leading to Ethereum issuing extra ETH than it burns in most blocks.

For context, Ethereum burned 45,022 ETH whereas issuing 78,676 ETH over the past 30 days. This resulted in a web provide enhance of over 30,000 ETH, underlining the inflationary affect of the diminished base payment surroundings.

Staking affect

The rise in Ethereum’s inflationary strain can also be linked to the rising ETH staking ratio. Coinbase analyst David Han famous that whereas the Dencun improve has considerably impacted Ethereum’s ecosystem, the inflation price adjustments seem linked to broader components, together with the rising ETH staking ratio, which is accelerating all token issuance.

Ethereum’s transfer to Proof of Stake (PoS) has strengthened community safety and boosted participation, but it surely has additionally resulted in additional ETH being issued. Validators who lock up their ETH to safe the community earn rewards in newly minted tokens.

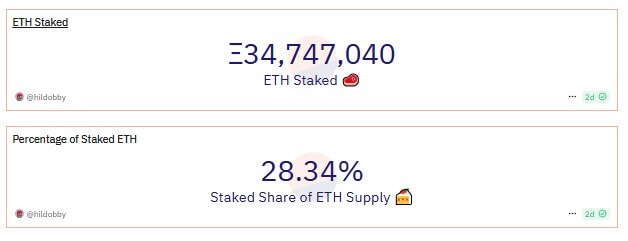

In line with Dune Analytics information, roughly 34.7 million ETH—about 28% of the overall provide—is at the moment staked. This staked ETH helps safe the community and generates rewards, additional rising Ethereum’s provide.

Moreover, the rising pattern of restaking, particularly with protocols like EigenLayer, amplifies this impact. Customers reinvesting their staking rewards generate much more ETH, compounding the inflationary affect.