Ether (ETH), the second-largest cryptocurrency, has dropped 39% this 12 months relative to bitcoin (BTC), the most important, taking the ratio between the 2 to the bottom in virtually 5 years.

On the present stage, 1 ETH is the equal of 0.02191 BTC. That is the least since Could 2020, when ether was buying and selling round $200 and bitcoin slightly below $10,000. In the present day the ETH worth is about $1,800 and the BTC worth round $82,000.

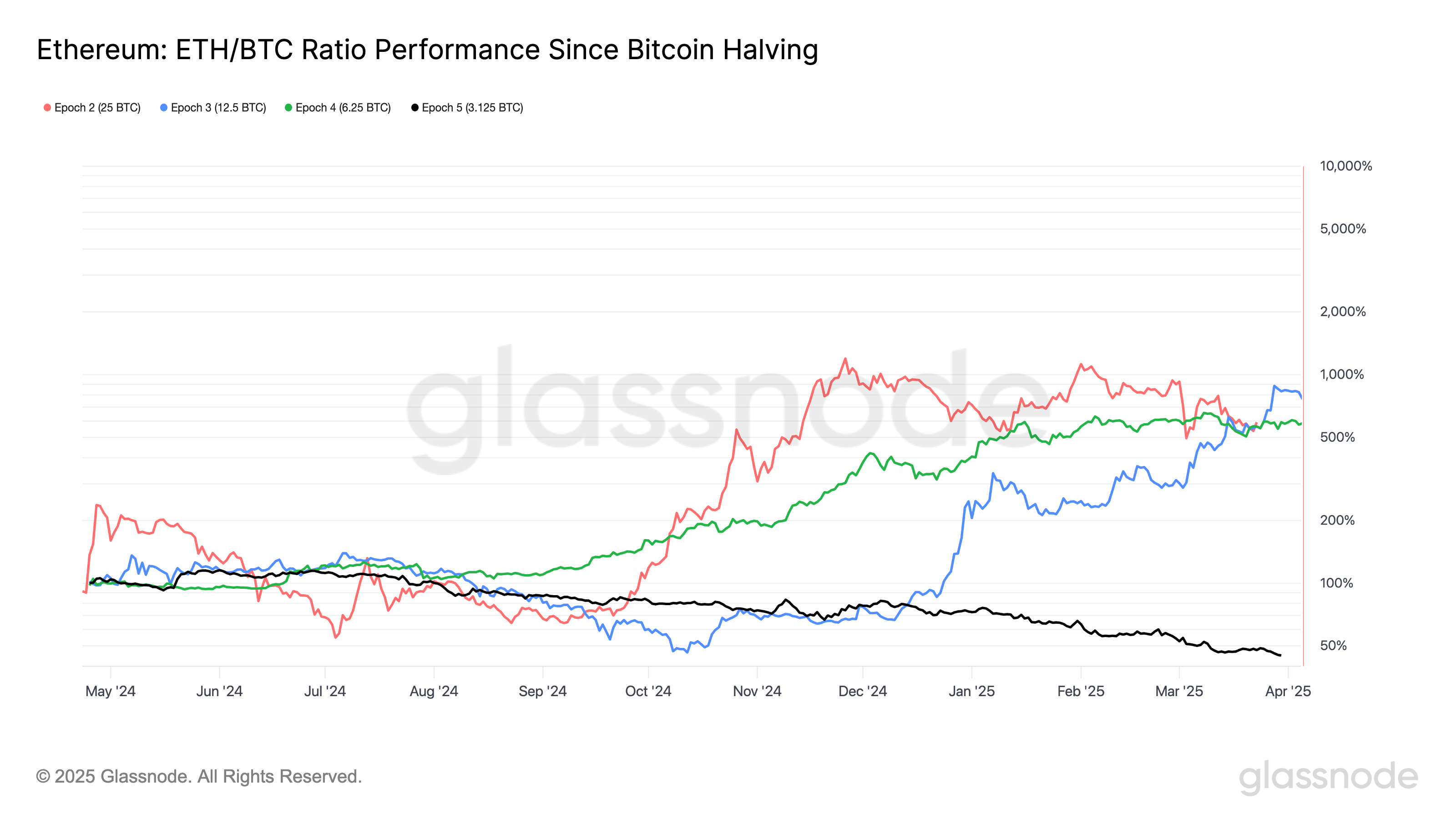

The underperformance is notable as a result of it is the primary time ether has weakened in opposition to bitcoin within the 12 months after a BTC reward halving. On April 20, 2024, the cost Bitcoin miners acquired for confirming blocks on the blockchain was diminished by 50% to three.125 BTC.

In earlier halving cycles, ether outperformed bitcoin within the first 12 months after a halving. This time, the ratio has dropped by greater than 50%.

This relative efficiency additionally marks one in every of ether’s worst quarterly performances in opposition to bitcoin in a number of years, in keeping with knowledge from Glassnode. The final time ether underperformed bitcoin to the same diploma was within the third quarter of 2019, when the ratio dropped to 0.0164, a quarterly decline of 46%.

This present stoop mirrors the underperformance seen in 2019 and additional highlights ether’s relative weak point, particularly when in comparison with different layer-1 belongings. The SOLETH ratio — measuring the worth of Solana’s SOL relative to ether — is up 24% year-to-date to 0.07007. This means that SOL has considerably outperformed ether in 2025, regardless of the token itself itself being down 35% year-to-date.