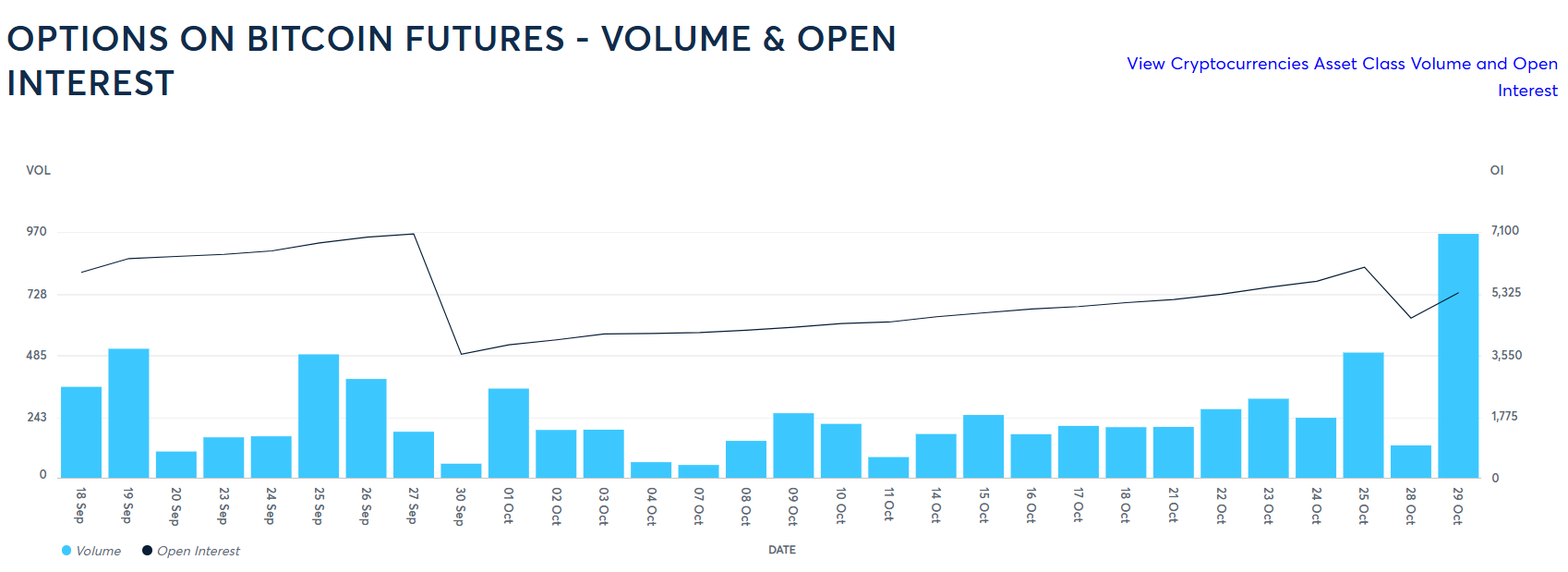

Institutional merchants are betting that Bitcoin will surge to $79,300 by the tip of November. This bullish sentiment is obvious in latest buying and selling actions on the Chicago Mercantile Change (CME), the place Bitcoin choices have skilled a few of their highest buying and selling volumes forward of the US presidential election.

Bitcoin To Rise Above $79,300?

Joshua Lim, co-founder of Arbelos Markets—a buying and selling agency offering liquidity throughout cryptocurrency derivatives markets—shared insights on X about these notable trades. “CME Bitcoin choices simply skilled a few of its largest quantity days ever, forward of the US election,” Lim acknowledged.

He highlighted two substantial transactions that occurred prior to now week. On Friday the twenty fifth, merchants bought 1,875 Bitcoin models of the 29-November $70,000 strike calls. In choices buying and selling, a name choice provides the client the precise, however not the duty, to buy an asset at a specified strike worth earlier than the choice expires. On this case, the strike worth is $70,000, which means the patrons are betting that Bitcoin will exceed this worth by the tip of November. Lim detailed that on the time of the commerce, “$8.3 million of premium was paid, $147,000 of vega, $65 million of delta.”

Associated Studying

Then, on Tuesday the twenty ninth, one other vital commerce occurred with the acquisition of three,050 Bitcoin models of the 29-November $85,000 strike calls, the place the strike worth is $85,000. Lim famous that “$4.6 million of premium was paid, $173,000 of vega, $42 million of delta” on the time of the commerce.

The quantities of $8.3 million and $4.6 million point out substantial funding, reflecting robust confidence in Bitcoin’s potential rise. The excessive vega means that the merchants anticipate vital volatility, which may very well be huge across the US election. Delta represents how a lot the choice’s worth is predicted to vary with a $1 change within the worth of the underlying asset. Excessive delta values of $65 million and $42 million indicate substantial publicity to Bitcoin’s worth actions.

The overall notional worth of those positions—the overall worth of the underlying property represented by the choices—is roughly $350 million. Lim identified that that is “massive even within the context of Deribit,” referring to the world’s largest crypto choices change.

Associated Studying

The breakeven level for these positions is slightly below $79,300. Because of this for the merchants to start out making a revenue, Bitcoin’s worth must exceed this degree by the choice’s expiry date. This worth represents a couple of 16% improve from Bitcoin’s worth when these trades have been executed.

“Very bullish positioning into the election, and nice to see establishments sizing up like this on CME,” Lim commented. He added, “Maybe a very good signal that there’s and shall be rising liquidity within the crypto derivatives markets because the asset class matures.”

The timing of those trades is especially noteworthy. With the US presidential election imminent, market volatility is predicted to extend, probably impacting all the Bitcoin and crypto market. General, nearly all of specialists imagine {that a} Trump victory is bullish for the BTC worth.

At press time, BTC traded at $72,382.

Featured picture created with DALL.E, chart from TradingView.com