Up to date on February 20, 2023.

The Elliott Wave Idea buying and selling technique is taken into account a complicated technical evaluation strategy which may provide in-depth understanding of value actions. This idea means that value adjustments observe some long-term patterns. If merchants handle to establish them, it might improve their buying and selling technique. As we speak we are going to take a look at the fundamentals of this strategy and see the way it could also be utilized in buying and selling.

Elliott Wave Idea Defined

Again within the Thirties an American economist Ralph Elliott began analyzing hourly, every day, weekly, month-to-month and yearly value charts of varied indices. His objective was to establish constant patterns out there exercise. He believed that there was a motive for each value motion. So he went by way of charts protecting 75 years of inventory market information to show his idea.

After years of analysis, Elliott concluded that although market exercise might generally appear random and scattered, in actuality it follows sure guidelines. Which implies that merchants could possibly use them to realize their buying and selling aims.

At the moment, the Elliott wave idea buying and selling ideas are considered as a common set of market conduct patterns. The Elliott wave buying and selling outcomes might rely on understanding the ideas of this idea, so let’s go over the primary concepts.

What Are Elliott Waves?

Buying and selling with the Elliott wave idea entails monitoring waves – a collection of repeating value actions. The idea means that costs observe 2 essential wave patterns: impulse (motive) and corrective.

Impulse (Motive) Waves

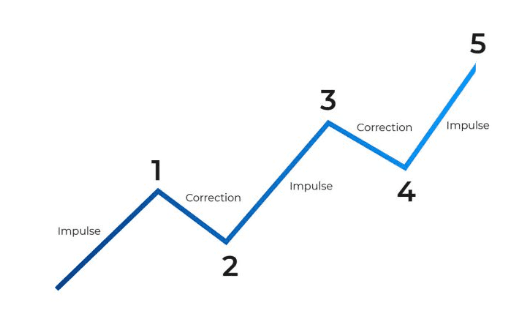

Impulse (motive) wave sequence consists of 5 smaller waves: 3 massive value actions within the course of the uptrend and a pair of corrections.

These waves are labeled waves 1, 2, 3, 4 and 5 respectively.

To establish these waves appropriately, merchants ought to remember the next guidelines.

- The third wave (second impulse wave) is often the most important of the sequence. Waves 1 or 5 can’t be longer than wave 3.

- Wave 2 by no means goes past the low of wave 1. It’s sometimes 60% the size of the wave 1.

- The excessive of wave 3 have to be greater than the excessive of wave 1 (in any other case it’s mandatory to begin the wave rely once more). The waves ought to be making progress.

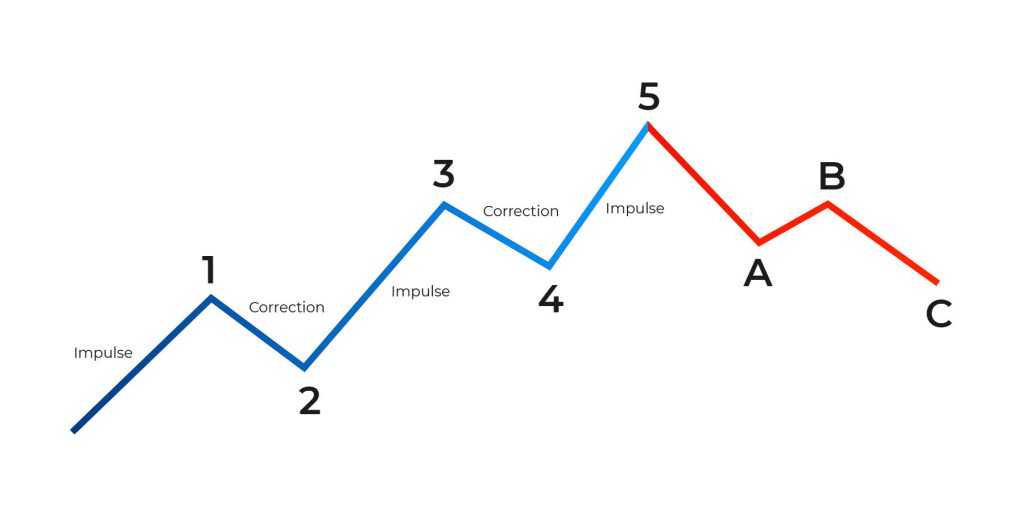

Corrective Waves

The corrective wave sequence, in accordance with the Elliott wave idea buying and selling ideas, consists of three waves: an impulse down, a correction to the upside and one other impulse down. These waves are labeled A, B and C. As a rule, corrective waves A, B and C often finish within the space of the prior wave 4 low.

Each motive and corrective waves may be seen within the image above. It is very important take note of the size of the waves in addition to their proportions.

How you can Use Elliott Wave Idea for Buying and selling?

When buying and selling with the Elliott wave idea, it’s necessary to remember the principles of the waves sequence described above. It will not be straightforward to establish these patterns straight away, as there are a lot of guidelines to remember. Nevertheless, you might learn to use the Elliott waves appropriately and get extra correct outcomes over time.

What you must bear in mind is that, in accordance with the Elliott wave buying and selling ideas, costs transfer in cycles. Which means you could possibly predict an upcoming value reversal. After which use this info to open or shut a deal on the optimum second.

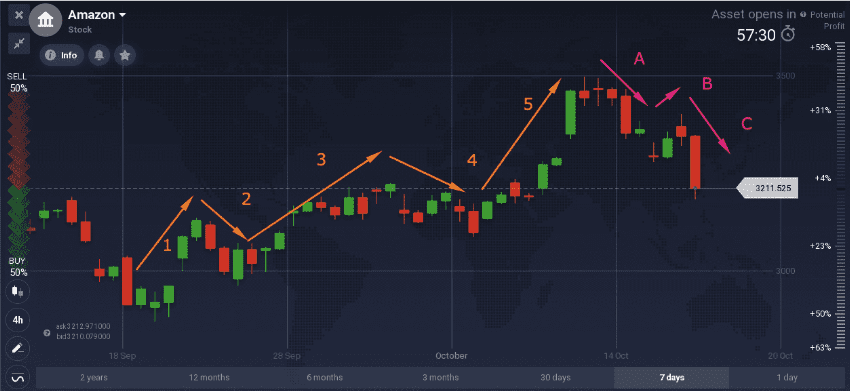

For instance, such a construction may be discovered on a month-to-month chart on the Amazon inventory. It’s clearly seen that the worth first climbed upwards in a cycle of 5 waves, adopted by 3 corrective waves.

Discovering the waves and analyzing the chart on this approach might assist merchants make buying and selling selections. As an illustration, they could select to enter an extended (BUY) place in the course of the pullbacks (corrective waves) of an uptrend. By doing this, they may be capable of “journey” the next uptrend as the worth rises to the following excessive.

With regards to instances the place the Elliott wave downtrend is revealed, it might be doable to open a brief (SELL) commerce throughout corrective waves in a downtrend. This may increasingly enable merchants to probably profit from the market trending down. Nevertheless, you will need to notice that there is no such thing as a assure of 100% right indications.

FAQ

FAQ

Does Elliott Wave Idea Work in Foreign exchange?

The Elliott wave idea buying and selling ideas are mostly used for inventory buying and selling. Nevertheless, it might even be utilized to technical evaluation of various property, together with Foreign exchange.

Can I Use the Elliott Wave for Intraday Buying and selling?

The Elliott wave buying and selling ideas might provide invaluable insights into long-term value actions. Nonetheless, if merchants handle to establish recurring patterns in value adjustments, they could learn to use the Elliott wave idea of their intraday buying and selling as properly.

Is the Elliott Wave Idea Correct?

When utilizing any technical evaluation software, remember that they don’t present any sort of certainty about future value motion. However they could be useful in predicting potential value actions. Contemplate combining buying and selling with the Elliott wave idea with different types of technical evaluation, together with technical indicators, to establish particular alternatives.