Fabio Panetta, a member of the manager board of the European Central Financial institution (ECB), has acknowledged that corporations rising their revenue margins might be serving to to gas inflation. In an interview with the New York Instances, Panetta warned in regards to the impact that corporations rising such margins might have on inflation ranges in the long run.

ECB’s Panetta Hyperlinks Revenue Margins With Inflation

Fabio Panetta, a member of the manager board of the European Central Financial institution (ECB) and former deputy governor of the Financial institution of Italy, has introduced consideration to the impact that the rising revenue margins of varied corporations might have over inflation ranges. In an interview given to the New York Instances on March 31, Panetta talked about these earnings and price-setting practices, and their doable hyperlink with the excessive inflationary ranges in Europe.

The present headwinds the world economic system is going through may lead corporations to boost their revenue margins if they’re anticipating an increase of their prices, which may come from totally different sources, based on Panetta. He acknowledged:

“We’re in all probability paying inadequate consideration to the opposite part of revenue — that’s, earnings. The scenario which prevails within the economic system, there might be excellent situations for corporations to extend their costs and earnings.”

Nonetheless, Panetta defined that his statements didn’t indicate that the European bloc would act to manage these costs. As a substitute, he clarified that he wished to look at all of the elements that have been affecting the inflation ranges.

Inflation Ranges Falling, however Far From the Aim

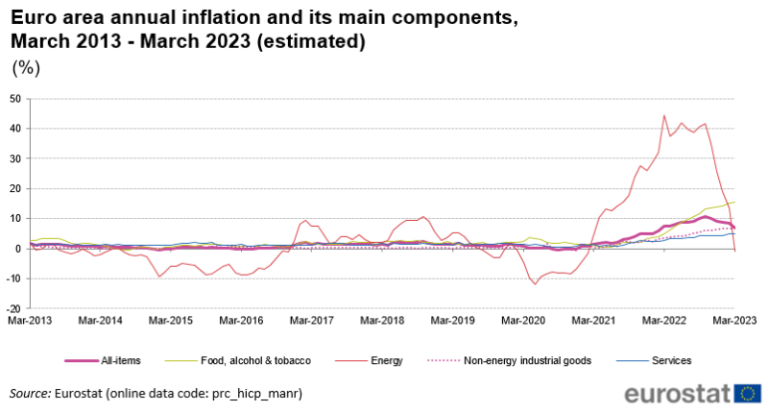

Preliminary numbers issued by the European Union point out that March completed with a 6.9% inflation fee, cooling down from the 8.5% reached in February. That is because of the sharp decline in power costs throughout Europe. Nonetheless, the costs of the core components of European inflation, which exclude power and meals, have continued to surge, reaching an all-time excessive of 5.7% throughout March.

Which means the ECB will doubtless maintain elevating rates of interest within the foreseeable future, because it embraces its data-dependent strategy. That is the opinion of Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics, who acknowledged:

Policymakers on the ECB received’t learn an excessive amount of into the drop in headline inflation in March and can be extra involved that the core fee hit a brand new report excessive.

On March 16, the ECB raised rates of interest by 0.5%, with President Christine Lagarde stating that inflation was “projected to stay too excessive for too lengthy,” with ranges being nonetheless very removed from the two% objective proposed by the establishment.

What do you consider Fabio Panetta’s tackle the rise of revenue margins and its impact on inflation? Inform us within the remark part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Alexandros Michailidis / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.