The full worth of property locked (TVL) on decentralized finance (DeFi) initiatives recorded a 30% year-on-year decline to drop to its lowest level for this yr at $36.95 billion, per knowledge from DeFillama.

Whereas DeFi initiatives began the yr strongly, peaking at greater than $52 billion in April, the sector has witnessed six months of constant underperformance, dragging it to its present low.

Liquid staking initiatives thrive

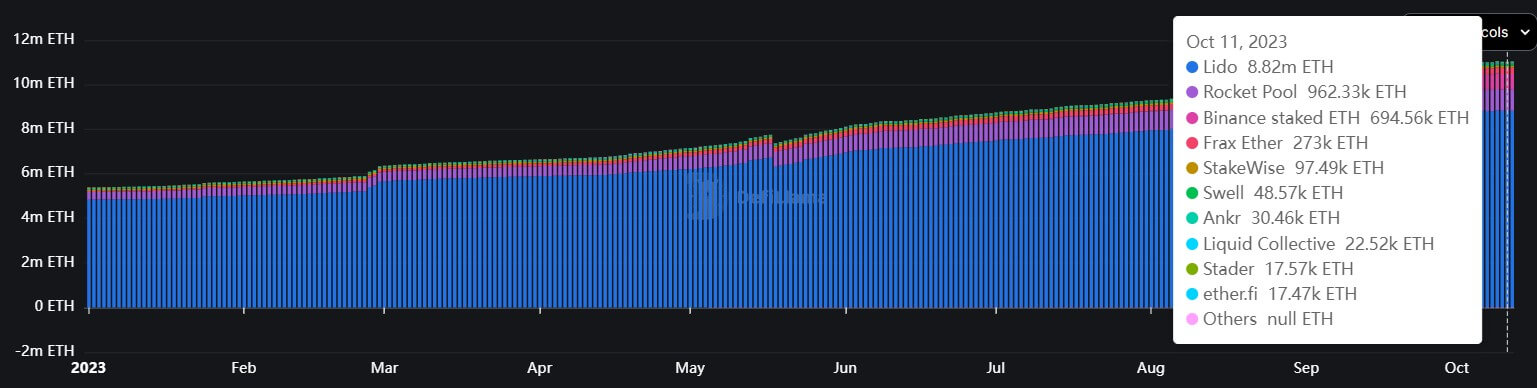

Within the ever-evolving panorama of the DeFi sector, liquid staking initiatives have emerged as a beacon of resilience, contrasting with the broader decline seen in different DeFi classes.

Regardless of the prevailing bearish sentiments, liquid staking initiatives have thrived, returning virtually 300% from their 2022 low to just about $20 billion in TVL, in keeping with DeFillama knowledge. As of the most recent figures, TVL now stands at $17.67 billion.

Lido is the dominant participant inside this area of interest, sustaining over 50% of the market share, outpacing main contenders like Binance, Coinbase, and Kraken, as per insights from Nansen knowledge shared with CryptoSlate.

Tron-based initiatives TVL rise

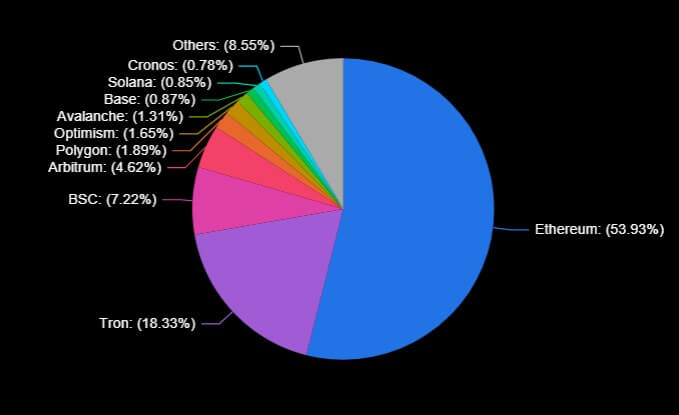

The Tron community, too, has witnessed vital progress in its DeFi initiatives, with their contribution to the general TVL hitting an all-time excessive of 18.23% from the 6.5% recorded earlier within the yr.

On-chain sleuth Patrick Scott attributed Tron’s elevated TVL to the expansion of the primary Actual-World Property (RWA) on the community, stUSDT. In accordance with DeFillama knowledge, the venture’s TVL is nearing $2 billion in simply 4 months since its launch.

Nonetheless, CryptoSlate reported that the venture has come underneath scrutiny, primarily attributable to its governance and transparency, whereas a few of its claimed companions, like Tether (USDT), have denied any affiliations.

In the meantime, Ethereum stays the first platform for DeFi initiatives and purposes, controlling greater than 50% of the market. Different networks like Binance Sensible Chain, Polygon, Arbitrum, and others additionally host many initiatives.

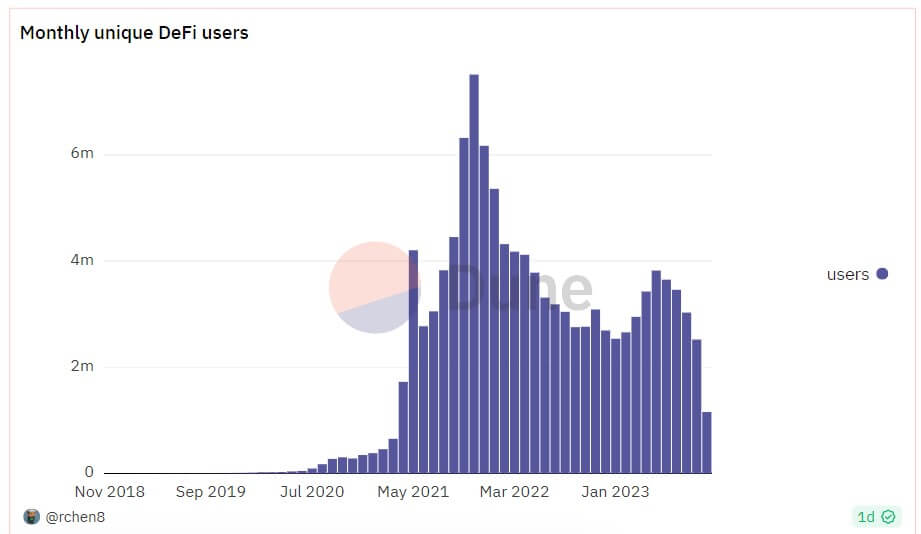

DeFi initiatives misplaced 2.5M month-to-month customers.

Because the TVL has flatlined, DeFi initiatives have encountered one other problem: a lower of roughly 2.5 million lively month-to-month customers all year long, Altindex reported, citing a Dune Analytics dashboard by rchen8. Per the report, the decline commenced in Might and has maintained a downward development.

In Might, the DeFi sector boasted over 3.8 million month-to-month customers, however by October, this determine had dwindled to round 1.15 million, in comparison with the two.7 million customers reported the earlier October. Total, month-to-month distinctive customers have dropped by 66% from the all-time excessive of seven.51 million recorded in November 2021.