The Bitcoin mid-September rally has slowed down main as much as the top of the month. Though it ended September at a inexperienced month-to-month candle shut, the cryptocurrency has fallen beneath the psychological $65,000 worth mark once more, with the concern and greed index coming back from greed to impartial sentiment. This appears to have induced some second-guessing amongst Bitcoin traders. Nonetheless, CryptoQuant CEO Ki Younger Ju just isn’t entertaining any such thought.

In response to Ki Younger Ju, Bitcoin remains to be in the midst of a bull cycle. That is optimistic information for Bitcoin traders, because the crypto business is now transitioning right into a traditionally bullish fourth quarter of the 12 months.

Bitcoin Bull Market Not Over

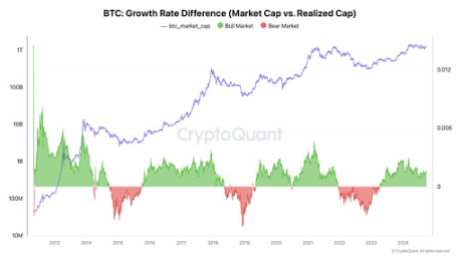

CryptoQuant CEO Ki Younger Ju is a part of fervent Bitcoin investors who stay unfazed by the current worth fluctuations. Nonetheless, his stance isn’t simply primarily based on speculations however is backed by technical worth information and evaluation. Ki Younger Ju attracts his bullish outlook on the Bitcoin progress charge distinction, which presents an fascinating outlook on the cryptocurrency. Primarily, the Bitcoin progress charge distinction compares the market cap of Bitcoin to its realized cap with the intention to gauge its bullish or bearish energy.

Associated Studying

The market cap of a cryptocurrency is the full worth of all cash in circulation, calculated by multiplying the present worth by the full provide. In distinction, the realized cap takes under consideration the precise worth paid for every BTC in circulation primarily based on the value at which every coin final moved. A better market cap progress charge suggests the spot worth of the typical coin has elevated in comparison with the final it was moved.

In response to a Bitcoin technical chart he shared on social media platform X, Ki Younger Ju famous that Bitcoin’s market cap remains to be rising sooner than its realized cap, which continues to level to a bull cycle. Notably, the analyst has talked about in an earlier evaluation of the expansion charge distinction that this development, which began in late 2023, usually lasts for a mean of two years.

What Does This Imply For BTC?

Going by previous bull cycle traits, which Ki Younger Ju famous usually lasts for about two years, Bitcoin is anticipated to proceed in a bull cycle for at the least greater than a 12 months going ahead. Moreover, present fundamentals level to regular progress for Bitcoin as inflows proceed to pour in from institutional traders.

Associated Studying

Talking of institutional traders, Spot Bitcoin ETFs, which ended final week with the most important influx ($494.27 million) since July 22, have begun the brand new week on a optimistic notice. Significantly, they registered $61.3 million in web inflows yesterday, which is a signal of excellent issues to come back. Institutional involvement, particularly via automobiles like Spot Bitcoin ETFs, is an important issue in BTC’s sustained worth progress.

On the time of writing, Bitcoin is buying and selling at $64,080.

Featured picture created with Dall.E, chart from Tradingview.com