Soar Buying and selling’s latest switch of tens of millions in Ethereum to centralized exchanges has unsettled the crypto market.

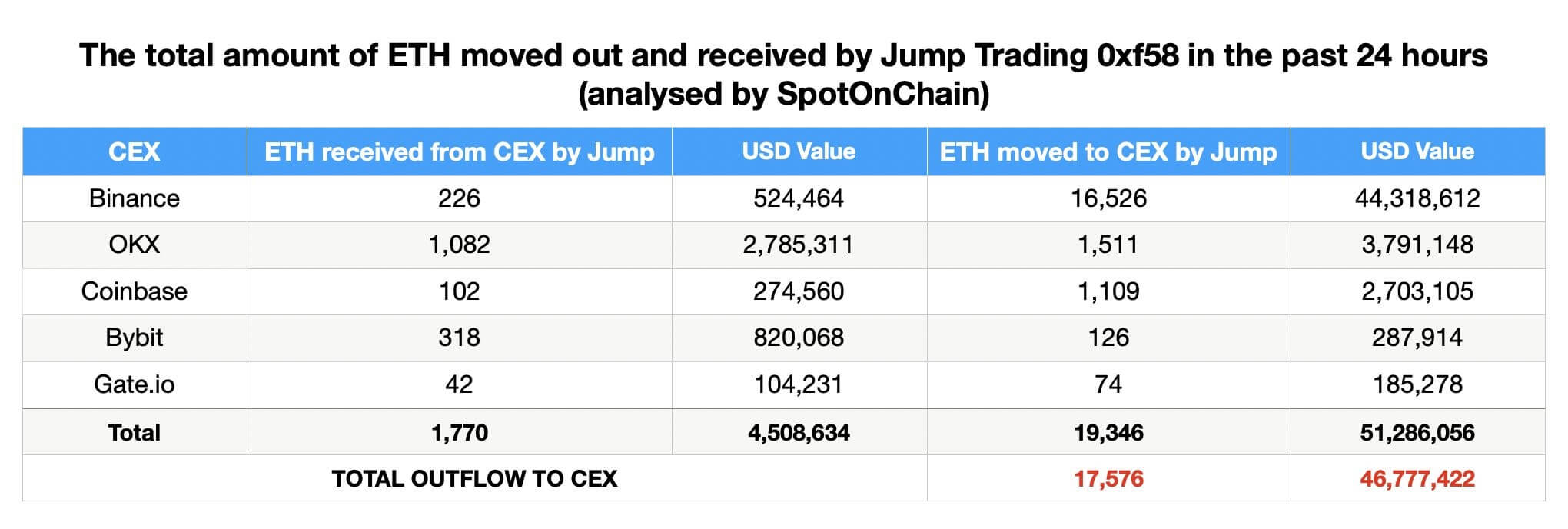

Over the weekend, the agency moved 17,576 ETH, valued at $46.78 million, to exchanges resembling Binance, OKX, Coinbase, ByBit, and Gate.io, based on blockchain analytical platform Spot On Chain.

This transfer follows a sample famous by crypto analyst Ember CN. Since July 25, Soar Buying and selling has transformed 83,091 wstETH, price $341 million, into 97,600 stETH and unstaked 86,059 stETH, valued at $274 million, from Lido Finance. The agency subsequently deposited a internet 72,213 ETH, price $231 million, into varied exchanges.

Sometimes, such transfers sign bearish sentiment, suggesting holders might need to unload their crypto. Regardless of these strikes, the agency nonetheless retains vital belongings, together with roughly 37,604 wstETH and three,214 RETH, valued at round $110 million, based on Arkham Intelligence knowledge.

In the meantime, one other pockets related to the agency holds round $585 million in crypto, together with USDC and USDT. Nevertheless, on-chain knowledge exhibits that the pockets’s stability declined by greater than 50% final month earlier than recovering to its present stability.

Market impression

Soar Buying and selling’s actions have contributed to a broader market decline, with main digital belongings like Bitcoin and Ethereum experiencing double-digit drops. Blockchain analyst Lookonchain identified that the market has fallen by over 33% for the reason that agency started promoting on July 24.

Gracy Chen, CEO of Bitget, advised CryptoSlate that distinguished gamers like Soar Buying and selling offloading ETH and the bearish forecasts following ETF approvals influenced the market downturn.

Adam Cochran, the Managing Associate at Cinneamhain Ventures, criticized Soar Buying and selling’s operations, stating:

“Soar liquidating their crypto e-book into skinny markets on a summer time Sunday afternoon completely sums up why their crypto operation is such a large number.”

In the meantime, different crypto group members speculated that the fund motion could also be a prelude to its impending authorized confrontation with the US Commodity Futures Buying and selling Fee (CFTC). The monetary regulator is investigating the agency’s buying and selling and funding actions inside the crypto house. Amid these challenges, firm president Kanav Kariya has resigned.

Over time, Soar Buying and selling has confronted quite a few challenges, together with a $325 million hack of Wormhole, losses from the FTX collapse in 2022, and accusations of manipulating Terra’s algorithmic UST stablecoin peg.