Bitcoin can’t appear to go away the $60,000 value degree because it continues to commerce in uncertainty. On Saturday, August 3, the cryptocurrency skilled one other sharp decline, briefly dipping under the $60,000 mark.

Though this drop lasted only some minutes, it was fairly vital, particularly on condition that Bitcoin had traded above $62,000 earlier the identical day. This fluctuation has notably impacted market individuals, resulting in the liquidation of quite a few lengthy positions.

Associated Studying

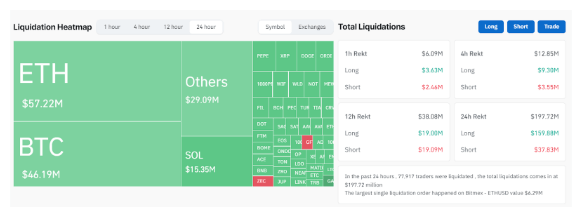

On the time of writing, over $197 million value of leveraged positions have been liquidated up to now 24 hours. Notably, this determine soared to as a lot as $288 million in the course of the peak of the promoting strain.

Bitcoin And Market Liquidations

The persistent lack of ability of Bitcoin to keep up a steady place above $60,000 highlights the uncertainty and speculative nature of the cryptocurrency market. Merchants and traders stay cautious, carefully monitoring its value actions.

This cautious strategy has possible been amplified by current stories of repayments initiated by the bankrupt crypto lender Genesis World Capital, which flooded the market with extra digital belongings, primarily Bitcoin and Ethereum.

Contemplating Bitcoin and Ethereum’s dominance over the market, this cautious strategy has inadvertently led to a lingering bearish sentiment surrounding different cryptocurrencies. Though Bitcoin and Ethereum skilled the best liquidated positions, the impression has spilt over into different digital belongings.

In keeping with Coinglass information proven under, Ethereum led the market with $57.22 million value of leveraged positions liquidated. Bitcoin adopted carefully with $46.19 million in liquidations and Solana with $15.35 million.

The full liquidation quantity reached $197.72 million, with the bulk ($159.88 million) in lengthy positions. Most of those liquidations occurred on Binance, OKX, and Bybit, with $85.88 million, $65.83 million, and $16.47 million in liquidations, respectively, every exhibiting an 80% lengthy liquidation charge.

Prevailing Bearishness

The crypto trade is not any stranger to sporadic liquidations of such enormous quantities. Contemplating the prevailing short-term bearish sentiment, most of those liquidations have repeatedly been on lengthy positions. On June 24, the market witnessed virtually $300 million value of positions liquidated in below 24 hours. Equally, over $360 million value of positions had been liquidated on June 7 when the Bitcoin value crashed from $71,000 to $68,000.

Associated Studying

Current market dynamics recommend that the trade won’t be out of the woods but regarding such liquidations. Bitcoin continues to battle to carry above $60,000, a pattern that would persist within the coming weeks. That is partly as a result of Spot Bitcoin ETFs, which have traditionally been a catalyst for Bitcoin value surges, ended final week on a detrimental observe. Particularly, they concluded Friday’s buying and selling session with $237.4 million in outflows, the most important every day outflow since Could 1.

Featured picture from The Michigan Each day, chart from TradingView