Vetle Lunde, a senior analyst at K33 Analysis, has issued a stark warning relating to the practices of distinguished crypto exchanges in regards to the authenticity of liquidation information. In a put up on X, Lunde outlines how exchanges reminiscent of Binance, Bybit, and OKX have systematically modified their information reporting processes in a manner that he claims considerably distorts the true scale of market liquidations.

Why Crypto Liquidation Information Is Bogus

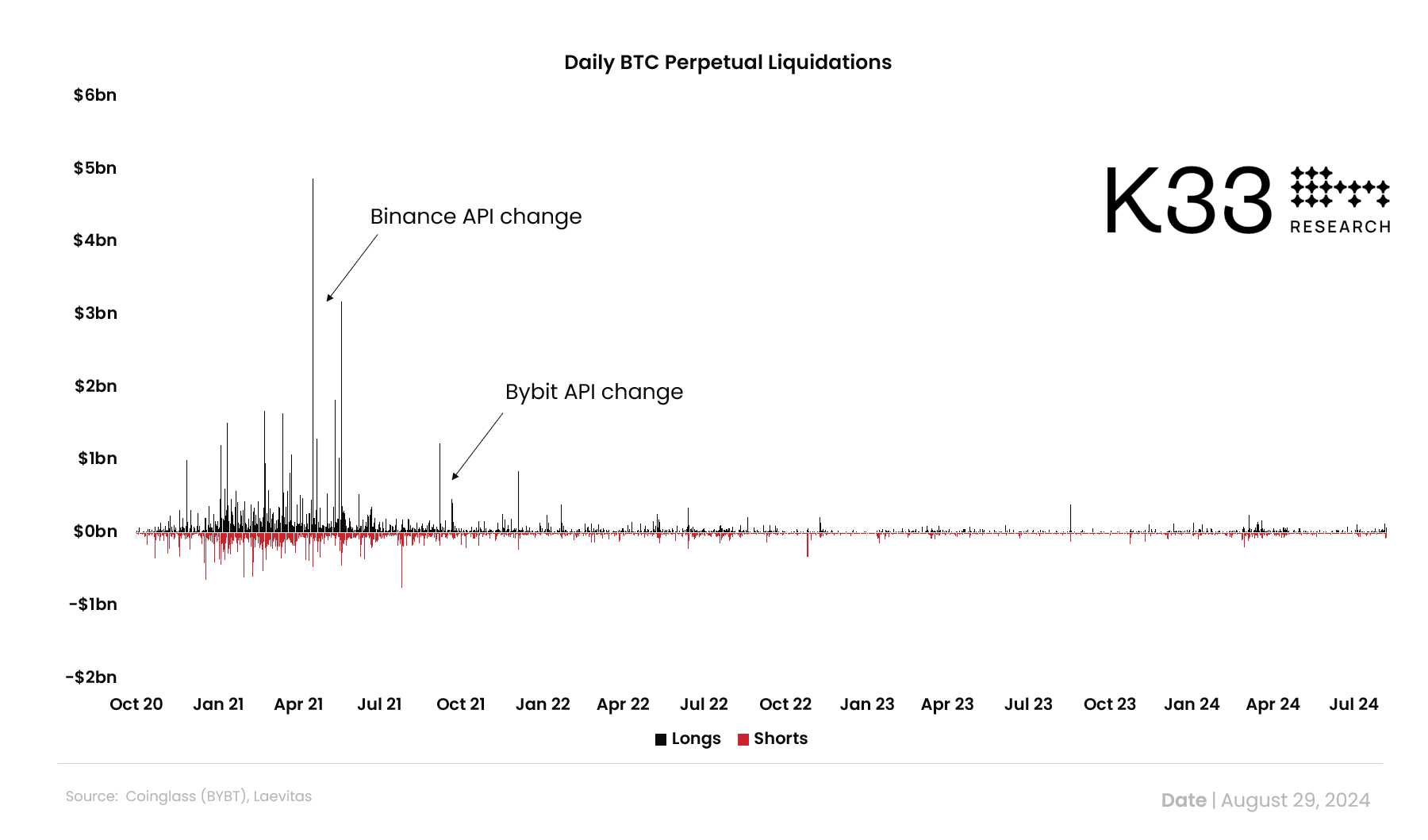

The core of Lunde’s argument revolves round adjustments applied by these exchanges round mid-2021. For instance, each Binance and Bybit adjusted their liquidation WebSocket API to report just one liquidation per second, ostensibly to “present a ‘honest buying and selling setting’” and “optimize person information stream,” respectively. Equally, OKX has applied a cap, limiting the reporting to at least one order per second per contract.

Lunde explains that this modification within the information stream profoundly impacts the market’s transparency, resulting in a state of affairs the place liquidation information, a essential metric used to evaluate market well being and dealer habits, is “wildly underreported.” In response to Lunde, this has been the case for the previous three years, which has implications not just for merchants but in addition for the broader monetary evaluation of the crypto market.

Associated Studying

Traditionally, liquidation information has served as a barometer for the market’s leverage ranges and has been instrumental in understanding how merchants react to sudden value actions and volatility. Correct liquidation information helps in gauging the market’s danger urge for food and in assessing whether or not a market downturn has successfully purged extreme speculative leverage positions. With this information now being underreported, Lunde means that merchants and analysts are flying blind.

Lunde speculates on the motives behind these adjustments, suggesting that they could be pushed by a want to manage the narrative round market stability and dealer success. He factors out that through the first half of 2021, high-profile liquidations have been frequent fodder for media and social media discourse, usually portray an image of excessive danger and volatility within the crypto markets. By limiting the visibility of such occasions, exchanges is perhaps attempting to domesticate a extra secure and trader-friendly picture to draw and retain customers.

“I’m guessing it’s a PR alternative. In H1 2021, liquidation gore was Twitter, media, and everybody’s bread and butter. Consistently figuring on the high of liquidation leaderboards will not be aligning with a technique of attracting as many as doable to commerce as a lot quantity as doable,” Lunde remarks.

Associated Studying

Additional complicating issues, Lunde hints on the risk that exchanges is perhaps withholding liquidation information to keep up a aggressive edge. “Some exchanges even have pursuits in funding companies that will commerce on data that the remainder of the market doesn’t have,” the researcher speculates.

Regardless of these vital challenges in accessing dependable information, Lunde discusses various strategies to estimate present liquidation volumes, reminiscent of analyzing shifts in open curiosity or leveraging historic information to extrapolate present traits. Nevertheless, he acknowledges that these strategies have their shortcomings. They usually fail to precisely mirror the adjustments in market participant habits over time or would possibly overemphasize uncommon market occasions that aren’t indicative of broader traits.

Concluding his put up, Lunde expresses a deep skepticism concerning the utility of the at present obtainable liquidation information. He requires a return to the degrees of transparency seen prior to now, although he pessimistically notes that such a change is unlikely given present traits.

“For now, liquidation information is usually inaccurate leisure and never actionable. I’d welcome a return to previous transparency, however I assume we’ve already crossed the Rubicon,” Lunde concludes.

At press time, BTC traded at $59,540.

Featured picture created with DALL.E, chart from TradingView.com