Lower than two months in the past, a group of 74 listed cryptocurrencies centered round synthetic intelligence (AI) amassed a powerful $4 billion valuation. Nonetheless, the intervening weeks have seen a pointy decline in crypto-AI financial system positive aspects, with losses of $730 million. The three most outstanding AI-driven crypto tasks have all suffered double-digit losses, starting from 10% to 29.58%, towards the U.S. greenback over the past 30 days.

Curiosity within the Mixture of Crypto and Synthetic Intelligence Has Declined, Crypto-AI Token Economic system Sheds $730M

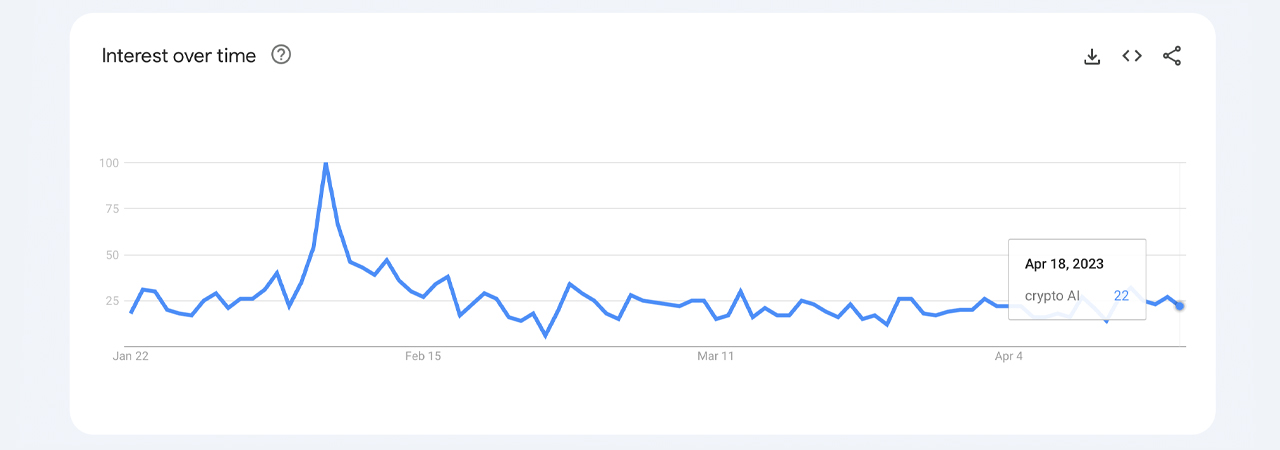

Numerous information factors counsel that curiosity in and worth of crypto-AI tasks has waned. World search tendencies for “crypto ai” peaked in early February 2023, with a Google Tendencies’ rating of 100. Regardless of the rise, over the previous 90 days, the rating has slumped to a low of twenty-two. Slovenia, the Netherlands, Cyprus, Lebanon, and Nigeria make up the highest 5 nations involved in “crypto ai” searches at current.

In February, the collective crypto AI financial system reached a $4 billion milestone, pushed by spectacular positive aspects amongst high AI-focused cryptocurrencies following a multibillion-dollar funding by Microsoft in Openai, the creators of Chatgpt. Nonetheless, the crypto AI sector has since incurred important losses. Present information from cryptoslate.com signifies that $730 million has been wiped off the crypto AI token financial system.

The most important crypto AI asset by market capitalization, graph (GRT), has suffered a lack of 10.71% prior to now month. The second largest AI-centric crypto asset, singularitynet (AGIX), has fared worse, down 29.58% in the identical interval. Fetch (FET), the third largest crypto AI token, has seen a 14.36% drop in worth over the previous 30 days. Most of those losses occurred over the past seven days of buying and selling, coinciding with a basic downturn within the broader crypto market.

General, the crypto tokens related to synthetic intelligence have declined by 7.38%. The previous week has been significantly tough, with a drop of 15.70% recorded. At present, the 24-hour international commerce quantity for the crypto AI sector stands at $325.58 million. Apparently, the cannabis-focused crypto sector is at present the highest performer, having gained 3.89% towards the dollar prior to now week, in line with information from cryptoslate.com.

What do you suppose the long run holds for the intersection of AI and cryptocurrency? Why do you suppose curiosity in crypto-ai tasks is waning? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.