CRV, the native forex of Curve Finance, the decentralized trade targeted on stablecoins, is shaking off August’s weak spot and printing increased highs when writing on September 22. Trackers reveal that CRV is up 22% previously two weeks, including 10% within the final week alone.

Coincidentally, there was elevated exercise from a whale transferring CRV from Binance, the world’s largest crypto trade by shopper rely.

Whale Offloads CRV From Binance To Curve Finance

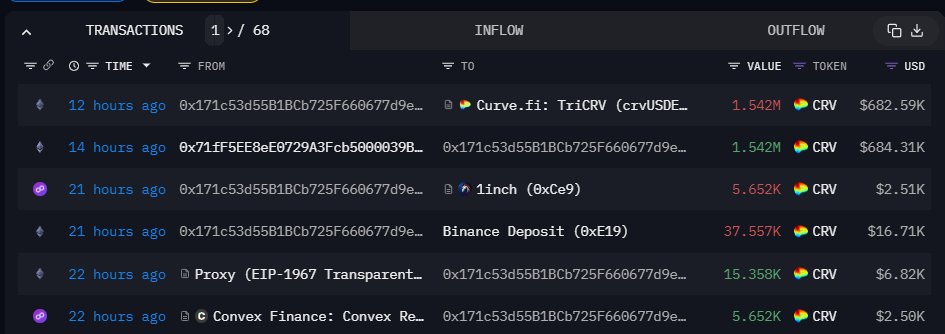

In line with The Information Nerd, a tracker, a whale transferred 1.542 million CRV, value roughly $684,000, from Binance. Afterward, the whale, solely recognized as “0x171,” added liquidity to Curve Finance.

Over the past week, the whale has been actively supplying liquidity to Curve Finance, offering 5.36 million CRV value $2.27 million.

CRV is the governance token in CurveDAO, the decentralized autonomous group (DAO) behind Curve Finance. For the reason that trade is decentralized, CRV holders have voting rights. Furthermore, they’ll obtain rewards every time they provide liquidity to any of Curve Finance’s swimming pools.

Curve Finance used an automatic market maker (AMM) mannequin for the trustless swapping of stablecoins, together with DAI, USDT, USDC, and different tokens like ETH and wrapped Bitcoin (wBTC). Nonetheless, to operate optimally, Curve Finance depends on liquidity swimming pools the place customers can provide liquidity and get a share of charges distributed in CRV.

The withdrawal of cash from Binance to a non-custodial pockets is a vote of confidence for CRV. The token has been free-falling in Q3 2023. As an example, CRV crashed by 32% in August alone.

The draw-down was worsened by the broader contraction in crypto occasioned by waning momentum across the approval of a number of complicated derivatives for Bitcoin and Ethereum. On the similar time, regulatory actions, particularly from the Securities and Trade Fee (SEC), considerably impacted sentiment and token costs.

CRV Offered Off After Hack

The free-fall of CRV might be straight pinned to an exploit of a number of Curve Finance liquidity swimming pools in late July 2023. In a re-entrancy assault, a hacker exploited a vulnerability within the older model of a Vyper compiler, draining over $61 million value of tokens from Curve Finance’s swimming pools.

Via the re-entrancy assault, the hacker might infinitely withdraw deposited tokens from Curve Finance’s swimming pools, leading to losses.

Curve Finance has since patched the vulnerability, however CRV costs are but to get better regardless of the current pump. Additionally, its co-founder and CEO, Michael Egorov, needed to liquidate a giant chunk of CRV that he had used to safe loans on a number of platforms, together with Aave.

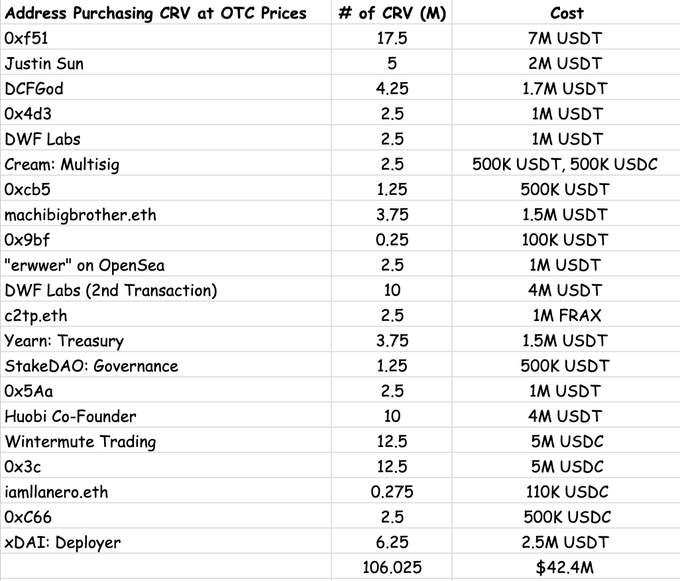

By early August, Egorov had offered 106 million CRV by way of over-the-counter (OTC) trades at a reduction to a number of entities. High consumers included Justin Solar, the co-founder of Tron, who purchased 2 million CRV, and Jeffrey Huang, who acquired 3.75 million CRV.

Characteristic picture from Canva, chart from TradingView