In what is basically a love letter to CBDCs and tokenization, the BIS lately launched a report outlining a imaginative and prescient for the monetary system.

Whereas the report hailed the benefits of tokenization, it maintained that present approaches of crypto fall wanting the mark. Underlying this failure lies the dearth of belief, one thing that continues to be firmly embedded in using central financial institution cash.

“Constructing on the belief in central financial institution cash, the personal sector makes use of its creativity and ingenuity to serve clients,” the introduction states. “Supported by regulation and supervision, this two-tiered construction preserves the “singleness of cash”: the property that funds denominated within the sovereign unit of account shall be settled at par, even when they use totally different types of privately and publicly issued monies.”

Nevertheless, financial techniques are flawed, and BIS maintains that tokenization, regardless of DeFi’s latest fall from grace, might be the reply.

Crypto and decentralized finance (DeFi) have provided a glimpse of tokenisation’s promise, however crypto is a flawed system that can’t tackle the mantle of the way forward for cash.”

BIS Blueprint for the Future Financial System

Crypto Falls Quick

The BIS “Blueprint for a Future Financial System” builds on the work acknowledged within the financial institution’s 2022 annual report – “The Way forward for Cash”.

Nonetheless reeling from the Terra/Luna collapse, the 2022 report outlined in painstaking element why crypto falls wanting its promise. BIS acknowledged that the collapse confirmed inherent weak point within the DeFi system, which this 12 months it has dubbed “self-referential.”

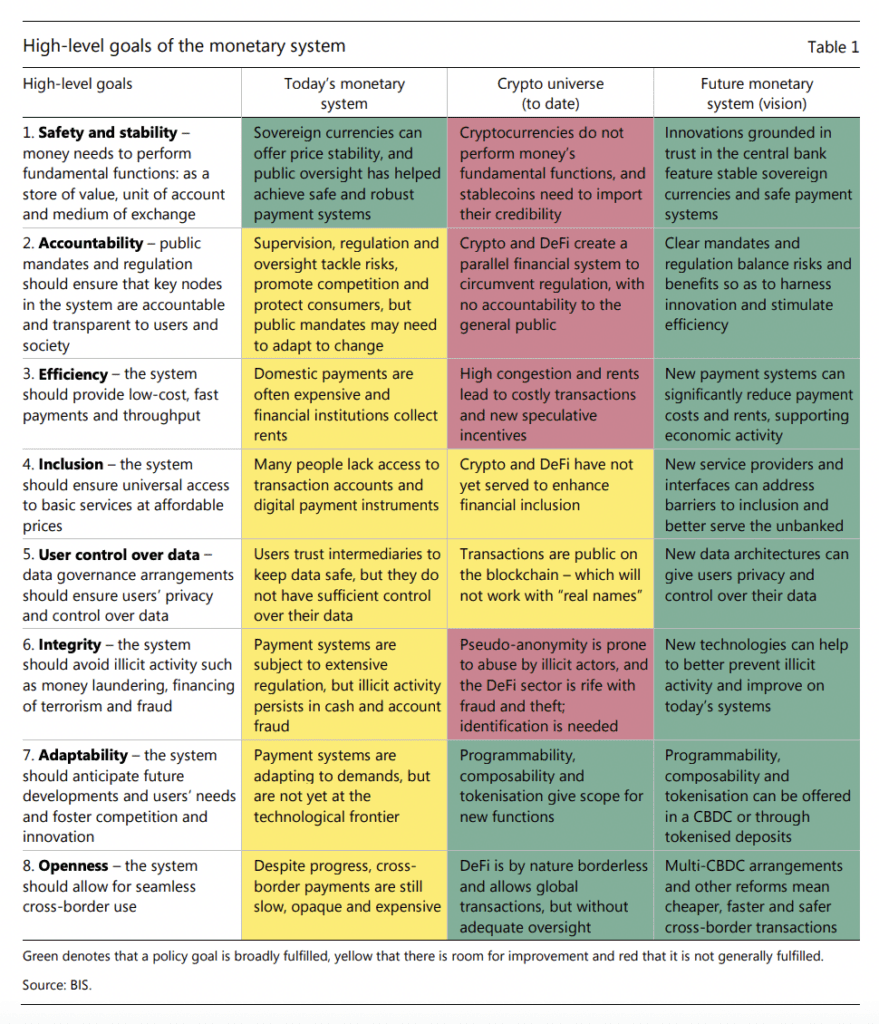

Within the BIS 2022 report, the Financial institution acknowledged that whereas the crypto universe provides scope for brand spanking new financial capabilities, main areas lay towards the financial system’s “high-level objectives.” Crypto’s place exterior the monetary system is portrayed as a breeding floor for illicit exercise, with out oversight and accountability to most of the people.

Nevertheless, it famous that crypto had proven one redeeming issue – “a glimpse at tokenization’s promise.”

Tokenization offers a possibility. Made up of digital belongings that maintain inside them data and guidelines, it provides a layer of programmability that might enormously affect the monetary world. No matter decentralization, it might streamline processes, enhance transparency and friction, and cut back prices.

RELATED: Actual-world asset tokens – a ‘killer use case’ for blockchain

Already, innovators have seen its potential, and the present world market worth stands at an estimated $2.87 billion, rising at a price of round 24%.

The merging of the 2 worlds was maybe inevitable as many strived for mass adoption. The final 12 months is testomony to why the sector, because it grows, couldn’t go on with out regulatory steerage.

The BIS’s thought for the long run goals to mix the financial system with the unparalleled advantages posed by crypto know-how – working to meet the system’s “high-level objectives” that present approaches fail to attain.

The Unified Ledger

The cornerstone of the BIS 2023 report is the idea of the unified ledger, made attainable solely by the presence of tokenization within the financial system.

Ledgers underline the effectivity and transparency of tokenization, and BIS’s imaginative and prescient for a unified ledger goals to automate and combine a number of monetary capabilities.

“The complete advantages of tokenization might be harnessed in a unified ledger as a result of settlement finality that comes from central financial institution cash residing in the identical venue as different claims,” acknowledged the financial institution.

The report outlined a single platform the place processes might be “bundled” collectively, eliminating delays and uncertainty. As well as, it defined that the one location might present a setting for automating related processes, thus increasing “the universe of attainable contracting outcomes.”

The described result’s a utopian system the place new kinds of financial association are attainable as a result of the ledger negates “incentive and informational frictions.” Whereas the identify “unified ledger” implies the existence of a singular, all-encompassing platform, the BIS report states that a number of might coexist, connecting via using APIs or extra belongings to create a “community of networks.”

In one thing akin to the tech revolution sparked by the invention of the smartphone, it’s acknowledged that “The eventual transformation of the monetary system shall be restricted solely by the creativeness and ingenuity of builders that construct on the system.” Nonetheless making use of the “two-tiered” method believed to supply the “singleness of cash,” tokenization might, on this means, be introduced into the monetary system whereas sustaining the protection and safety of the normal system.

CBDCs fall neatly into context, combining the acknowledged safety and belief of the normal financial system with tokenization’s programmability.

“The success of tokenization rests on the muse of belief supplied by central financial institution cash and its capability to knit collectively key parts of the monetary system,” states the report. “This capability derives from the central financial institution’s position on the core of the financial system.”

The BIS argues that the financial system, in no matter kind, requires a financial unit to denominate transactions. Subsequently, the tokenized system requires a tokenized central financial institution forex to accompany it. It states that the event of a wholesale CBDC is paramount to this objective, forming the muse for a world of personal tokenized “monies”.

Undermined by Present Approaches

Nevertheless, the proposal is however a place to begin, and a few centered on tokenization consider it to omit basic components that might undermine its adoption.

“Whereas this report from BIS affords an necessary endorsement for tokenization, a major situation stays unaddressed inside asset tokenization practices: standardization,” stated Ralf Kubli, Board member of the Casper Affiliation.

He defined that the advantages outlined by BIS that unified ledgers might pose couldn’t be realized by present tokenization strategies.

“Presently, tokenization platforms solely digitize the asset, not the liabilities or money flows. Which means tokenized belongings — designed to be extra environment friendly and automatic — nonetheless require human intervention to calculate money flows, which may introduce errors and discrepancies.”

“With out an open supply, standardized and algorithmic definition of the underlying monetary instrument, none of those new DLT or blockchain-based rails shall be adopted at scale, as the brand new rails will simply add prices to present gamers and never change the worth chain.”